By Josh Lehner

Oregon Office of Economic Analysis,

It’s no secret that the inflationary economic boom has translated into very strong public sector tax revenues. It’s the reason Oregon is currently facing a record kicker. These strong collections are nationwide and not a local phenomenon. 49 states saw revenues come in above projections this past year.

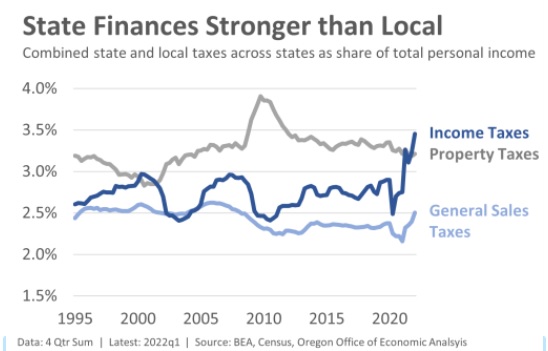

The combination of an underlying strong economy and sharp increases in non-wage forms of income, like corporate profits and capital gains, means that state and local taxes as a share of personal income are higher today than any point in recent memory as seen in the latest edition of the Graph of the Week. The chart focus on the big 3 taxes that state and local government levy, as regularly published by the Census Bureau.

That said, there is tremendous nuance and variation here that is worth spending a minute discussing.

First, some of these really strong gains are clearly temporary and will either fall or more likely crash back to earth in the quarters and years ahead. This is not a permanent shift to higher taxes but rather reflects pandemic factors and/or taxpayer behavior. The typical state is forecasting General Fund growth of just 1.2% this upcoming fiscal year, which will bring revenue as a share of income lower. Our office’s forecast is for a year-over-year decline in General Fund revenues coming off such highs.

Second, general sales taxes will retreat as consumer spending shifts back into services to a greater degree. Even if spending on goods holds steady in the years ahead, spending on goods as a share of income and as a share of overall spending will decline. This will impact most states’ sales taxes which generally only apply to physical/retail goods and not services. This will not be the case in Oregon where our new(ish) corporate activity tax (CAT) applies to goods and services alike. Policymakers designed Oregon’s CAT to be more immune to the tax base erosion other states have experienced in recent decades. Retail deflation will further erode sales tax revenue in the years ahead.

Third, due to property tax restrictions in quite a few states, property taxes are growing, but not seeing the same sort of growth as underlying economic activity, let alone property valuations would suggest. In Oregon, it is likely property taxes as a share of income are declining.

All of this brings me to my main point. There is tremendous variation between state and local government revenues today, and really across different local government jurisdictions all based upon their mix of revenues.

For instance, if we look across the country, about 90% of income taxes are state revenues versus 10% going to local governments. Similarly sales taxes are roughly 75% state and 25% local. So the biggest categories of public revenues, and the ones growing the most during the pandemic are primarily state resources and not local. On the other hand property taxes are 97% local and only 3% state.

As such, jurisdictions that are only or primarily funded by property taxes are seeing the slowest revenue gains. This is the basis for the title of the chart. States are seeing stronger revenue gains while some local jurisdictions without diverse revenue streams are seeing weaker.

Now, local governments’ revenues overall are roughly 1/3 transfers from the federal and state government, 1/3 property taxes, and 1/3 everything else. So local government revenues are growing, in part due to the large ARPA transfers and shared state revenues, and most of the things in the all other category are growing too, even if property taxes are growing slowly, especially in a state like Oregon.

At a high level, every public entity is facing the same inflation and cost pressures, and the same tight labor market now that full employment is here. However some jurisdictions are seeing correspondingly strong revenue growth — some even get to keep it to provide public services — while other are seeing solid gains but that are making ongoing budget choices more challenging than you might think.

Update: one macroeconomic implication is that strong state and local revenues, and accumulated reserve funds will offset some of the declines in federal spending after the pandemic programs ended last year

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.