By Oregon Small Business Association Foundation

Housing is the largest budget item for most households. In the broader economic picture, housing affordability impacts population migration and construction. It reduces existing home sales and new home starts.

Even though housing prices have somewhat stabilized, rising interest rates have made homeownership less affordable than in decades.

According to the Oregon Office of Economic Analysis, “ The combination of lower interest rates, rising incomes, and falling prices this year and next will bring overall affordability back to the historical range. Sales volumes and housing starts will revive along the way.” Most real estate professionals are not so optimistic.

Let’s look at some charts.

In the Portland Metro area seasonally adjusted prices are down about 4%, sales volume down 40%, new listings down 25%, and inventory up 95% over the last year. Only an estimated 19% of Metro households can afford the monthly payment on the median home sold; 131,000 fewer households than at the beginning of the year.

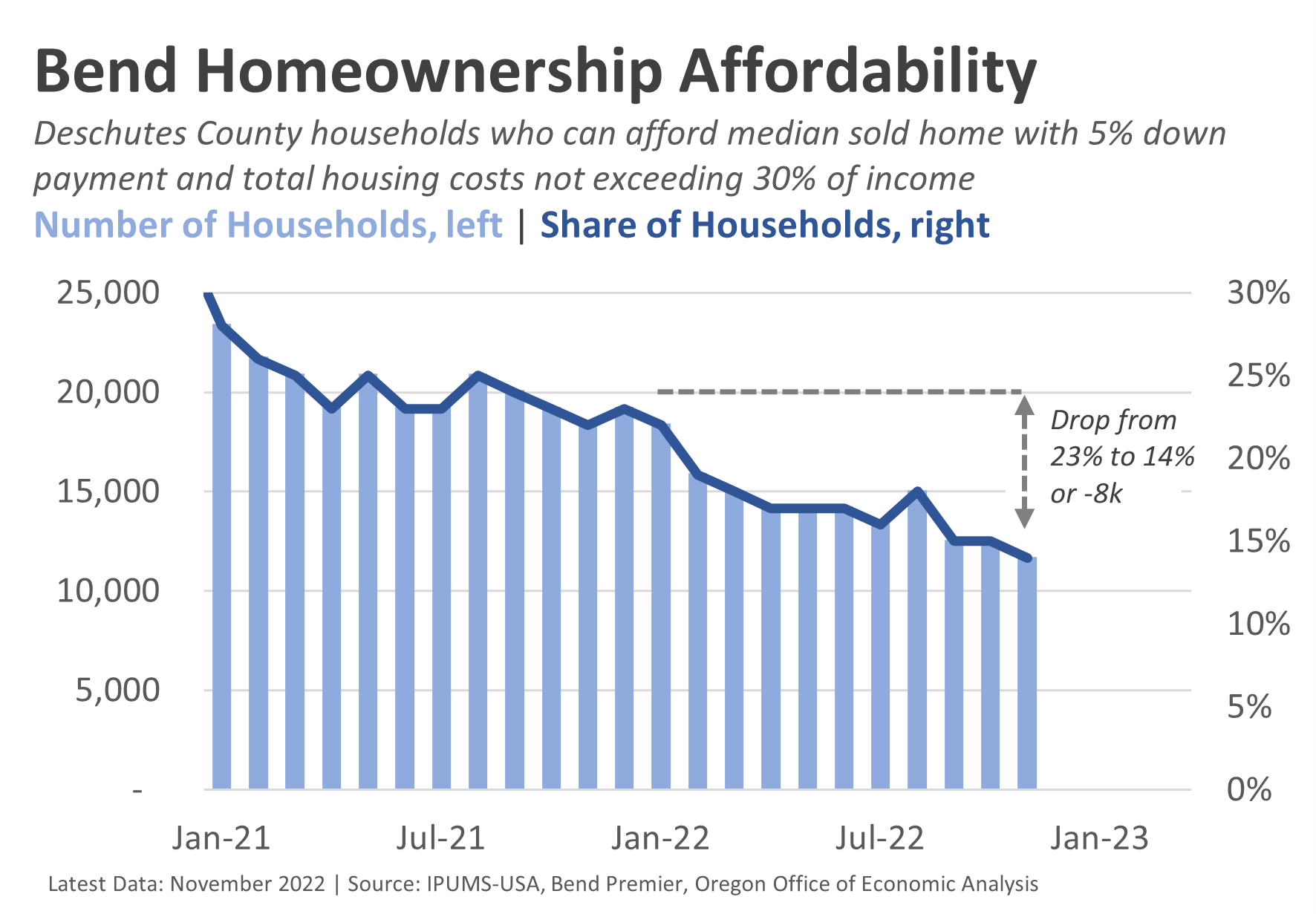

In Bend 14 percent of households could afford the monthly payment, a decrease from 23 percent at the start of the year.

In Salem 22 percent of local households could afford the median sold home last month, a decline from 38 percent at the start of the year.

In Eugene, 20 percent of local households could afford the median sold home last month, a decline from 36 percent at the start of the year.

In Medford, 28 percent of local households could afford the median sold home last month, a decline from 38 percent at the start of the year. The increase you can see in the chart last month is due to a substantial November price decline in the Medford market.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.