By Josh Lehner

Oregon Office of Economic Analysis

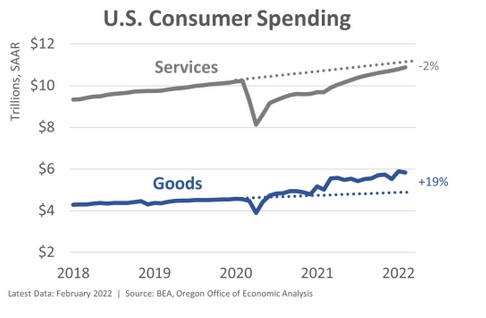

Consumer spending on physical goods remains robust. It accelerated earlier in the pandemic as we still had strong household finances but either couldn’t or didn’t want to spend on services like going out to eat, on vacations, performing elective surgeries, and the like as much as we used to. The increases in spending on physical goods has held up, even as service spending has rebounded. Today, consumer spending on goods is 19% above pre-pandemic trends, and even after adjusting for inflation it remains 8% above trend. Given household finances, the baseline outlook is for more of the same. Should they want to, consumers can afford to maintain their higher goods spending, while also increasing their service spending.

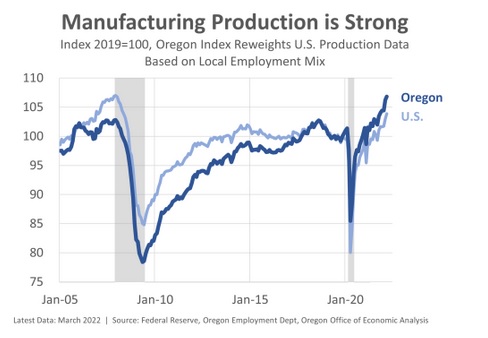

This matters economically because the strong consumer demand for goods is driving a more robust than expected manufacturing recovery. Industrial, and manufacturing production are higher today than at any point since the Great Recession. Our factories, warehouses, and logistics are all producing and moving record volumes of products trying to keep up with the strong consumer demand.

According to the latest Federal Reserve data, U.S. manufacturing production is now 4% above the pre-pandemic peak. Our office takes the U.S. data and reweights it based on our local manufacturing subsector employment trends. That estimate of Oregon manufacturing production is running a bit stronger and is now 5% above pre-pandemic peaks. While this is not an exact measure of Oregon production, what it does tell us is that the industries that Oregon has larger concentrations in are doing better than the industries in which we have smaller concentrations. Our more modern mix of manufacturing is benefiting our overall economic recovery.

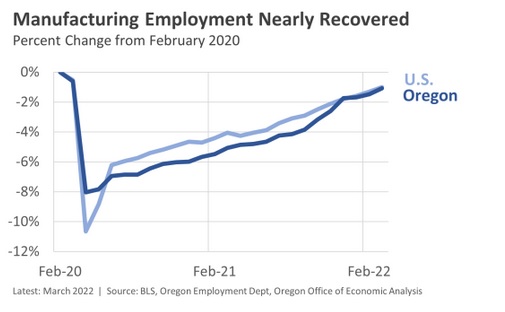

And of course, to produce enough products to meet demand, it means business investment and employment need to increase. Unfortunately, from a historical perspective, manufacturing employment doesn’t fully recover from recessions in recent generations. Specifically, in Oregon, manufacturing employment has not fully recovered from a recession since the 1990s. Nationally, US manufacturing employment has not fully recovered from a recession since the 1970s. However, this time may be different. Today, we are pretty close to a full manufacturing employment recovery. Both in Oregon and across the country, manufacturing employment is 1% lower that just prior to the pandemic. Although to be fair, employment is down a bit more from the peaks reached prior to the trade war back in 2018 and 2019, which resulted in some lost jobs leading into the pandemic.

A few additional notes and comments:

It is clear the good news outweighs the bad. That said there are two weak spots in Oregon’s manufacturing recovery: primary metal manufacturing employment is down 25% and transportation equipment is down 13%. Combined, all other subsectors are fully recovered and individually they are all at least close to a full recovery or better.

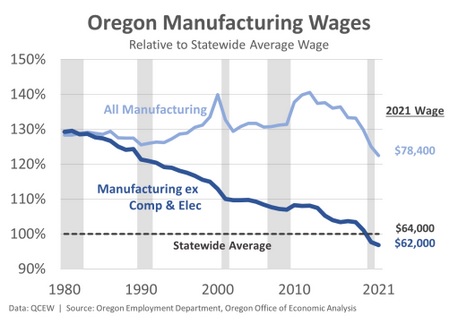

The overall strength in manufacturing employment is encouraging, if not a bit surprising given that wage growth has lagged. We know that both the career path for manufacturing is good but also that the manufacturing wage premium has been declining. There are a lot of low-wage, and entry-level type positions within the sector. Wages are rising during the pandemic. However these gains, at least for the average worker, have not kept pace with the broader economy. In fact, for the first time in which we have data the average manufacturing wage excluding computer and electronic products* is below the overall average wage in Oregon. Today the manufacturing wage premium is negative.

Wood products is the only manufacturing subsector to see above average wage gains over the past two years. This makes sense in the context that demand for wood products has been very strong during the pandemic. And with higher lumber prices, firms can pay higher wages to attract and retain workers to increase production. All other subsectors have seen wage gains, but near the average or slower.

Finally, in terms of the outlook there are a few important things to consider.

First, the baseline outlook calls for steady spending on goods, and therefore ongoing solid production and employment numbers. That said, the risks are weighted toward the downside. Should sales slow due to inflation causing demand destruction, to the pandemic-induced demand being met and fading away, or to consumers shifting out of goods and back into services, then we would see the local production and employment numbers soften as well. This could be outright declines, or just slower gains moving forward.

Second, current geopolitical events are muddying the picture. The war in Ukraine impacts energy and production costs, in addition to creating some global supply chain issues as it drags on. Similarly, the shutdowns in China will likewise impact global supply chains where the U.S. will see somewhat fewer imports for some period of time. This means fewer consumer products, but also fewer imported manufacturing inputs which could impact domestic production as well. The good news is these are more likely to be temporary disruptions, but disruptions nonetheless.

Bottom Line: The manufacturing recovery continues to outpace expectations. Production and employment are strong, as consumers continue to demand higher volumes of physical goods. This cycle is different. We may see a full manufacturing employment recovery for the first time in decades, or at least get really close. The outlook is not without risks, most of which are weighted toward the downside. In the meantime, expect manufacturing wage growth to pick up in order to attract and retain workers in a tight labor market.

* Due to composition of the computer and electronic products workforce, which is mostly higher paid engineers and white collar professional types, we exclude the wages here to get a better gauge of underlying wages in manufacturing

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.