By Josh Lehner

Oregon Office of Economic Analysis

We know the economy needs to cool to bring inflation down. It’s the reason the Federal Reserve raised interest rates and are expected to continue to do so in the months ahead. Inflation is not costless, and as Federal Reserve Chair Powell says, price stability is the bedrock of the economy. A key factor here has been that labor income is booming. That was great as we dug out from the recession and the federal aid expired. However here’s part of what our office wrote in our most recent forecast document:

The issue is consumer demand and the ability to spend is outstripping the economy’s ability to produce enough goods and services. When too many dollars are chasing too few goods, prices rise. The combination of higher interest rates, cooling of goods prices, and moderating household financial conditions should all work to slow inflation in the economy this year and next. It is an open question just how much inflation will slow. The ultimate risk is the economy needs higher interest rates to truly wring inflation out of the system.

What matters here for the macro economy are aggregate household finances. In terms of labor income that is a combination of jobs, hours worked, and hourly pay. Some slowing here is simply mechanical. Job growth will slow in a full employment economy simply because there aren’t many unemployed workers to hire. And some slowing is more expected due to forecasted changes in the economy such as average wage growth decelerating as firms are less desperate for workers as they staff up.

To be honest, so far the signals that this is happening are mixed at best. Job growth has slowed a bit nationally, but monthly job gains in Oregon haven’t really. Initial claims for unemployment insurance are up just a hair and job openings down a little, which points toward somewhat slower net job gains in the future. And different wage measures are doing that thing where they, well, differ with some showing deceleration (average hourly earnings) and others continued acceleration (Atlanta Fed’s wage tracker). Tomorrow’s Employment Cost Index for the second quarter will be another important wage data point to follow closely. It will be strong, but just how strong is the question.

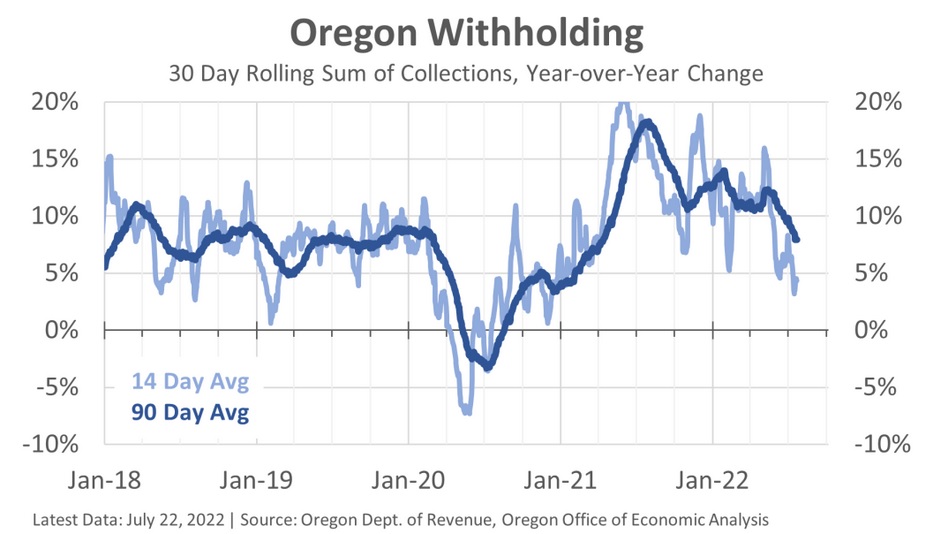

And yet, here in Oregon we are seeing the expected deceleration in withholdings. Growth in withholdings over the past year has slowed to broadly in the range we experienced pre-pandemic. They are no longer in double-digit territory. Now, in terms of potentially goofy math, in recent weeks we are comparing revenues to the peak growth rates from a year ago, which itself was exactly a year removed from the worst of the initial pandemic and shutdown impacts. As such it is possible that the true deceleration in the economy is less pronounced than this chart indicates, but time will tell.

Of course withholdings are not purely just wages. There are some withholdings out of retirement accounts, bonuses, stock options and the like. So it can be a bit harder to know exactly how much of this slowing is tied to those sorts of reasons versus the fundamental underlying slowing the economy needs to cool inflation. If it is more fundamental, then expectations are the jobs reports and other labor market data in the coming months should begin to show the same patterns. The next steps would then be less strains on supply chains as consumer demand cools, and underlying inflation in the economy begins to move in the direction of the Fed’s target. And despite today’s GDP numbers, it is unlikely the U.S. economy has been in recession the first half of the year, even as our office is on Recession Watch given the risks from all of these dynamics.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.