Josh Lehner

Oregon Office of Economic Analysis

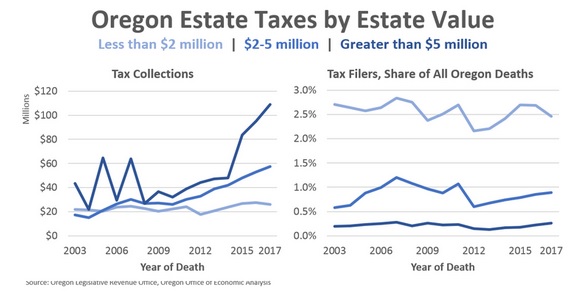

Here is a quick, updated look at estate taxes in Oregon. This is a follow-up, as promised, to our recent work looking at the income distribution and wealth. Recent years have brought record-breaking estate tax collections that have been significantly stronger than our office’s forecasts. Along with our friends at the Department of Revenue and Legislative Revenue Office, we have been trying to better understand the drivers of this growth and to what degree it is cyclical (asset market fluctuations), structural (aging demographics), and/or temporary (just a few estates accounting for tax collections).

Overall the number of estates impacted by the tax is relatively steady over the past decade, both in absolute numbers and as a share of all Oregon deaths. Now, of course not all those filing taxes in Oregon are Oregonians, as people living outside the state can and do own businesses and/or property. But it is helpful to gauge estate tax filings in relation to demographic trends. This shows that the estate tax is not affecting a larger share of the population today than it has in the past.

If it’s not more households being impacted, that means the underlying revenue growth is coming from cyclical and/or temporary factors. However it’s a bit fuzzy in trying to decompose these impacts. As seen below, there is no question that the increasing size of a few very large estates is driving much of the revenue growth. That said, we know that asset markets and valuations are rising and we are also seeing an increased concentration of wealth. This suggests future tax collections will remain strong, at least until the next recession when asset prices fall. Now, on the flipside, given the increased concentration among a handful of estates, tax collections may be more sporadic or irregular moving forward due to the unknown timing of when someone passes away.

Additionally, despite the concern that Oregon’s relatively low $1 million threshold will ensnare more Oregonians due to the hot housing market, so far this does not appear to be the case. Recent estimates made by LendingTree, Trulia, and our office’s examination of Census data all show that the share of housing units in Oregon valued at $1 million or greater is somewhere in the 2-3% range. This is more than double the share seen in the aftermath of the housing bust, but on par with or slightly higher than the share seen at the peak of the housing bubble. This highlights the fact that while most household’s primary residence is their source of wealth, this is not the case for high net worth households. They tend to hold a variety of assets including financial investments and business equity, in addition to their home. A hot housing market may contribute to their estate valuation, but by itself is not necessarily the driver of whether or not they are subject to Oregon’s estate tax.

Finally, we do know that tax planning is a key component for high net worth households and it does impact actual collections. Based on conversations with our advisors, we do take this into account in our forecast. Our outlook for estate tax collections remains strong, however it is not quite as strong as underlying demographics and asset markets suggest due to this tax planning capabilities.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.