By Josh Lehner

Oregon Office Economic Analysis,

Demand for housing is very strong. Vacancy rates are falling, home sales are rising, and while new construction activity is increasing some, in the big picture it is relatively steady here in Oregon.

The lack of a sustained supply response in housing in the past 20 years is problematic for both current residents, and longer-term economic and revenue growth.

Oregon has underbuilt housing by 111,000 units in recent decades. Unfortunately the industry is running into supply side constraints. In general these include the lack of financing, particularly for land acquisition, development, and construction loans, which contributes to the low supply of available land and buildable lots. Layered on top of those are local land use, zoning and parking requirements, permitting processes and design reviews, and the like which are generally well-intentioned, but can reduce the timeliness and number of units being built. Furthermore labor is tight, particularly for an industry that has seen zero productivity increases in recent generations. It will take more workers to built more units.

All of these issues exist, and then the pandemic hit which simultaneously boosted homeownership demand and disrupted supply chains. Material and product availability is challenging, with longer lead times and more slowdowns in new housing production.

A market where demand is stronger, mostly due to rising incomes and favorable demographics, but supply is weaker, is one in which prices can increase quite quickly. And when the market becomes a bidding war, as it does in a supply constrained environment, it is our lowest income neighbors and family that lose out.

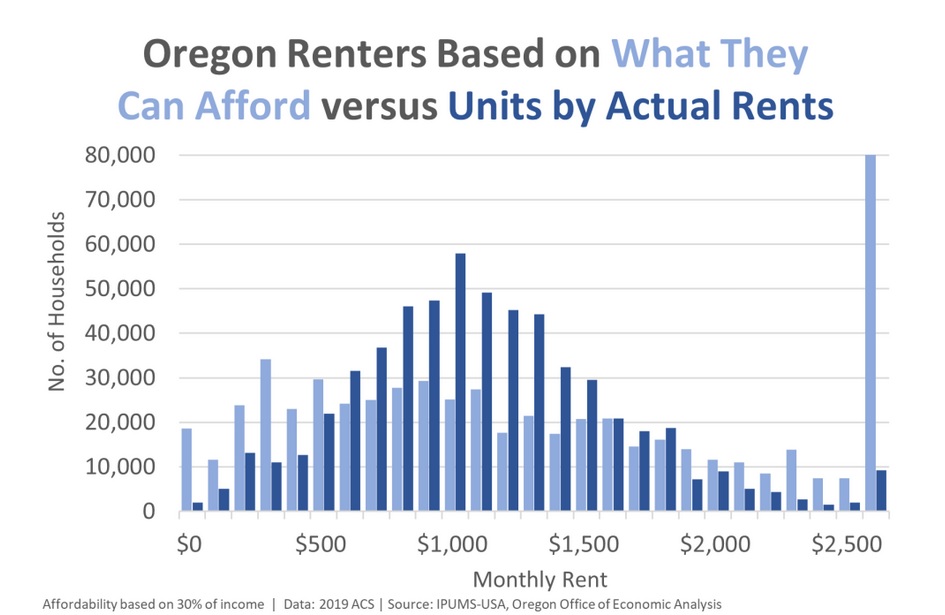

The statistics on the struggles of low-income households are myriad, and staggering. In Oregon, about one in four rental households spend more than 50 percent of their income on rent. There are twice as many very low-income rental households in Oregon (<$22,000 in income) than there are rental units that are affordable to those households (<$600 per month) without subsidies. And only about one in four eligible households actually receive federal rental assistance. As a result, estimates are that half of the state’s underproduction of housing – 54,000 of the 111,000 units – is needed among those earning less than half the area median income (AMI), or about $40,000 per year. The greatest need is among our lowest income neighbors, family, and friends.

It’s important to keep in mind that housing affordability has two components: housing costs, and household income. Affordability is the ratio of the two. As such, a growing economy with more-plentiful and better-paying job opportunities does help housing affordability, at least insofar as incomes rise faster than housing costs do. Improvements can be made on both components.

The issue is worse housing affordability forces families to make difficult, and at times impossible trade-offs. This includes other basic needs like food, clothing, transportation, and health care. Affordability problems are also the root cause of homelessness. New market rate construction is necessary and provides a lot of benefits, but it does not solve low-income affordability problems in the near-term. As such, continued investment in Affordable housing is needed. New Affordable projects are expensive – for example, two recent projects in the Portland region are approximately $400,000 per unit – and require substantial public funds either from the public sector directly or voter-approved bonds. Even so, it is clear that every single unit counts.

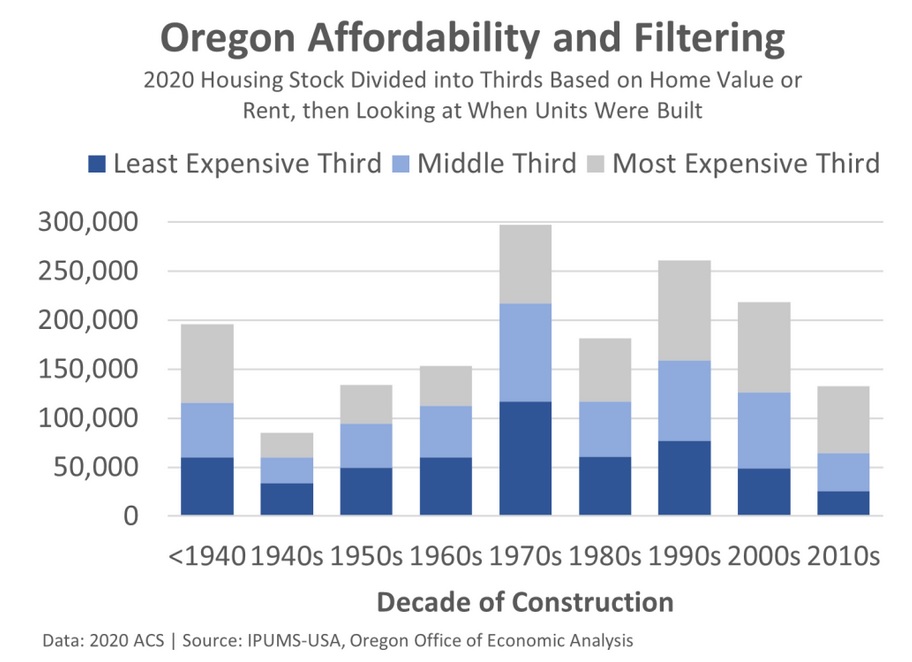

But those investments and improvements in low-income affordability cannot be achieved in a vacuum either. New market rate construction is required. New construction meets the demand of mostly high-income households. What this means is they are not competing with middle-income households for the same units, of which they will most likely remodel extensively bringing the older, less expensive units back up to the luxury tier. New market rate construction also contributes to longer-run affordability through filtering, which is a decades-long process. Filtering is the main source of workforce, or middle-income housing. Older units are generally less expensive in part due to being used, with a little more wear and tear, less up to date, and broader societal changes in housing tastes and preferences. Consumers are willing to pay a premium for new, and/or updated homes.

For more see this UCLA literature review on the effects of market-rate developments on neighborhood rents.

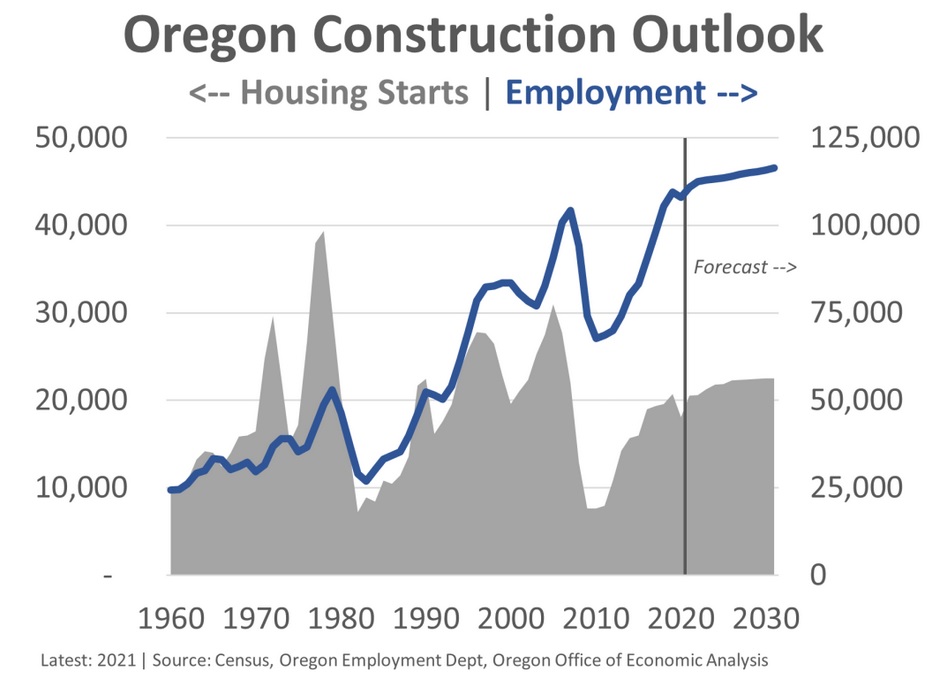

Today’s tight housing market is in part a function of the lack of new construction in the 1980s and in the aftermath of the Great Recession this past decade. There are fewer units to go around as a result. Housing supply matters, and if you build more units, you get more filtering. For example there are more housing units that are in the most affordable third of the market built in the 1990s than were built in the 1980s, despite being 10 years newer. This is due to the fact Oregon built 80,000 more units in the 1990s than in the 1980s. Similarly there are nearly as many units in the most affordable third built in the 2000s than were built in the 1980s, despite being 20 years newer. This is due to the fact Oregon built 40,000 more units in the 2000s than in the 1980s. Again, if you build more units, you get more filtering. What this also means is that given Oregon built so few units in the past decade, it will unfortunately have a lasting impact on availability and affordability for decades to come.

Our office’s forecast in the decade ahead is for 220,000 new housing starts, which are closely tied to the population and demographic forecast. This outlook does not make up the existing shortfall. The primary reasons are all of the supply side constraints discussed earlier, and the simple fact that Oregon has not built enough units in recent decades so it is hard to assume we suddenly will tomorrow.

Now, public policies like duplex legalization (HB 2001, 2019) and regional housing needs analysis (HB 2003, 2019) do support an increase in housing supply. These changes should provide economic, environmental, and societal benefits in the decades ahead. These benefits include better affordability, improved economic mobility, more walkable neighborhoods, and more efficient use of infrastructure to name a few. However these policies are best thought of as long-term improvements and are not a silver bullet to the immediate supply issues. Rather, it will likely take a concerted policy and workforce effort to increase the authorization and actual construction of more units than in our office’s baseline outlook.

Ultimately, housing affordability is a longer-term economic and revenue risk. Our office’s forecast assumes that households will continue to move to Oregon in search of the plentiful job opportunities and high quality of life. However to the extent fewer households can afford to live in and move to Oregon, or choose to live in a relatively more affordable state like those in the Intermountain West, then our office’s longer-run outlook will need to be revised lower. A slower growing population means there are relatively fewer workers earning less total income than in the baseline forecast. This translates directly into fewer customers and sales for local firms, and less taxes paid to state and local governments. This is not the baseline outlook for our office’s forecasts. However, housing affordability remains a key risk.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.