By Josh Lehner

Oregon office of Economic Analysis

Our office continues to get asked about the potential impacts of the coronavirus (COVID-19) on the economy. Long story short is that it is still too early to tell how much economic fallout will occur given the ongoing public health developments as the virus spreads. That said, we did write up our thoughts on the potential impacts in our latest forecast (see PDF pg 6) and discussed this with the Legislature during the forecast release last month. What follows are the main points in how we are thinking through the impacts.

1. In times of war, famine, and disease, the largest impacts are human and social. The coronavirus outbreak is a public health event first and foremost. The dark scenarios here are that the costs of the pandemic are the health and potentially even the lives of our neighbors, friends, and family. I think it’s important to keep these things in their proper perspective and that there are bigger concerns at play than possible short-term, work-related disruptions. With that said, like other natural disasters, there is an economic fallout as well.

2. The outbreak will likely stress the healthcare industry. Clearly health care-related jobs have grown quite a bit in recent decades, and have proven more stable than the overall economy. However much of these gains are simply keeping pace with population growth. We have yet to see these facilities and workforce stressed with a large outbreak, and a sizable population needing intensive care. This goes for medical facilities, public sector programs, insurance companies, and the like. Hopefully we will not see this play out, but if the virus continues to spread further, it is an increasingly likely scenario. See Bloomberg’s Justin Fox for more on some of these numbers.

3. The biggest economic risk of the coronavirus is that it serves as a coordinating event and recession catalyst. Fears over the human and economic impact could potentially reach critical mass where consumers pull back and delay spending money and employers put off hiring and investment decisions. If enough firms and households do this at the same time, then a recession ensues as growth plunges. We’re not there today. Prior to the outbreak the U.S. and Oregon economies were strong. We only have economic data through January and it all points toward ongoing, solid growth. We will begin to get February data here in the coming weeks and March data a month from now. The U.S.-based outbreak and domestic concerns are all too new to show up in the standard measures yet. But, economically speaking, the coronavirus’ potential to be a coordinating event is the the worst case scenario.

4. Outside of serving as a recession catalyst, the most economically disruptive impact of the coronavirus is its impact on supply chains, both globally and increasingly locally.

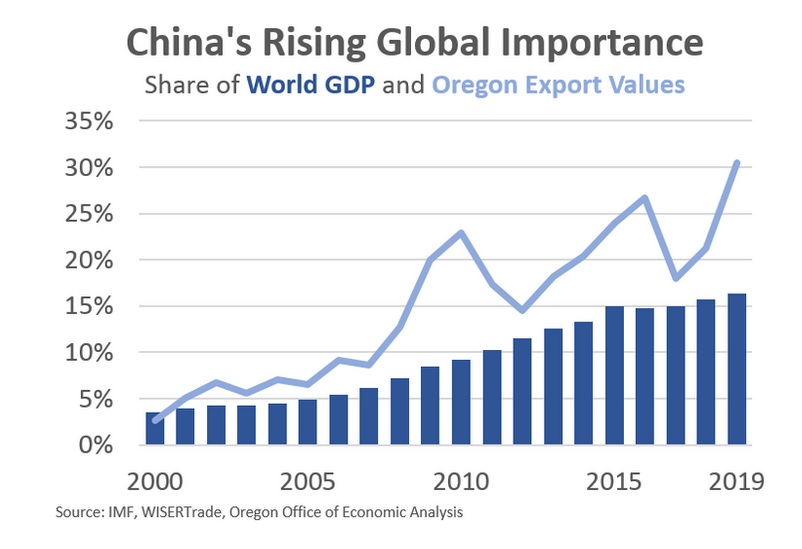

China is the world’s second largest economy, accounting for roughly 16 or 17% of global GDP. China is closer to a quarter of global manufacturing. All industries rely on imports to some degree, with manufacturing being the most prominent. Additionally, China is also Oregon’s largest market for exports, accounting for 20-30% of Oregon exports in the past decade.

As such, disruptions to the Chinese economy, like effectively shutting down for 3 or 4 weeks, have ripple effects around the world. Depending where your firm sits in the supply chain, shortages and stockpiles emerge. Chinese economic activity remains at depressed levels relative to a few months ago but it is growing again and coming back online slowly. Until fully back, global trade overall will be reduced. The economy will be operating below potential.

Now that the coronavirus is clearly on our shores, we are potentially no longer talking just about shutdowns, social distancing or quarantines across the Pacific, but possibly locally as well. If Oregon or the U.S. gets to the point where we isolate/quarantine our friends and neighbors, or ban public gatherings or the like, then these types of disruptions will obviously be more noticeable given they impact our everyday lives. We won’t go to work, or not full-time. Our children will stay home from school. We won’t go out to eat and similar types of social activities will be reduced.

The thinking today remains that of natural disaster recoveries. There is a temporary disruption but relatively limited permanent, or long-run damage. There may even be a short-term boost to grocery store sales as households load up ahead of hunkering down. But overall there would be much slower economic growth in the near-term. Sales would be depressed across a host of industries as consumers stay home or put off some purchases. The key question is how long would this last?

As the population and economy gets back up and running after fears of contagion subside, then many of those sales would return due to pent-up demand. People will still buy a car or a house, just a month or two later than they originally thought. That said not all of the sales will come back. Are you going out to eat twice tomorrow because you didn’t go out to eat tonight? Will you take 2 vacations next year because you had to cancel your plans this year?

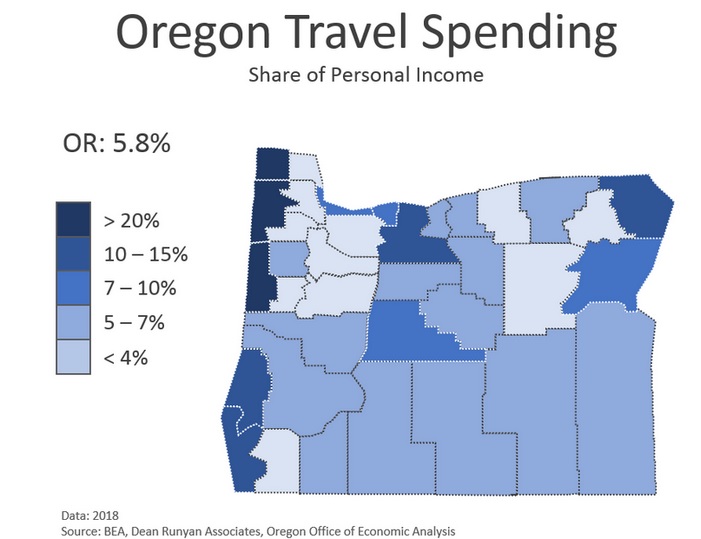

5. Besides supply chain disruptions and the manufacturing industry, travel or leisure and hospitality more broadly will likely be where the next largest impacts are seen. Chinese tourism to Oregon accounts for about 2% of total travel spending in the state. So the direct linkages there are manageable from an industry wide perspective. Of course specific locations, or types of business will see larger impacts than others. However the real fallout will be if broader travel restrictions are put in place, either formally or informally, and either internationally or domestically.

Here we would see the same types of impacts talked about above in terms of lost travel and restaurant sales as people stay home more to avoid public settings. The workers — mostly hourly and part-time — in these impacted industries will bear the brunt of the losses as well. Even in a temporary disruption scenario, these workers will still lose a paycheck or work reduced hours given the low level of sales. They may need to rely on the social safety net to a larger degree as a result.

Note: The map below shows local travel spending as a share of personal income as a way to highlight where any declines in travel will be felt the largest. Leisure and hospitality employment patterns are similar, but the focus is on potential changes in travel spending due to short-term disruptions if households bunker or restrictions are put in place.

6. Finally, the coronavirus can impact the economy through financial markets and heightened risks. This could mean a stronger U.S. dollar, wider credit spreads, or a drop in equity markets. All of these would work to slow current economic growth via fewer exports, less borrowing and lending activity, and lower levels of consumer spending and business investment.

Clearly the U.S. has seen some of these last impacts in recent days. The Federal Reserve’s emergency rate cut this week, largely in response to these financial market risks, should, or at least hopefully, go a long way from turning the virus’ supply shock into a broader demand shock. Of course we shall see.

Bottom Line: Prior to the coronavirus outbreak, the Oregon and U.S. economies were strong and continuing to see solid gains. This remains the case today based on economic data through January, however forecasters are still assessing the situation and adjusting their forecasts. It may be easy to envision dark scenarios and even recession catalyst scenarios developing, but we just don’t know yet. Given current information, many forecasters as expecting slower growth during the first half of the year, but much of that should or at least could be made up later in the year.

Of course the longer any global problems last, or if significant local issues emerge, the larger any economic fallout from the public health outbreak will be. Economically, the strong response from the Federal Reserve is encouraging. Let us pray the health situation follows suit or at least hope it does not deteriorate too much.

Our office’s next forecast is scheduled for May 20th. At that time we will have another couple months of economic data plus public health updates that we will incorporate into the economic and revenue outlook. Until then our office will continue to monitor the data and look for impacts.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.