By Josh Lehner

Oregon Office of Economic Analysis

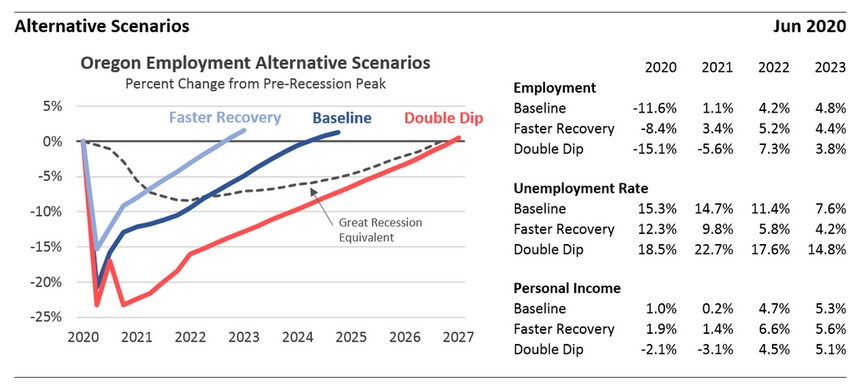

The economy faces years of high unemployment which directly translates into reduced revenues for public services. While the baseline forecast is our outlook for the most likely path of the Oregon economy, many other scenarios are possible. Given the uncertainty about the path of the virus and public health, the range of potential outcomes is larger than usual.

I have seen commentary arguing our health assumptions are either too optimistic or too pessimistic. Some of the time when getting criticized in both directions it indicates you did a good job, however some of the time it means you just plain messed up. We shall see.

As always, our office did include a couple alternative scenarios in the forecast last week. These are not designed to be the absolute upper and lower bounds on the potential outcomes. These scenarios are modeled on realistic assumptions of a stronger, faster recovery due to medical treatments becoming available sooner than the baseline, and also the real possibility of a double-dip recession with a longer, slower recovery.

Optimistic Scenario – A Faster Recovery:

The initial severity of the recession is not as deep as under the baseline with the unemployment rate peaking at 18 percent instead of 23 percent. The overall economic recovery is considerably faster primarily due to the accelerated timeline for the development and widespread availability of a vaccine or medical treatment. As the public health situation improves, business and consumer confidence returns to a greater degree, strengthening the economic recovery. Overall the amount of permanent damage done during the shutdown phase is minimal. Personal income is 3-4 percent higher than the baseline, largely driven by stronger employment and wage gains. Even so, the economy does not fully recover until late 2022. What took 3 weeks to break, takes 30 months to put back together. Under the faster recovery scenario, General Fund revenues would be around $500 million higher in both the 2019-21 and 2021-23 biennia.

Pessimistic Scenario – A Double-Dip Recession:

There are two main channels through which a double-dip recession could occur. The first is through a second wave of cases surging this fall resulting in another round of strict social distancing. The resurgence in cases may be due to a seasonal component of the virus, an economy that reopens too soon, or people simply ignoring the ongoing public health guidelines. The second channel is more economic in nature. As the federal assistance programs like the PPP and expanded UI expire over the summer months, it leads to another round of layoffs and closures as firms struggle to stay afloat amidst a weak economy and lower levels of consumer demand.

Regardless of the exact reason, the recession is deeper and more prolonged. The unemployment rate remains above 20 percent for nearly two years and personal income is 7 percent lower than the baseline though the middle of the decade. Overall Oregon’s recovery is slower and the economy does not fully return to health until late 2027. This would put it on the same timeline and trajectory as the aftermath of the Great Recession and the early 1980s recession. Under the double-dip recession scenario, General Fund revenues would be nearly $700 million lower in 2019-21 and nearly $1.4 billion lower in 2021-23.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.