By Josh Lehner

Oregon Office of Economic Analysis

It’s the first one in a couple of years that might actually feel like Spring Break. COVID cases and hospitalizations are low, masks are off if you want, and household finances remain strong. There is definitely some pent-up demand for travel, entertainment and fun. Ahead of next week, let’s take a quick look at how real consumer spending (adjusted for inflation) for a number of these categories stack up.

In the chart below, sales are compared to a pre-pandemic trend, which is basically just a counterfactrual of moderate growth. As you can see, most of the travel and entertainment activities are yet to fully recovery, but are showing growth in the past year. The only categories to be fully recovered would be purchases of luggage (we’re ready for vacation!) and going out to eat (which has shifted a bit from more fast-food during the earlier stages of the pandemic, to more sit-down dining in the past six months or so). Other categories like going to the movies, concerts, or amusement parks are still half of what we would have expected absent a pandemic. We are starting to do those more, but still quite a bit less frequently than we used to.

While the spending numbers shown above are national, we have a couple different looks at travel behavior closer to home. First, the latest traffic counts from ODOT show that driving is basically fully back to where it was pre-pandemic. For much of the past couple of years, driving behavior was just a little lower than it had been, but that gap looks to have closed. Oregon does have a slightly larger population today than a few years ago, so on a per capita basis, driving is down a little, but no longer in aggregate.

Second, we have the latest passenger counts from airports in Oregon. As discussed previously, air travel to the state’s regional airports is essentially fully recovered, whereas passenger counts at the state’s largest airport, PDX, remain about 20-30% lower. This pattern is likely impacted by the fact that leisure travel has rebounded strongly, but business travel remains weak.

Third, as reported weekly by Travel Oregon, hotel occupancy outside of the Portland area is above pre-pandemic figures.

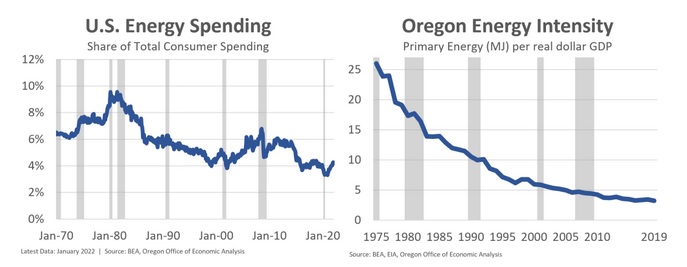

Now, given the recent surge in gas prices, if we’re headed out on a Spring Break trip, we will definitely be paying more at the pump to fill up for the journey. An important thing to note is that oil shocks are not good news. That said, Oregon and the U.S. have never been better able to manage an oil shock than today. The macroeconomic impacts will be smaller than in previous oil shocks like those back in the 1970s or mid-2000s. Why?

First, spending on gasoline, or energy more broadly was a record low just a few months ago. Yes, energy spending is rising quickly, but there is room in household budgets to adjust. Second, the energy intensity of the economy continues to decline. The amount of energy it takes to produce goods and services has never been lower. Don’t get me wrong, there will be an impact from the oil shock, but that impact will be more muted than in previous periods; Oregon likely even more so than the nation. And third, the U.S. is an energy and oil producer these days. High oil prices are bad for consumers and business costs, but good for the drilling and mining industry. The net impact on the U.S. economy is the combination of consumer spending, and business investment in new wells and increased mining activity (jobs and wages). High oil prices are not longer just bad news for the U.S.

Finally, getting back to Spring Break, it’s important to keep in mind that this shift in consumer spending back into services is economically important. Services are labor-intensive, and therefore the improving sales of us going on vacations, out to eat and other forms of entertainment is helping drive the employment recovery in the past year and in the years ahead, and will boost the regional economies more reliant upon these industries as well.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.