By Josh Lehner

Oregon office of Economic Analysis,

The inflationary economic boom continues. The U.S. economy grew at its fastest pace last year since the early 1980s. This is true even after adjusting for the current bout of high inflation. More of the same is expected this year. Labor markets will grow and fully recover, however labor will remain tight for businesses looking to hire. Inflation will persist noticeably above the Federal Reserve’s two percent target, but the real economy will see strong gains due to business investment and consumer spending.

Today, households are flush with cash and rising wealth. Consumers have the ability and are showing the willingness to pay higher prices for goods and services. Business can pass along production cost increases as a result, maintaining or even increasing profit margins.

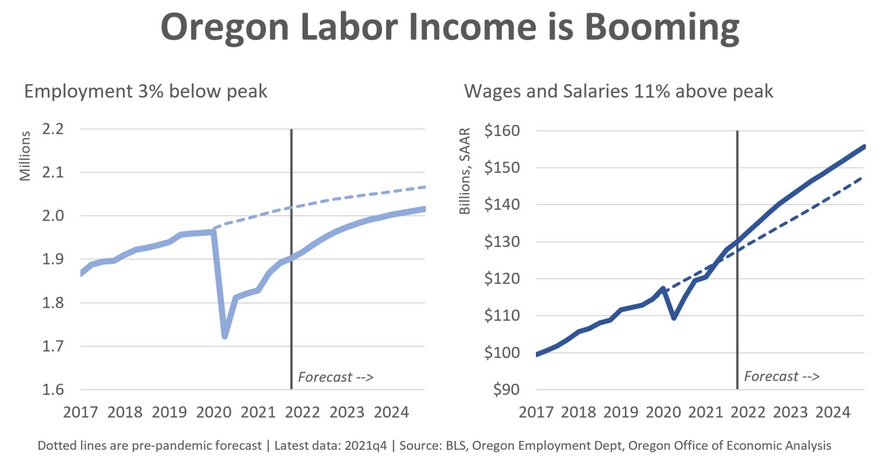

The biggest economic challenge remains the supply side of the economy. Supply chains are not broken but are overloaded due to strong consumer demand. Given that labor runs through everything, it is the single biggest constraint on the economy today. Labor supply is increasing. Oregon added a record number of jobs last year. However the labor market is very tight and expected to remain so.

The biggest risk to the outlook remains persistently high inflation. A year ago, inflationary pressures could largely be tied to reopening the economy and semiconductor shortages. Since then the inflationary pressures have broadened. The Federal Reserve is pivoting hard toward tightening monetary policy. While not the baseline outlook, the ultimate risk is that the economy runs too hot, creating a boom/bust dynamic in the years ahead.

As the inflationary boom persists, all of Oregon’s primary state revenue instruments continue to outperform pre-pandemic expectations. With the consensus of economic forecasters now expecting that there is more to come, the revenue outlook has been revised upward.

Tight labor markets are putting a considerable amount of upward pressure on wages, which is reflected in withholdings of personal income taxes. Withholdings of personal income taxes mostly result from the wages and salaries of workers, but also include some retirement and bonus income. Personal income tax withholdings are growing at roughly double the rate seen during the last expansion.

Businesses currently have a considerable amount of pricing power, and have been able to pass most of their cost increases along to consumers. As a result, profits and other taxable forms of business income have shrugged off the pandemic. In addition to the direct boost to tax collections, healthy business earnings are supporting equity markets and other forms of investment income. Although asset markets have weakened some to start the year, they have thus far been spared the sort of correction that we typically see accompany large job losses.

Inflation is also generating additional Corporate Activity Tax collections. Business sales are taxed by value, not by the quantity sold. As a result, tax liability has risen along with prices, and is expected to remain elevated until consumers are no longer willing or able to absorb price increases.

The recent revenue boom, together with an improving outlook for labor earnings, have led to a significant upward revision to the outlook for Oregon’s General Fund revenues. The current forecast projects a Personal Income Tax kicker credit of $964 million and a Corporate Kicker of $634 million. Overall, gross General Fund revenues have doubled since the Great Recession, and took a big step up after the pandemic hit. Revenue growth has continued, even as large kicker credits have been paid out. Although the baseline outlook calls for continued growth, overheating remains a real possibility. Inflationary booms of the sort we are experiencing today traditionally do not end well, putting recent revenue gains at risk going forward.

See our full website for all the forecast details.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.