By Josh Lehner,

Oregon Office Economic Analysis

This Oregon Office of Economic Analysis released the latest quarterly economic and revenue forecast. For the full document, slides and forecast data please see our main website. Below is the forecast’s Executive Summary and a copy of our presentation slides.

The economy continues to boom. Jobs, income, spending, and production are all rising quickly. However, pessimism about the expansion is growing. First quarter GDP was negative. Inflation is at multi-decade highs, eroding household budgets. Russia’s invasion of Ukraine created an oil shock and raised fears of increased conflict. A new round of pandemic-related shutdowns in China is set to exacerbate global supply chain struggles.

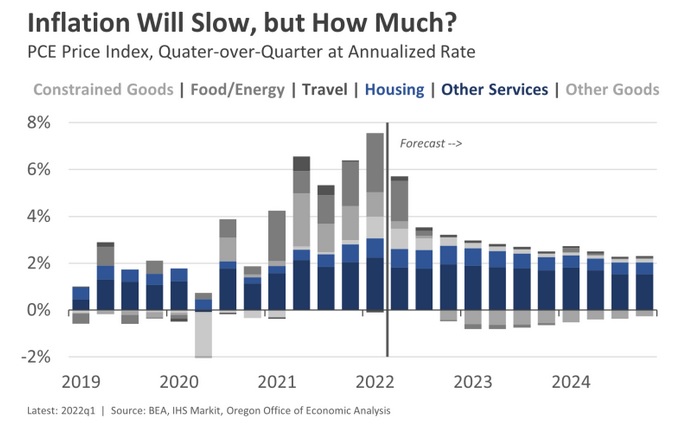

And yet, the U.S. economy is expected to push through. This peak in pessimism based on temporary issues will fade. Consumer spending and business investment have accelerated in recent quarters. Jobs and income will continue to grow. Inflation is set to slow due to the combination of higher interest rates, cooling of goods prices, and moderating household financial conditions. It remains an open question just how much inflation will slow.

The ultimate risk is the economy needs higher interest rates to truly wring inflation out of the system. Should that be the case, the risk of a boom/bust cycle increases. Recessions are in part psychological events, driven by what John Maynard Keynes called “animal spirits.” If firms and households believe there will be a recession and start pulling back on spending and investment, it can create a self-fulfilling event.

Regardless, it is clear the economy has moved into a new phase of the cycle. The dynamics are shifting. No longer is the U.S. or Oregon in recovery mode, but in net expansion territory. The challenges, risks, and trends associated with a mid-cycle expansion are different than those faced during the initial recovery.

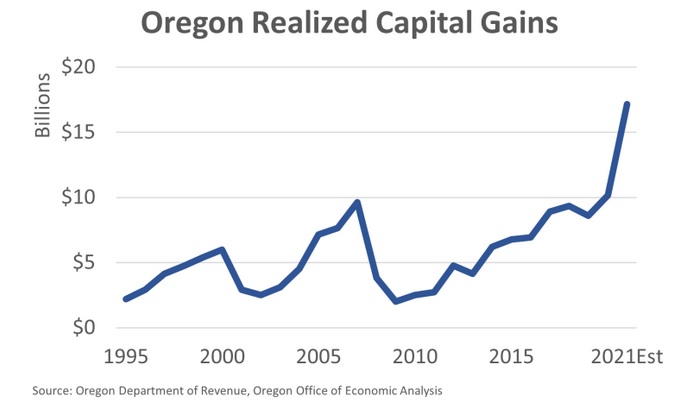

The 2022 personal income tax filing season has been shocking. Despite a record kicker credit being claimed, payments rose sharply. Given last year was a very strong year, today’s growth stands out even further.

The surge in tax collections was not unique to Oregon, with all states that depend upon income taxes seeing collections outstrip projections. Across states, high-income tax filers have accounted for much of the growth in personal income tax revenues. A wide range of investment and business income sources are booming. However, as is usually the case, Oregon’s revenue gains during the boom were relatively pronounced. Tax season payments will come in more than $1.2 billion (70%) larger than last year. The typical state has seen around half this rate of growth.

While economic growth remains strong, the large gains in reported taxable income have more to do with taxpayer behavior than they do the underlying economy. Investment and business income are not always realized for tax purposes at the same time as they are earned in the market. Late 2021 was a great time to cash in assets, with equity prices and business valuations high, and potential federal tax increases on the horizon. As a result, income reported on tax returns grew at more than double the rate of economic measures of income.

Given that revenue growth has been driven by nonwage sources of income, most of the recent surge in payments will likely prove to be temporary. After so much income was pulled into tax years 2020 and 2021, less will be realized in the near term. This taxpayer behavior also puts Oregon’s revenues at risk of the sharp declines experienced after asset market corrections in 2001 and 2007. With recessionary risks rising, profits and gains could soon turn into losses, and a smaller share of filers could be subject to the top rate.

The bottom line is that the unexpected revenue growth seen this year has left us with unprecedented balances this biennium, followed by a record kicker in 2023-25. The projected personal kicker is $3.0 billion, which will be credited to taxpayers when they file their returns in Spring 2024. The projected corporate kicker is $931 million, and will be retained for educational spending. Even so, if balances are not spent, net resources for the 2023-25 biennium will have increased by $427 million relative to the March 2022 forecast.

See our full website for all the forecast details. Our presentation slides for the forecast release to the Legislature are below.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.