By Josh Lehner,

Oregon office of Economic Analysis

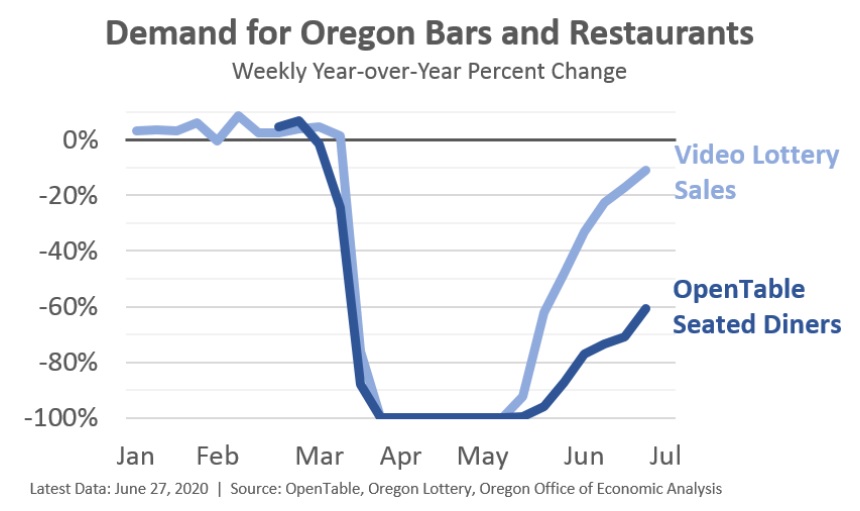

Oregon’s economy has reopened. Pent-up demand turns the economy from recession into recovery. But a key question is just how strong is that pent-up demand? Does cabin fever and increased household savings outweigh the fears and uncertainties about the virus? In this edition of the Graph of the Week we see some competing data points here in Oregon.

First, video lottery sales are booming. Currently they are running about 90% of the sales levels seen a year ago, and considerably stronger than expected. Players have returned to their favorite bars and restaurants. However, the number of seated diners at Oregon restaurants who use OpenTable is running around 40% of year ago numbers. The number of people sitting down to eat remains considerably lower. Without trying to both-sides the data, this gap is fascinating. The differences will be important to watch in the weeks ahead as for what it means in terms of the virus, consumer behavior, and the economy.

In terms of bars and restaurants, the latest data on U.S. consumer spending showed that Americans spent 33% less on going out to eat in May 2020 compared to May 2019. Here in Oregon employment at bars and restaurants is down 45% over the same time period. There are some differences seen depending upon the type of establishment with limited-service restaurant employment down 31% and full-service restaurant employment down 59%. Some of differences in the chart above are likely tied to the types of establishment as well.

It’s important to keep in mind that even as consumer demand returns for our favorite bars and restaurants, it’s not easy for these businesses. Leisure and hospitality is among the most at-risk sectors due to the economic hit and the number of small businesses.

In terms of video lottery and gaming more broadly, I will follow up here in a few weeks when June financials are released around the country. Most everywhere was shut down in April and May, so June revenues will be an indication of pent-up demand for gaming elsewhere. In the meantime I think it may be worth quoting what we wrote in our forecast last month with a couple updates in brackets [ ].

As always, there are considerable risks to the outlook. On the upside, the level of pent-up demand for gaming may return sales to a higher level, faster than assumed. The state has seen a noticeable increase in scratch ticket sales in recent weeks [during the shutdown], as players seek out available gaming opportunities and entertainment. Additionally, even though most professional sports were put on hiatus, some players continued to wager on table tennis. When combined with the initial video lottery sales in Phase 1 reopening counties, this indicates that pent-up demand for gaming and entertainment more broadly is real. [Clearly we have seen this.]

However, downside risks certainty remain. This initial pent-up demand may reflect the one-time household recovery rebates or the extra $600 per week in expanded unemployment insurance payments. [Oregon kicker refunds as well] These are temporary and any impact will fade in the weeks ahead. But the real downside risks pertain to hesitant consumers only going out to their favorite bars and restaurants more gradually than assumed, or pull back further on discretionary spending like they did in the aftermath of the Great Recession.

At this point, the key question for the outlook is how will households behave going forward. Will these trends continue? Are households continuing to dip their toes in the water more and go out to eat little bit? Or given the potential fiscal cliff issues regarding federal assistance, and the growing number of cases, will household demand level off or retrench? These are the issues our office are monitoring and discussing with our advisors.

Here’s to everyone having a fun and healthy holiday weekend. Be kind. Wear a mask. That way all of us and the economy can learn to grow around the virus, and not shut down again.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.