By Josh Lehner,

Oregon Economic Analysis,

One forecasting challenge is we do not know what the 11th or 12th year of an economic expansion looks like. We’ve never been here before. Our baseline forecast calls for ongoing, but slowing growth as we run into supply side constraints. However, that is more theory than data. I’ve been wrestling with two big questions in recent months that I’m putting to our advisors in the coming weeks. The first is more of a short-run growth question, while next time I will lay out the long-run growth question.

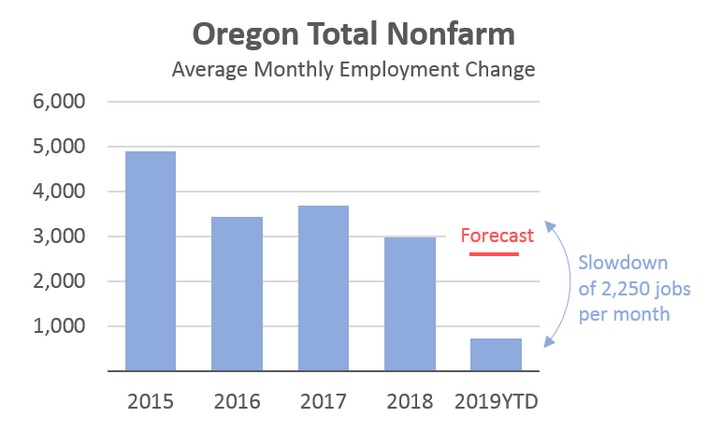

One trend so far in 2019 has been considerably slower job growth. Our office’s forecast has called for job gains to slow a bit but remain above trend through mid-2020 before cyclical growth slows and the demographic drag weighs to a larger degree. However, so far this year job gains are significantly below expectations. This slowdown appears to be legitimate as it is evident in both the household and payroll surveys. Plus the less timely, but near universal count QCEW confirms it as well, at least through June.

Now it needs to be pointed out that this is not necessarily a problem. Growth can slow for bad reasons of course, and we could even fall into recession. However, if growth is slowing due to full employment and demographics, then it is less of a concern. Given ongoing strong wage growth, low levels of layoffs and the like, it is clear the sky is not currently falling. But the slower growth is a bit of a puzzle that we continue to dig into and will be discussing with our advisors.

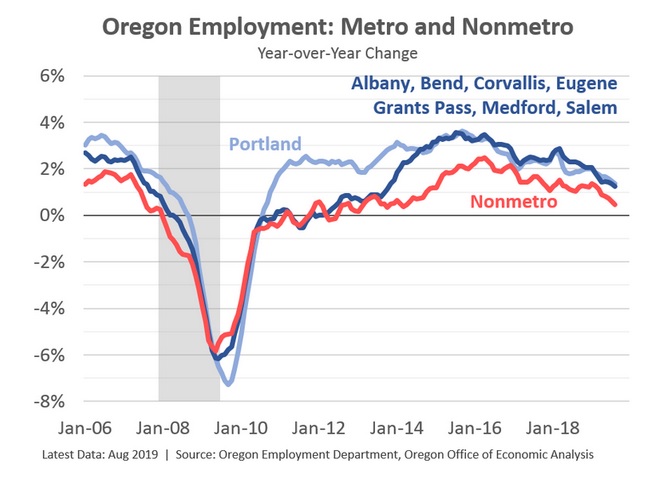

The slower job growth is seen across the state, in both urban and rural Oregon. Only about 5 counties are adding more jobs per month in 2019 than they did in 2018, while the vast majority are experiencing slower growth or even losses.

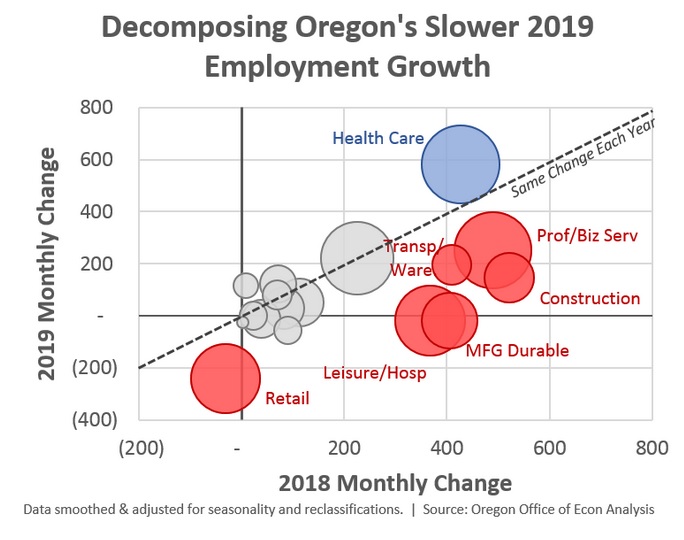

That said, the slowdown isn’t impacting all industries equally. Most are growing a little bit slower than last year, but it really is a handful of larger sectors seeing big downshifts in growth that’s driving the overall trends.

Warning: In the following chart I have smoothed the data, removed outliers and adjusted for industry reclassifications. I usually don’t do this and don’t take doing so lightly. However we are trying to identify where the underlying slowdown is occurring. I think this provides a better, or at least a clearer look at the issue.

Let’s look at these sectors a little bit more.

– Health Care is really the only sector adding jobs faster in 2019 than in 2018. This increase looks to be across all sub-sectors, including ambulatory care, hospitals, nursing facilities, and social assistance.

– Retail has gone from bad to worse. This isn’t necessarily a surprise, even if our forecast expected stabilization.

– Durable Goods Manufacturing slowing is across the board in terms of wood products, tech, transportation equipment, metals, and machinery. This would be the first place to look for the impact of the trade war.

– Transportation and Warehousing slowdown is mostly about a strong 2018 when large, e-commerce distribution centers opened up. 2019 gains are relatively strong, just not as strong as last year. Another big distribution center is currently ramping up but does not appear to be hitting the employment numbers just yet.

– Construction’s slowdown has been expected in our forecast for some time. While construction activity remains strong, job gains have appeared to outpace measures of activity. As such we expected job gains to slow, although it has not happened in recent years. It is somewhat of a question whether the slowdown in 2019 is as expected (confirmation bias!) or due to something broader impacting the industry.

Now, there are two other sectors showing significant slowing that are harder to understand at the moment. I don’t have any sector-specific stories to fall back on here.

– Professional and Business Services. This slowdown is across all three main sub-sectors in terms of professional and technical services, management of companies, and admin and waste services. It’s not just temp workers or something like that.

– Leisure and Hospitality is entirely about food service grinding to a halt. The hospitality and entertainment parts show ongoing gains, as do limited-service restaurants. The drops are in full-service restaurants and bars. The number of restaurants continues to increase, while the number of bars is flattening out. Wage growth remains solid.

Now for the hard part. Why are we seeing the slowdown in Oregon employment growth? I’m going to hold off on giving my thoughts on this until after our advisory meetings. However I see at least three main channels in which a slowdown could materialize.

First would be lower business demand. If firms realize slower sales growth or costs rising faster than revenues, they may pull back on hiring. This could be due to weak consumer spending, a drop if foreign sales tied to the trade war, or policies that raise the cost of doing business. Second would be firms putting off hiring today because they are unsure of future sales, even as current conditions remain favorable. Third would be the lack of available workers. The economy really may be at full employment, or migration may be slowing more than expected, or retirements may be increasing faster than expected. All of those would result in fewer available workers to hire even if businesses wanted to fill openings.

A couple final thoughts. The sky is not currently falling. The unemployment rate remains near historic lows. The best labor market leading indicator is initial claims for unemployment insurance and those remain very low. At this point, the slowdown in job gains is more of a puzzle to be solved than a concern to fret over. We will be diving into this again after our forecast advisory meetings and certainly in our upcoming forecast which will be released November 20th.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.