By Josh Lehner

Oregon Office of Economic Analysis

“Inflationary booms traditionally don’t end well.”

Mark McMullen, State Economist

That was Mark back in our forecast release in February. Since then inflation has continued to stay elevated, and inflation expectations are creeping higher. Yesterday we saw a noticeably more hawkish Federal Reserve in terms of their outlook and expected policy path moving forward.

As Fed Chair Powell says, a sustained economic expansion requires price stability. One of the challenges is that the near-term economic path looks pretty much the same regardless of if we are headed for the soft landing or the recession as part of a boom/bust cycle. We need to, and currently are seeing tighter financial conditions taking some of the froth out the stock market, housing cool noticeably from its overheated pandemic days, and consumer spending shift back into services and out of goods. Even as the economy is delivering the things we need to see to get the good outcome, the pessimism overall is growing. As we noted in our most recent forecast, recession are in part psychological events driven by what John Maynard Keynes called “animal spirts.”

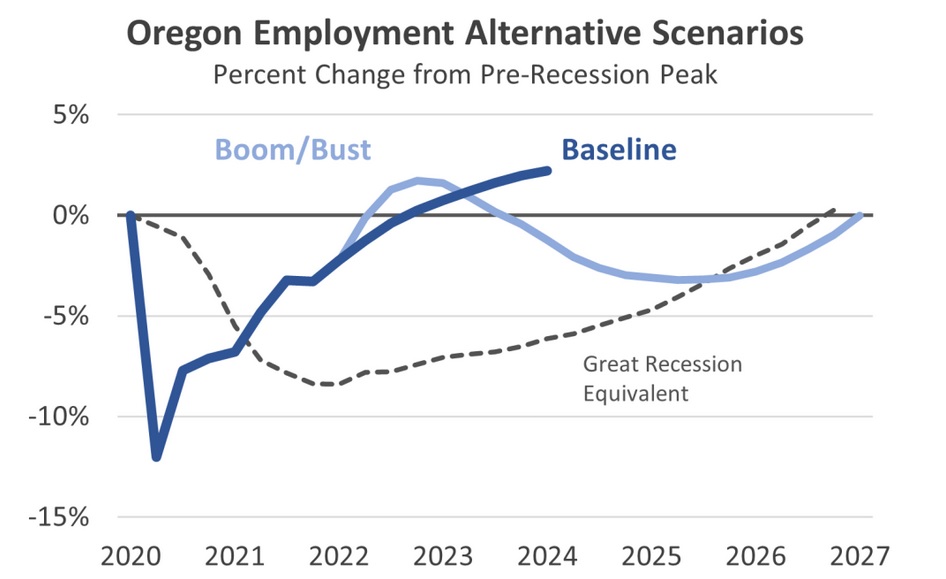

With that in mind, let’s take a look at the Boom/Bust alternative scenario our office has been incorporating into our forecast for the past year. Now, the baseline outlook is still the most likely path for the Oregon economy, and the baseline remains the soft landing and a continued economic expansion. However, our office believes the most likely alterative path for the economy is some sort of stronger boom this year followed by a bust in the next year or two.

Keep in mind that this is a stylized scenario. The economy is unlikely to unfold exactly as described here but this sheds some light on the potential causes and consequences of such a scenario.

Boom/Bust Scenario:

The inflationary boom continues. By late this year, employment, income, and spending are all 2-3 percentage points higher than the baseline. Corporate profits are up even more. The unemployment rate drops to 3 percent by late summer or early fall. Inflation cools from today’s highs but remains closer to 5 percent. The Federal Reserve raises interest rates more aggressively. The policy goal is to cool the economy and bring inflation under control. However, the end result of raising interest rates high enough to actually slow inflation is to send the economy back into recession beginning in 2023. Depending upon the exact timing of the Federal Reserve policy changes, the recession may be pushed out into 2024.

In any future recession, the key will be the severity of the cycle. Today, there is relatively little leverage in the economy. Household debt remains tame, and the labor market is structurally tight, although a recession would make it cyclically weak for a period of time. Without clear imbalances, or leverage in the economy, any ensuing recession is likely to be mild or moderate, and less severe. One risk here is just how entrenched inflation is in the overall economy. A more severe recession would likely be needed to wring out more entrenched inflationary pressures, whereas a milder recession may be needed if most of today’s inflation is transitory, or temporary.

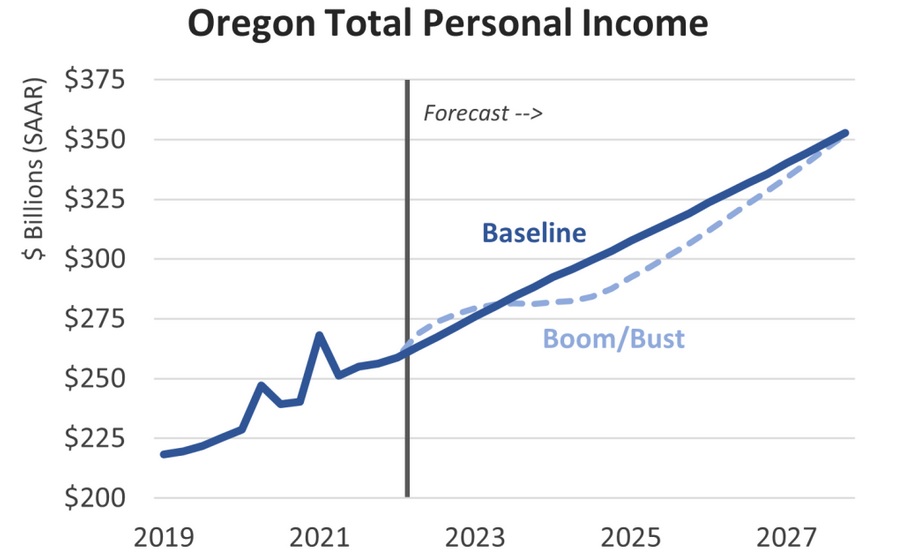

In this boom/bust scenario, Oregon suffers a moderate recession. The state loses 100,000 jobs and the unemployment rate rises to nearly 9 percent. Nominal personal income does not necessarily decline significantly, but rather stalls out for a year and a half or two years. This type of cycle would be similar to the aftermath of the dotcom bust here in Oregon in the early 2000s.

Another key consideration is the relative starting point of the bust. With an economy growing faster than expected this year, the fallout from a recession, when compared to the baseline, is somewhat less severe. In the upcoming 2023-25 biennium, employment and total personal income in Oregon are about 4 percent below baseline.

Growth resumes in early 2025 and the recovery is strong. Oregon’s economy regains full employment and catches up to the baseline outlook in 2027 or 2028.

The revenue implications of the Boom/Bust economic scenario a larger projected kicker this biennium as revenues continue to boom. The ensuring recession after the Federal Reserve hikes interest rates to head off inflation takes a toll on state resources. Revenues in both 2023-25 and 2025-27 are considerably below the baseline outlook. Declines would also be seen among Lottery sales and the Corporate Activity Tax revenues as well as consumers spend less during recessions.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.