Oregon Economic and Revenue Forecast, September 2017

By Josh Lehner

Oregon Office of Economic Analysis

This morning the Oregon Office of Economic Analysis released the latest quarterly economic and revenue forecast. For the full document, slides and forecast data please see our main website. Below is the forecast’s Executive Summary.

The economic expansion continues and the outlook remains bright. For the first time since the financial crisis, the U.S. economy lacks a major headwind. Expectations are not for a substantial pick-up in growth rates themselves, but for the expansion to endure, possibly becoming the nation’s longest on record. If anything, the current macroeconomy is a conundrum for the Federal Reserve given low unemployment and low inflation. Even so, there do remain significant risks to the outlook, particularly the uncertainty of federal policy.

Oregon’s economy is largely tracking expectations of slower growth in a mature expansion. The state continues to see healthy job gains that are enough to keep pace with a growing population and hold down the unemployment rate. However recent, preliminary employment reports, and stabilizing growth in withholdings out of Oregonian paychecks indicate that risks may be tilted toward the upside over the next year.

To maintain stronger labor market gains Oregon will need to see either stronger population growth overall or higher labor force participation rates among current residents. To date Oregon has experienced a very strong, and needed labor force response. Participation rates have increased considerably in recent years as more Oregonians have come back to the workforce in search of the more-plentiful and better-paying jobs. Further participation gains, particularly among the prime-age population is not unreasonable to expect in a strong economy. Oregon continues to hit the sweet spot as the economy approaches full employment.

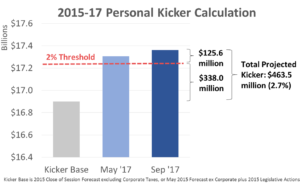

Oregon’s General Fund revenues surged at the end of the 2015-17 biennium, putting Oregon’s unique kicker law into play. Both personal and corporate tax collections grew at double-digit rates during the fourth quarter of the fiscal year. As such, the personal and corporate tax kicker payments that were assumed in the May forecast have become a reality, and have grown in size.

Personal income taxes ended the biennium 2.3% above the Close of Session forecast, triggering a $464 million kicker for tax year 2017 to largely be paid out during income tax filing season in April 2018. Corporate excise taxes ended 2015-17 $111 million above their Close of Session forecast, and above 2% kicker threshold. However, instead of returning unanticipated corporate collections to taxpayers, statute directs that the corporate income tax kicker be dedicated to education spending.

Heading into the 2017-19 biennium, a larger kicker payment reduces expected revenue growth. Combined with weaker outlooks for corporate profits and inflation, the larger kicker has resulted in a $60 million reduction in the outlook for General Fund tax collections. However, this reduction is more than offset by a stronger lottery sales forecast, higher ending balances in BI2017-19, and $227 million in legislative changes made during the 2017 session.

Although revenue growth is still healthy compared to other states, the slowing pace of Oregon’s expansion has become evident in tax return data just as it is has in the economic data. Income growth has been cut in half over the past two years, with slowing across a wide range of income types. While still growing for now, business, retirement, investment and labor income have all decelerated rapidly. Looking ahead, General Fund revenue growth in the current biennium is expected to be only one-third of what was seen during BI2015-17.

Revenue growth in Oregon and other states will face considerable downward pressure over the 10-year extended forecast horizon. As the baby boom population cohort works less and spends less, traditional state tax instruments such as personal income taxes and general sales taxes will become less effective, and revenue growth will fail to match the pace seen in the past.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.