Oregon Household Formation Boomed During the Pandemic

By Josh Lehner

Oregon Office of Economic Analysis

Earlier this year our office looked at the seemingly contradictory data in the housing market. On one hand we know population growth overall slowed during the pandemic. Usually this would mean that overall demand for housing would slow as well. However on the other hand both home sales increased and rental vacancy rates were declining. Housing demand was clearly up. The way you can square these different facts is if household formation increased overall. That means more, and smaller households among existing Oregonians, some of which was likely fueled by strong income growth, the desire for more personal space during a pandemic, and underlying demographics as Millennials fully aged into their 20s and 30s.

In real time we weren’t entirely sure that household formation truly picked up given both the lagged nature of the data and the fact that the 2020 ACS data were “experimental estimates”. It certainly made sense, but we couldn’t know entirely. Well, we no longer need to wonder. The just released 2021 figures confirm the household formation boom here in Oregon and across the country.

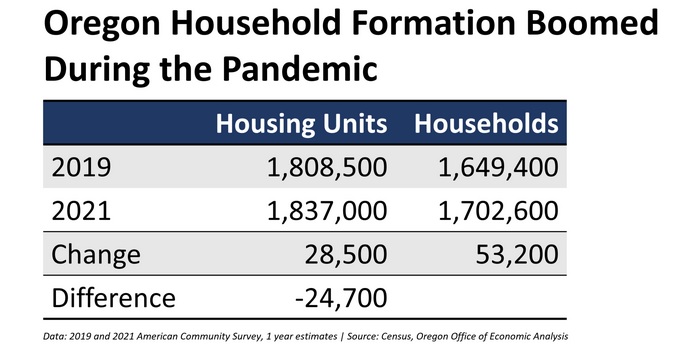

From 2019 to 2021, Oregon added a net 28,500 housing units. However over the same time period, the number of households in Oregon increased by 53,200. This means household formation during the pandemic outpaced net new construction by nearly 25,000 units. This is why the housing market is so tight, and why affordability is so bad. Oregon’s housing shortage is now even larger than we thought. Oregon needs to build more housing.

A few additional notes:

Of course Oregon is not alone. The housing shortage has gone national in recent years. Over this same time period, the U.S. added 2.5 million housing units, but the number of households increased 4.7 million. Not a single U.S. state added more housing units than households during the pandemic.

There is tons more here to dig into from local/metro level figures to household formation rates by age and the like. We will post more in the weeks and months ahead. Some of this likely will need to wait until December when the microdata is released.

Next week I’m in front of the House Committee on Housing discussing some of the latest work on what it would look like to actually increase Oregon’s housing production (new construction). I plan on posting a summary of that here on the blog.

Finally, given the tight housing market and affordability issues, our office expects household formation to slow this year and next. The pandemic era household formation boom will likely slow considerably, and in pockets, could even reverse somewhat. We could see some more individuals living at home a bit longer, or taking on more roommates to share the costs. And after the formation boom we just experienced, vacancy rates are the lowest they have been, so even if one can afford higher prices, out right availability of housing is a challenge.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.