By Josh Lehner

Oregon Office Economic Analysis

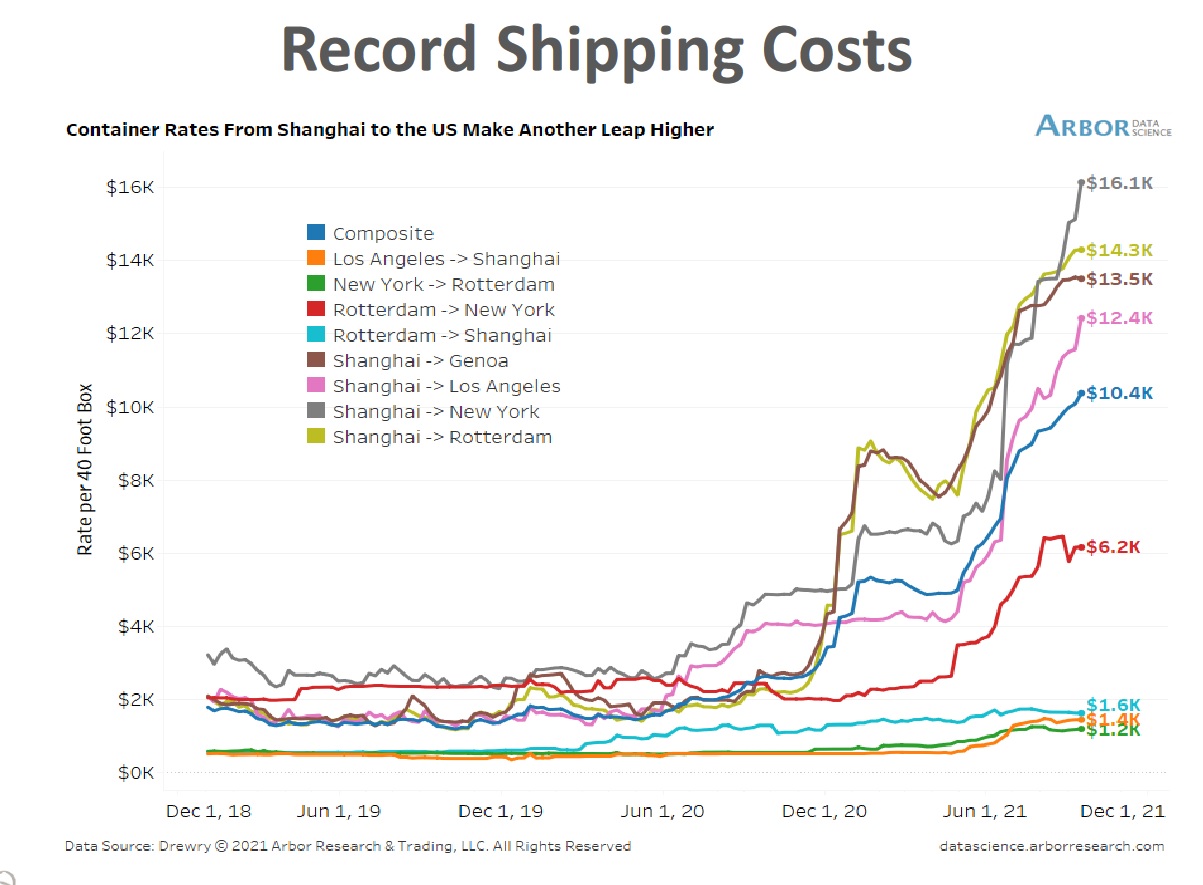

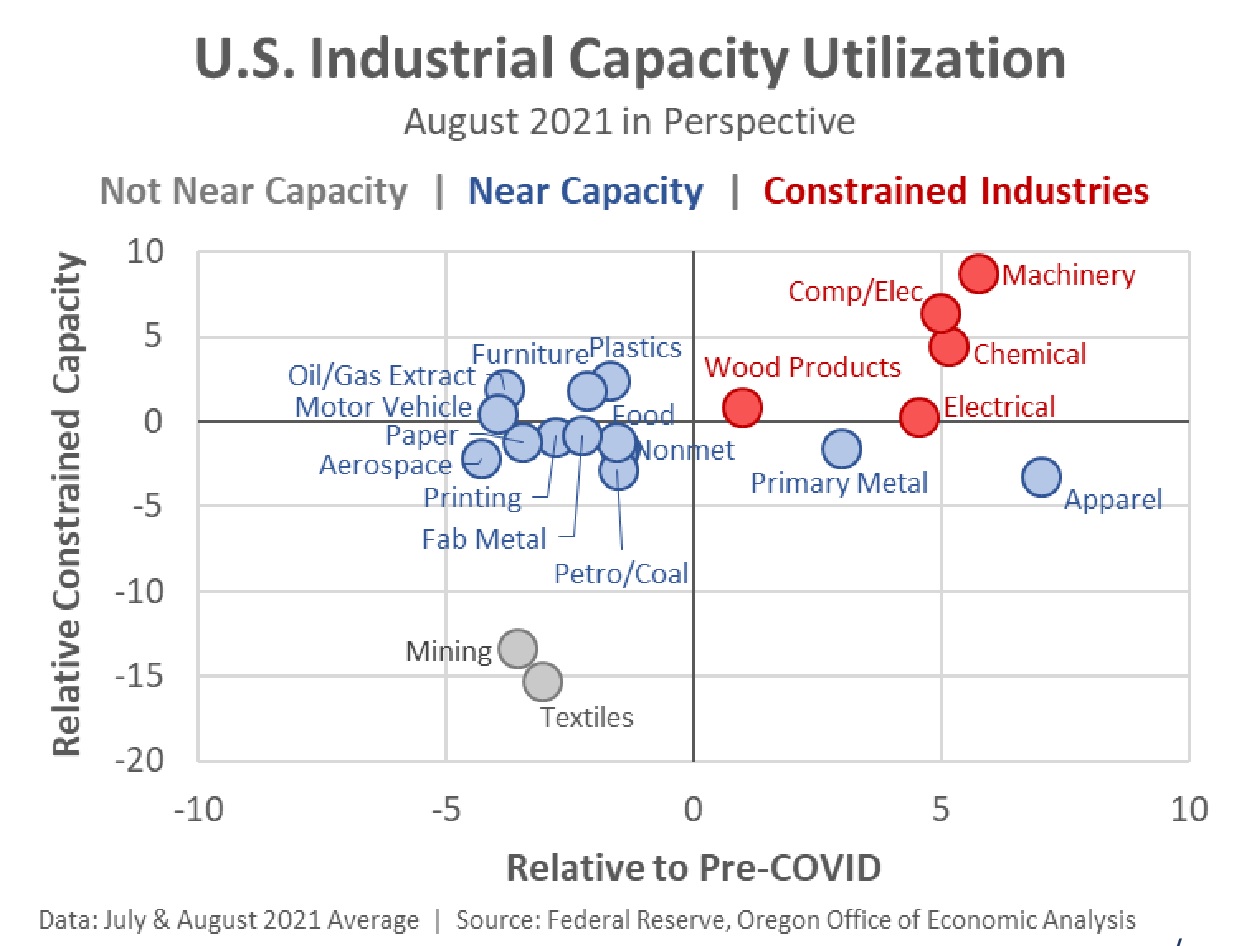

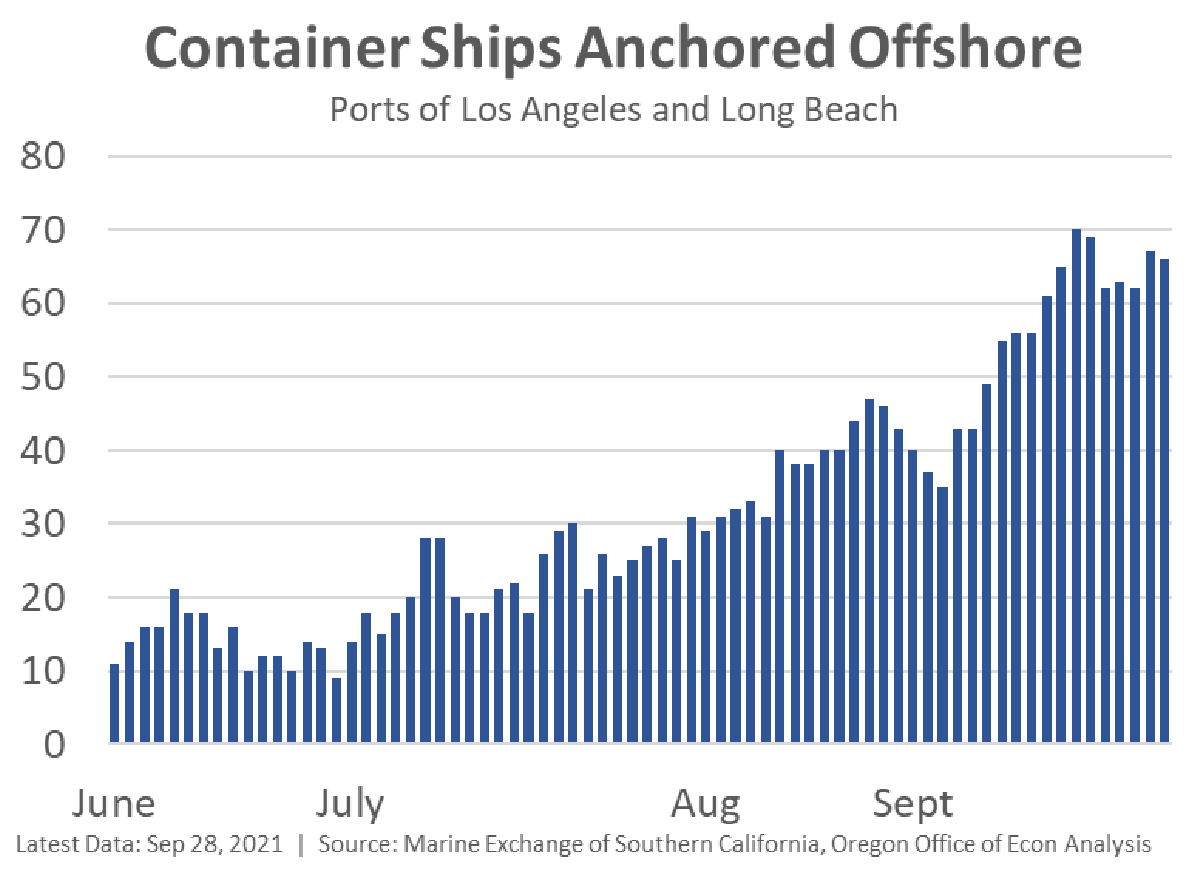

Right now consumer spending is strong, COVID is keeping some workers home sick, and factories and warehouses are operating at or near capacity. These factors result in struggling supply chains, bare shelves and rising prices. Firms are indicating that these issues are likely to persist well into next year. From an economic growth perspective what matters isn’t just when things normalize, but when do things stop getting worse. It is possible that we are currently at or near peak supply chain problems, but still quarters away from any return to normal.

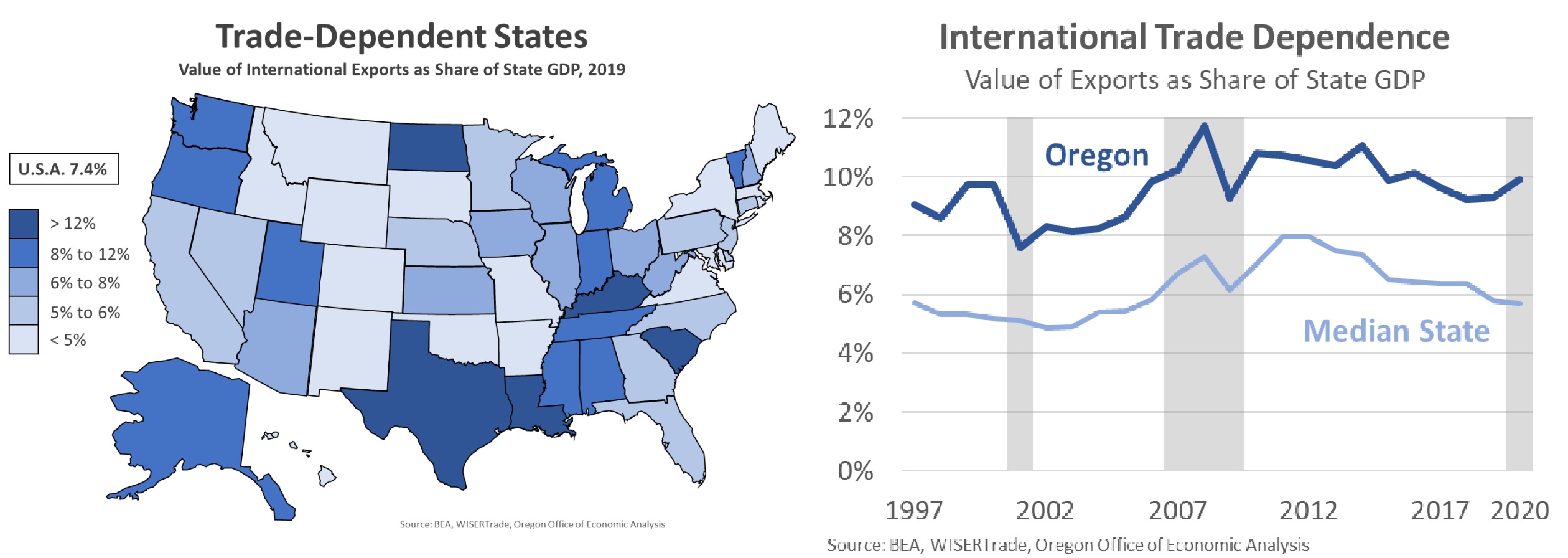

Here in Oregon we have good and bad news. The good news is that we have less direct exposure than most states to these supply chain problems. Our manufacturers rely on imported intermediate goods less than most other states. This is largely because we rely more on local sourcing for wood products and food, and our largest valued added comes from locally grown ingots that turn into silicon wafers and the like. Additionally the movement of freight — the value of shipments relative to the size of the economy — is relatively smaller in Oregon than in many other states. That means the supply chain problems disrupt a somewhat smaller slice of the regional economy than is the case in the Midwest, for example.

Now the bad news. Even if we are directly exposed to a lesser degree, we are not immune. Supply chains that are global in nature impact everything. An old ODOT report estimates that 60% of all goods produced in Oregon will be sent out of state, while 70% of all goods consumed in Oregon will be brought into the state. Slowdowns at ports in southern California, or backups at rail yards in Chicago impact the ability of Oregon firms to get the supplies they need and for Oregonians to buy products at the store. High transport costs and supply chain problems are a macro constraint.

Where do we go from here? Broadly speaking there are a few potential avenues for improvements. First, as the pandemic improves, more workers can return to their jobs, improving production and the movement of goods within existing supply chains. Second, firms can increase their productive capacity to meet the strong demand. Not only would this boost economic growth, but a supply increase also would slow inflation. Included here would be added trucking activity to relieve the bottlenecks. The vast majority of freight moves on trucks. Third, consumer demand may cool, easing pressures. This could be due to consumers shifting their spending more into services as the pandemic wanes, or higher prices resulting in fewer goods sold, which would better align with current supply capabilities.

These bigger adjustments will take time. The silver lining today is vendor delivery times are no longer worsening economywide — they’re terrible but not getting worse in recent months — and business investment is strong. Supply chain improvements should be coming, but we’re a long way from normal.

Given these issues and requests for data, our office has pulled together a number of supply chain related charts which you can see or download below.

More related charts which you can see or download below.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.