Tech Hubs and Venture Capital, Oregon Edition

By Josh Lehner

Via Oregon Office of Economic Analysis

Over at Indeed, Jed Kolko has a new piece looking at high-tech job postings across the nation. Among the trends he highlights, Jed notes that the eight biggest tech hubs — Austin, Baltimore, Boston, Raleigh, San Francisco, San Jose, Seattle, and Washington D.C. — have tightened their grip on the industry. He writes:

Therein lies a key point about the dynamics of tech hubs: Although the overall share of tech jobs in hub metros has been essentially flat from 2013 to 2017, higher-salary tech jobs have become more concentrated in top-tier tech centers over the past year, while lower-salary tech jobs have dispersed a bit. In other words, tech hubs are keeping their grip where it really counts.

Now, keep in mind these are job postings and not actual employment counts, but this new research fits in with the overall pattern of the high-tech sector we’ve seen in recent years. Jobs, wages, venture capital and the like continue to be heavily concentrated in the existing tech hubs. Among other metros across the country, Jed does find that the Portland region’s mix of tech jobs is similar to Silicon Valley. Portland (and Boulder) “should be considered cousins of Silicon Valley, not because of the amount of tech-job postings they have, but rather because of the kind.”

All of this is new and interesting work and does fit into previous efforts our office has worked on as well. I think one key point is the importance of agglomeration, particularly when it comes to these tech hubs. It is hugely beneficial for these companies to locate near one another, develop a strong labor market full of people with these particular skills, enjoy the fruits of knowledge spillovers and so forth. And while tech jobs are being added all over the country, they are not increasingly moving outside of the existing hubs, or at least not yet.

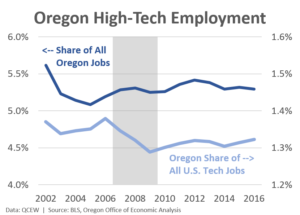

Let’s take Oregon as an example. While we have seen good growth locally, and a big transition from hardware into software, the share of all Oregon jobs in tech-related industries has remained pretty steady over the past 15 years. And Oregon’s share of all U.S. high-tech jobs has remained steady over the past 15 years as well. Again, it’s not that we haven’t seen good growth, we have. It’s that so too have other regions.

In terms of the regional outlook, I remain optimistic. The transition that Oregon tech is making in terms of moving from hardware into software is encouraging. Historically Oregon has not had much of a software sector, but it is growing in recent years. These jobs are diversifying our economy and are needed and welcomed. Plus our region’s ability to attract and retain young, skilled workers is a huge advantage. We have even seen a shift toward more young migrants to Oregon with scientific, technical and medical degrees than has traditionally been the case.

However, even with all this good news, our tech jobs are not growing significantly faster than in the rest of the nation. Furthermore, a good portion of the software growth represents outposts or satellite offices rather than homegrown headquarters. The hope is that our regional economy develops enough of a critical mass that it can withstand the business cycle and achieve even better growth moving forward. It should be pointed out that our advisors do think we have reached critical mass in this regard, which is great news for the Oregon economy.

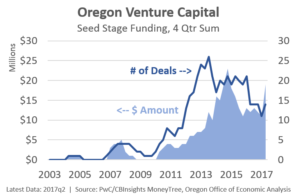

Along these lines something that has struck me recently is a small shift in the type of venture capital funding Oregon firms are now getting. In recent years Oregon companies have started getting seed stage VC funding (or early stage more broadly) which didn’t really happen a decade ago. Keep in mind these figures are still really small (a little less than 1% of nationwide totals), and statewide we add around 4-5,000 new companies every year across all industries. However getting seed or early stage investments in one indication that local start-ups are doing better. Or at least finding a VC audience. Note: this data is for all industries, not just high-tech.

The hope would be that one or three of these new companies will be very successful and help propel our regional economy forward. And with agglomeration and clusters, success tends to feed on itself and a positive, self-reinforcing cycle ensues. Now, it can be hard to know if Firm A, Firm B, or Firm C will do the best, however the probability that one will be successful increases if you have more start-ups overall. The probability of success for each firm may not change, however the probability of a single success does increase. An added bonus in this scenario is that homegrown firms do generally provide broader support for the regional economy.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.