By Josh Lehner,

Oregon Office of Economic Analysis

The Oregon Office of Economic Analysis released the latest quarterly economic and revenue forecast. For the full document, slides and forecast data please see our main website. Below is the forecast’s Executive Summary and a copy of our presentation slides.

Economists are on recession watch. The combination of slower economic growth, high inflation, and rising interest rates has historically been problematic. That said, despite the crosscurrents in the economic data so far this year, the U.S. economy is unlikely to have entered into a recession. Employment and industrial production continue to grow. Personal income and consumer spending are rising quickly, but struggling to outpace the fastest inflation the U.S. has experienced since the early 1980s.

While this may be reassuring today, the risks to the outlook are real. Inflation remains the key issue. Even as headline inflation slows in the months ahead, the underlying inflation trend is likely to remain above the Federal Reserve’s target. As such, the Fed is raising interest rates further to cool the economy. Given the impact of rate increases is generally felt one to two years down the road, getting policy just right is extremely difficult.

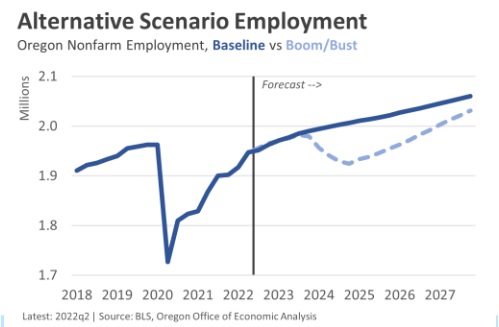

In our office’s recent forecast advisory meetings there was a strong consensus that the risk of recession was uncomfortably high. The outlook is essentially a coin flip between the soft landing and a recession. For now, our office is keeping the baseline, or most probable outlook as the soft landing and continued economic expansion. Employment, income, and spending continue to grow, but at a slower pace than assumed in previous forecasts. This slower growth is needed for inflation to subside.

However, if inflation does not slow as expected, and the Federal Reserve raises rates even further, our office’s alternative scenario of a mild recession beginning in late 2023 is more likely.

Heading into the budget development season, growth in Oregon’s primary revenue instruments continues to outstrip expectations. Both personal and corporate tax collections remain strong, in keeping with income gains seen in the underlying economy. The forecast for the current 2021-23 biennium has been revised upward.

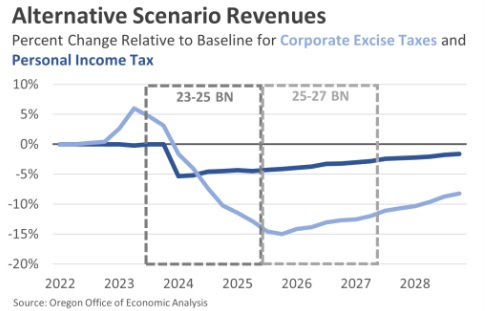

Although the near-term forecast calls for additional revenue, this is offset in future budget periods by a more pessimistic economic outlook. Growth in spending and wages will need to slow to tame inflation, which translates into less state revenue growth across a broad range of taxes.

The potential recession would weigh heavily on revenues over the next several years. However, even if the economic expansion persists, General Fund revenues are due for a hangover in 2023-25. General Fund resources have continued to expand in recent years despite large kicker credits being issued. This growth is expected to pause in the near term, as nonwage forms of income return to earth and gains in the labor market slow.

Recent gains in reported taxable income have been driven by taxpayer behavior as well as underlying economic growth. Investment and business income are not always realized for tax purposes as the same time they are earned in the market. Late 2021 was a great time to cash in assets, with equity prices and business valuations high, and potential federal tax increases on the horizon. Income reported on tax returns last year grew at more than double the rate of economic measures of in income. After so much income was pulled into tax years 2020 and 2021, less will be realized in the near term. And with recessionary risks rising, profits and gains could turn into losses, and a smaller share of filers could be subject to the top rate.

The bottom line is that the unexpected revenue growth seen this year has left us with unprecedented balances this biennium, followed by a record kicker in 2023-25. The projected personal kicker is $3.5 billion, which will be credited to taxpayers when they file their returns in Spring 2024. The projected corporate kicker is $1.1 billion, which will be retained for educational spending. If current balances are not spent, net General Fund revenues for the upcoming 2023-25 biennium will be reduced by $24 million relative to the June 2022 forecast.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.