By Josh Lehner

Office of Oregon Economics Analsyis

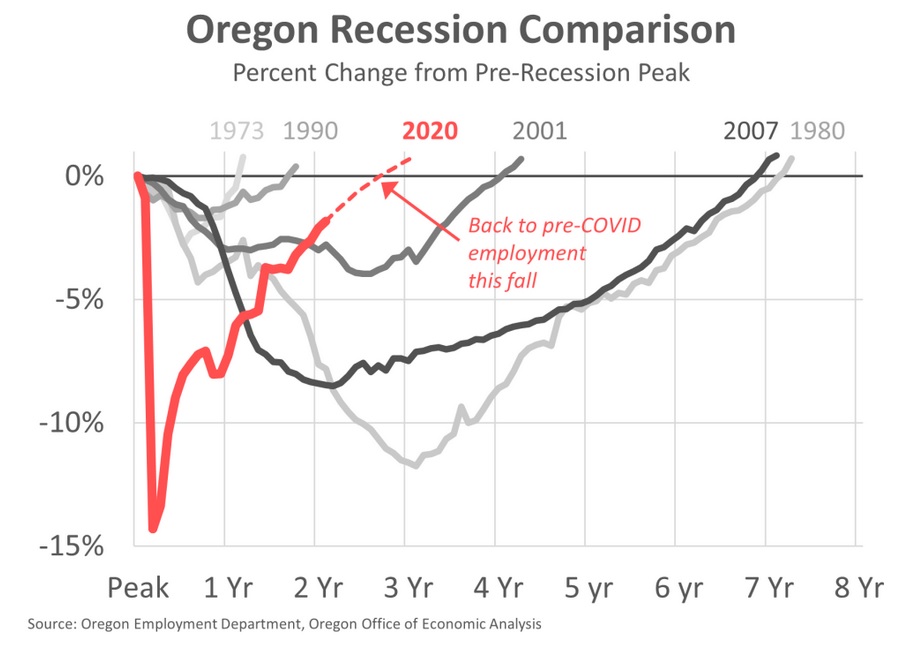

The inflationary economic boom continues. Jobs, incomes, and output are all rising quickly. The economy will reach full employment much quicker than following recent recessions. However, this cycle brings different challenges. For instance, the nation’s large urban economies lag due to increased working from home and lack of business travel. Even so, no challenge or risk today is bigger than inflation. The baseline outlook calls for higher interest rates to cool demand, slowing inflation and ensuring a continued economic expansion. Unfortunately, a boom today leading to a bust in a couple of years is not out of the question should high inflation persist.

This week we got two updated pieces of data confirming the inflationary boom.

First, this morning our friends at the Oregon Employment Department released the March employment report. Oregon added 5,600 jobs last month and the unemployment rate fell to 3.8%. Oregon has now regained nearly 90% of it’s lost jobs and remains on track for a full labor market recovery later this year.

The combination of strong job growth and robust wage gains means overall labor income is booming. These wage gains offset the fading impact of federal aid from earlier in the pandemic. With households flush with cash, they have the ability and are showing the willingness to pay higher prices for goods and services. Remember, supply chains are not broken. Rather they are overloaded due to the strong consumer demand.

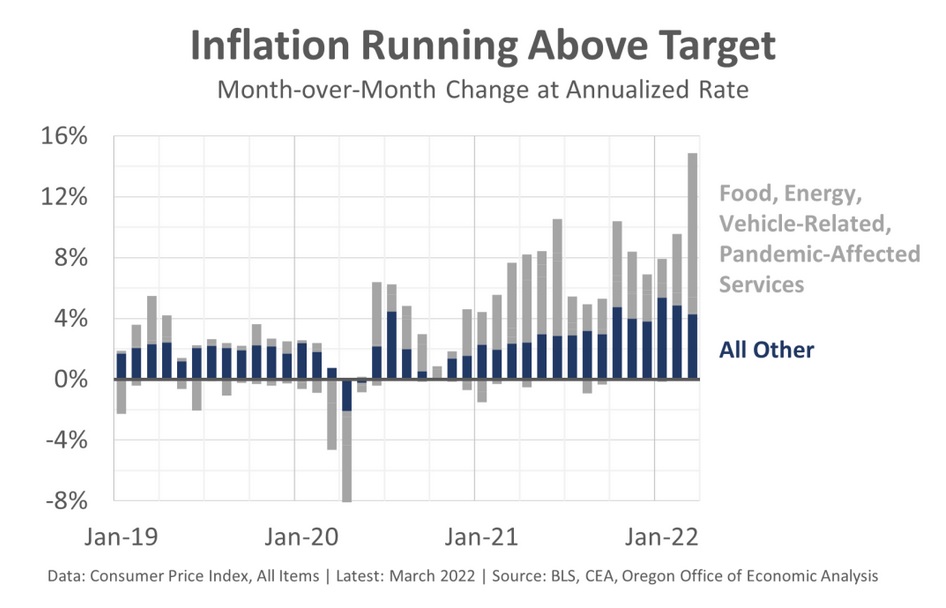

This brings us to the second piece of data this week: inflation. In March, the U.S. consumer price index rose nearly 15% at an annualized pace. Much of the increase is due to the oil shock, which are never good news but the economy is better able to handle today. In a half snarky comment, I think it is fair to say that we are at peak inflation. Prices won’t increase at double-digit rates moving forward. But there’s no comfort in that comment, as we know inflation is not costless. The latest U.S. research indicates that 80% of workers have seen real wage declines in the past 6 and 12 month period.

The real challenge is the blue part of the chart above. We know there are some constraints and issues in the economy. The prices of automobiles, hotels, and the recent surge in food and energy prices are all driving headline inflation higher. However, even when we strip those out (gray portions) we are left with an underlying trend in inflation that has accelerated in 2021 and is now running about 4-5% at an annual basis.

Inflation is likely to remain above the Fed’s target this year and into next, but on a slowing trajectory. As supply chains improve and demand cools, the sharp increases in durable goods prices are likely to reverse somewhat. Headline inflation will also slow as the oil shock from the war in Ukraine fades. However, the key items to watch are to what extent service inflation accelerates and offsets the goods declines, and whether wage growth slows from its brisk pace. The interaction between actual inflation, inflation expectations, and income or wage growth all matter here. Right now they are all pointing toward something faster than what we experienced last cycle.

As such, the Federal Reserve is raising interest rates faster, and higher than they previously anticipated. The good news is the economy can withstand higher rates. In fact, the Fed estimates the neutral rate of interest – where policy is neither stimulating nor restricting the economy – is about 2.5%. The federal funds rate today is the range from 0.25-0.5%. Expectations are the Fed will raise rates to close to neutral this year and monitor the impacts. The real question is whether the economy needs restrictive policy to truly slow inflation. The risk is recessions tend to happen after policy becomes restrictive.

But for now, the near-term outlook continues to be bright. A full labor market recovery is just a few months away. Household incomes are rising quickly. Consumer spending on goods is still 19% (!) above pre-pandemic trends, and service spending is nearly fully recovered. The underlying economic risks here are such that goods spending may revert to trend, leading to a manufacturing recession but not an overall recession, and that service spending accelerates further increasing pressure on the labor market (services are labor-intensive) and inflation overall.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.