Tax Foundation

by Garrett Watson, Nicole Kaeding

This week, Oregon’s Legislative Revenue Office (LRO) provided economic projections to the Joint Committee on Student Success Subcommittee on Revenue to assess the impact of a proposed gross receipts tax on Oregon’s economy. The committee is interested in raising about $1 billion in annual revenue from a new source to improve the state’s public education system. This is the third time Oregon has considered a gross receipts tax in the past five years, after a legislative proposal failed in 2017 and a ballot initiative to enact a gross receipts tax was rejected by voters in 2016.

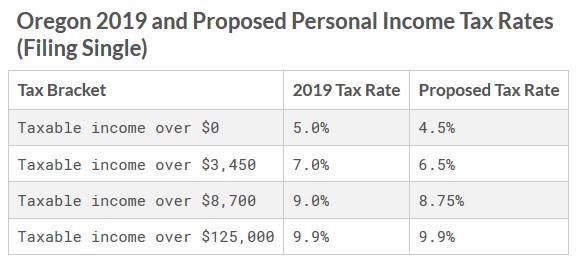

LRO modeled a gross receipts tax similar to Ohio’s Commercial Activity Tax, levied at 0.48 percent of a firm’s gross receipts above $1 million in Oregon, plus a $250 minimum tax on all firms. The petroleum sector is exempted from the proposal, as petroleum is governed under an industry-specific tax regime in Oregon. The proposal also calls for the use of some of the revenue from the gross receipts tax to reduce Oregon’s personal income tax rates:

LRO provided two simulations to estimate the impact of the new gross receipts tax and personal income tax rate reductions on, among other indicators, state revenue, household income, employment, and wages over five years. The projection combines the effects of both the gross receipts tax and the changes to personal income tax rates, which will have different economic impacts. The gross receipts tax is expected to lower economic output, raise prices, and harm job creation, while a reduction in personal income tax rates would help economic growth by increasing the incentive to work and invest in Oregon.

The first simulation found that household income would fall by 0.3 percent across every income level, and the state would lose about 8,400 full-time equivalent jobs, a decrease of 0.31 percent. Revenue increases by about $1.1 billion annually, though $27 million is lost due to the negative economic impacts of the gross receipts tax. Investment would decline by 0.06 percent.

LRO also provided a second simulation, which incorporates the new spending on education made possible from gross receipts tax revenue. The model finds that the spending improves long-run labor force productivity, raising the state’s economic growth. It assumes that as the new revenue is used on education, new entrants into the labor force are made more productive through a higher quality public education.

In contrast to the first model, the second simulation finds that Oregon’s disposable household income rises on average by 0.3 percent. However, lower-income households see a fall in their incomes by 0.1 percent to 0.2 percent. Job creation also suffers, as 3,000 net fewer jobs are created. Under this model, Oregon is expected to raise about $1.34 billion in revenue, including $212 million from additional economic growth stemming from improved labor force productivity.

Both models are useful for understanding the impact of the two changes to Oregon’s tax code on the state’s economy. However, it’s important to note that the economic growth found in the second simulation is the result of an improved education system and not from imposing a gross receipts tax. There are better and worse ways for Oregon to raise a given amount of revenue, and we would expect economic growth to be larger if policymakers use a more efficient method to raise revenue for the education system. The first simulation provides a better perspective on the direct effects of a gross receipts tax, though the negative effects are somewhat mitigated by the reduction in personal income tax rates.

To make an informed judgment about the different revenue options, the committee will need to evaluate the economic impact of the proposed Business Activity Tax, a value-added tax. We will provide analysis when LRO provides a model run of the VAT proposal.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.