By Josh Lehner

Oregon office of Economic Analysis

This morning our friends over at the Oregon Employment Department released the July employment report. I think their headline says it all: Oregon’s Unemployment Rate Drops to 5.2% in July as Oregon Adds 20,000 Jobs. It was a banner report. Since it’s been a couple months since our last nuts and bolts summary, let’s do a rapid-fire run through five charts and end with a few comments on the potential impact of the Delta variant.

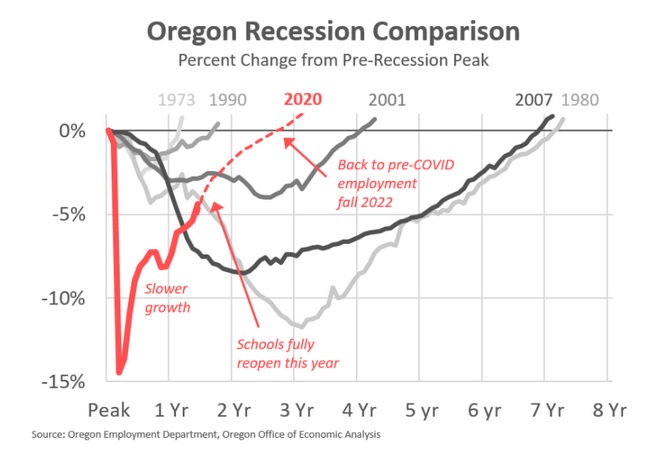

First, the big 20,000 monthly job gains is huge. It means Oregon has recovered 70% of its initial pandemic job losses. Today employment remains 4.4%, or 86,000 jobs below where we were in February 2020, but progress is ongoing and much faster than in recent cycles. The latest data comes in a smidge above our office’s most recent forecast, but in line with expectations. (Note that our next forecast comes out next Wednesday, August 25th.)

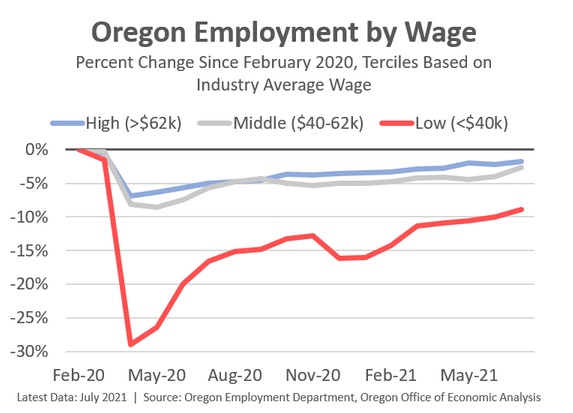

Second, given the nature of the pandemic and its economic impact on in-person service industries, low-wage sectors continue to be disproportionately affected. The good news is the recover is ongoing. Leisure and Hospitality added more than 7,000 jobs last month on a seasonally-adjusted basis, although the sector is still down about 20% from pre-pandemic levels. While the total number of leisure jobs will reach historic highs in the years ahead, our office has made some downward adjustments on a per capita basis, as discussed previously. Higher-wage jobs today are boosted, in part, due to their greater ability to work remotely and therefore are less disrupted by the pandemic itself.

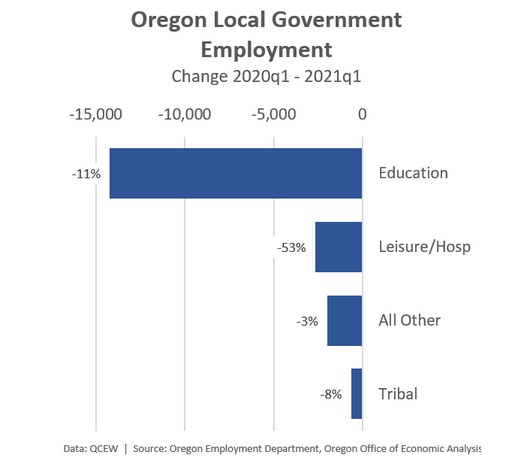

Third, in July the largest sector increases were in local government. A lot of this nationally had to deal with seasonal factors related to education where this summer school districts did not lay off their normal amount of workers as their employment counts are already down during the pandemic with online learning and the like. I suspect this is happening in part in the Oregon data. Just a reminder that local government employment is down roughly the same as the private sector, in large part due to the pandemic. Education is down as districts use fewer substitutes, bus drivers, and nutrition workers with online learning. Public sector leisure and hospitality (zoos, community centers, etc) are down due to the virus and health restrictions. Tribal employment is down a larger percentage likely due to the leisure and hospitality (casinos and hotels) components. Here is our office’s tracking chart based on the latest detailed data which goes through March.

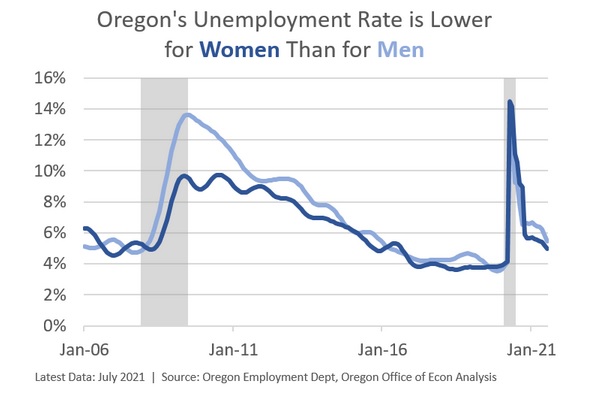

Fourth, speaking of education and counter to the conventional wisdom, the data continue to point to the lack of in-person schooling not being a macroeconomic constraint. No doubt it is a micro constraint for impacted families, but at the top line it is hard to see any real impacts when it comes to basic statistics like do you have a job yes or no. For example, here in Oregon the unemployment rate for women is lower than for men. A more accurate look can be found in economist Jed Kolko’s updated analysis that finds employment rates for moms are now outperforming women without children nationally. These findings are surprising to some and do run counter to the conventional wisdom. The good macro and micro news is that students will return to the classroom and to college campuses next month. This will boost the direct number of education jobs and any lingering indirect effects on parental labor force participation.

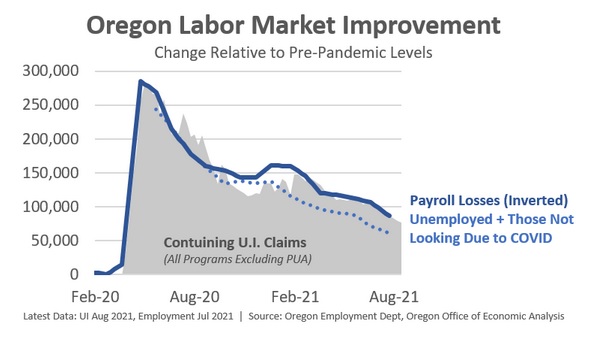

Fifth, the number of unemployed Oregonians continues to decline as jobs increase. The same is true for the number of Oregonians receiving unemployment insurance benefits. As our office has stated in the past, the number of jobs, the number of unemployed Oregonians, and the number of folks receiving UI are all moving together. This does not mean job growth could not be faster absent the enhanced benefits, but it also does not mean there is a large pool of potential workers who are not responsive to ongoing labor market dynamics. Another item to note is that the number of Oregonians who are not in the labor force — not actively looking for work — due specifically to the pandemic also continues to decline.

Finally, our office is increasingly asked about the impacts of the Delta variant given the surging cases and hospitalizations in Oregon. On one hand, what really moves the economic needle are shutdowns. More stringent health restrictions are not currently in place nor have been announced. Of course given the state of the pandemic that could change. On the other hand, there will likely be some pullback in consumer demand for certain in-person activities, be it air travel, bowling alleys, movie theaters, or the like. Given household income is strong and the stockpile of excess savings remains, any slowdown in spending today will probably be pushed forward into future months when the state of the pandemic improves. Any weaker growth in the near-term will likely result in stronger growth in the medium-term. It will be more of a shift in timing of consumer spending, rather than altering the overall trajectory.

In you check out our office’s COVID tracking page you will see that in the past week we are seeing the slightest declines in video lottery sales and OpenTable seated diners as the Delta variant surged. Nationally the number of air passengers is dropping as well (we don’t have real-time Oregon data here). Last week was the first really massive week of cases and hospitalizations, or massive enough to really grab the public’s attention it seems. As such, I’m interested to see how it impacts Oregonian behavior this week. Will it continue to be modest, or will we see larger declines in certain activities? We will have a better idea next Monday or Tuesday when the data is available.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.