By Josh Lehner

Oregon Office of Economic Analysis

The labor market is structurally tight. Mediocre demographics are the key reason why. Let’s run through a quick update on young workers in the trades.

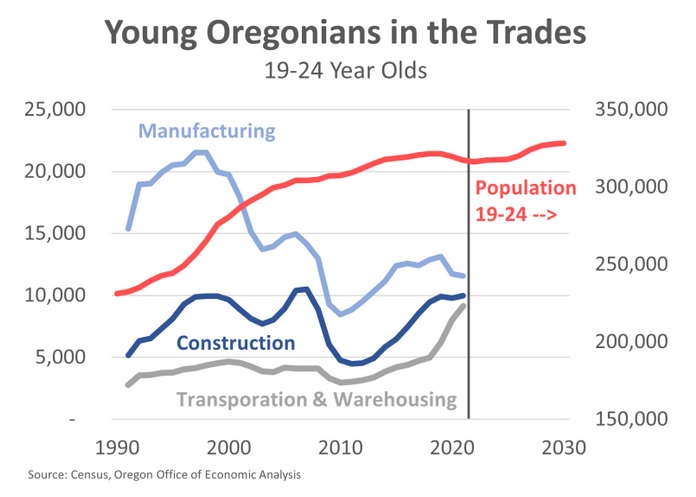

First, the good news. The total number of young Oregonians working in the trades is higher today than it has been in two decades. Even as a share of all young Oregonians, such workers are all the way back to where they were at the height of the housing boom.

The rebound in young construction workers following the housing bust took a few years to get going, causing some consternation of a lost generation when it comes to working in the industry. However, young workers have returned and there are just as many now working construction as in the late 1990s and at the height of the housing boom.

Even so, the vast majority of the growth has been in transportation and warehousing, with distribution centers really increasing employment in Oregon in recent years.

Manufacturing production is strong, and the recovery has been much better than anticipated, even as employment remains down a bit. This data indicates manufacturing employment for young Oregonians is down just a bit more than for all ages, which is something to keep an eye on moving forward.

Second, as the red line indicates, the pipeline of new workers into the labor market is more of a steady flow than a big increase. With Baby Boomers continuing to retire, the net growth in Oregon’s labor force will be slower than local businesses have become accustomed to in recent decades. All industries are facing the same demographic crunch, with the trades falling right in the middle of the pack. There will be increased competition to attract and retain workers in the years ahead.

Third, the outlook for businesses looking to hire may get just a little easier in the months ahead, although not necessarily for good reasons. There are an increasing number of anecdotal report that some firms and industries overstaffed during the delta and/or omicron waves. E-commerce and warehousing operations are included. Furthermore, as housing demand cools some as buyers adjust to higher mortgage rates, and consumer spending rotates back into services to a greater degree, the outlook for goods is softening.

As of today none of these changes are particularly worrisome. These patterns were expected, and needed from a macro level to help bring inflation down. Our office’s employment forecast for these industries called for noticeably slower growth. The real risk would be for larger changes and pullbacks leading to sizable job losses. Regardless, for firms looking to hire from this labor pool today, there should be a little less competition, making it a little bit easier to find and retain workers.

Fourth, in terms of finding workers in the structurally tight labor market, a key factor will be the Latent Labor Force. Oregon’s workforce is 53% female, and about 75% white, non-Hispanic (WNH) according to pre-pandemic ACS data. Diversity in the trades is generally lower. At the occupational level, both construction and installation, maintenance and repair jobs in Oregon are 96% male, and 75% WNH. Transportation and material moving occupations are 20% female, and 74% WNH. Production occupations — the manufacturing jobs that actually do the manufacturing — are the most diverse at 25% female, and 66% WNH.

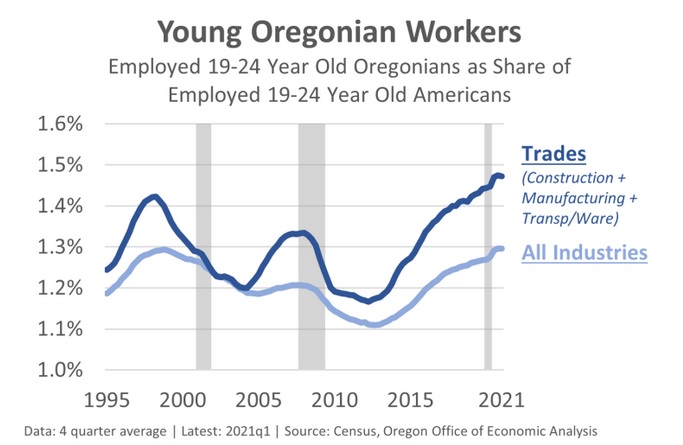

Fifth and finally, let’s take a look at young Oregonians compared to young Americans. Overall, Oregonians are working in the trades to a greater degree than many other states, at least according to this data. Oregon is generally about 1.2-1.3% of the nation. When it comes to younger workers in the trades, Oregon is nearly 1.5% of the U.S. overall. This holds up for construction, manufacturing, and transportation and warehousing individually as well.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.