By Josh Lehner

Oregon Office of Economic Analysis

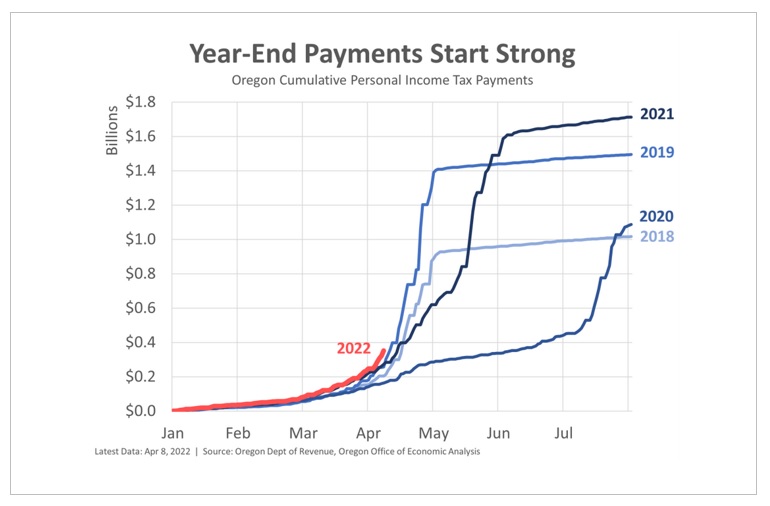

Our office’s baseline expectation for tax season combines three things. First, the tax filing deadline is back to being near April 15th, unlike the past two years where the deadline was delayed. As such, the flow of funds, so to speak, should be normal as well. Second, underlying income growth will be strong given the inflationary economic boom. Third, actual tax collections will be tempered some because we will be giving out a record kicker due to our office under forecasting revenues in the 2019-2021 biennium. Given the kicker is administered as a credit on the return the impact on state revenues is to collect smaller final payments or disburse larger refunds, both of which lower the total payments owed in April.

As of last week, final payments are off to a strong start this tax season. It is still a bit too early to tell where exactly they will end up. Peak processing season for our friends over at the Department of Revenue is just getting underway (at least in terms of dollar volume of returns). We will know more in a couple weeks.

Overall our office expects revenues to be more like 2020 (also a kicker payout year) than 2019 or 2021. The key will be just how strong is underlying income growth, including some non-wage forms of income like capital gains. Stock markets were up about 25% last year. Capital gains are not included in the BEA estimates of current personal income, in part because a key piece is taxpayer behavior. Households can choose when to realize their gains, which can either buck or amplify trends in the underlying asset market valuations. We will know more soon, and particularly after the extension filers are processed later this fall.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.