![]() By Fred Thompson,

By Fred Thompson,

Oregon Economics Blog

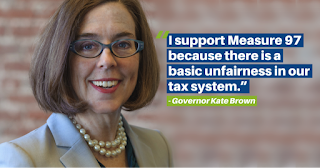

So far, my criticisms have been directed to the pro-97 camp – to claims like Gov. Brown’s that “there is a basic unfairness in our tax system that makes working families pay an increasing share for state and local services.” Not so. Oregon has long had one of the US’s least regressive state and local tax systems and recent changes have increased its progressivity. For example, the state already has the nation’s highest capital-gains tax rate. And, even if it were so, Measure 97 wouldn’t make the tax system fairer, but would cause ‘working families’ to pay more for government services and to pay for them more regressively.

I acknowledge that most of the claims I have criticized are at least somewhat arguable – mostly wrong, not Pinocchios. For example, the pro-camp claims that some of the $3 billion or so that Measure 97 will collect each year “will come out of CEO pay, some out of dividends, some out of consumers in other states.” But, they acknowledge, “Some will come from some of us.” That’s basically the position of the Legislative Revenue Office, except that they estimate that the “some [that] will come from some of us” is about 2/3 the total, that most of the rest will be shifted to the IRS, with the remainder borne by shareholders (about $200 million a year, which is enough to explain a lot of opposition) and corporate employees (about $100 million).

Think what it would look like, were Measure 97 truly a tax on corporations: total Oregon profits run about $20 billion a year. The share earned by C-corps, the only businesses subject to the tax under Measure 97, is about half that, or $10 billion, of which 70 percent comes from corporations with more than $25 million a year in Oregon sales, or about $7 billion, from whom the state currently collects about $375 million a year. If Measure 97 were to increase the tax take from these corporations by $3 billion a year, we would be talking about an average effective state corporate income tax (CIT) rate of nearly 50 percent – five times the highest state CIT rate in the US. Because gross receipts taxes are recorded as ordinary expenses and reduce ‘‘earnings from operations,’’ remittances to the state would cut federal CIT obligations by about $1 billion (given the 35 percent federal CIT rate), but, even so, this implies an average combined CIT rate of over 60 percent. Bizarrely, however, this tax only hits businesses with low profit rates (as a proportion of turnover); really high profit businesses would continue to be unaffected by it. How credible is that? And, if it’s credible, imagine what this could do to the state’s economy.

This is also an area where Measure 97’s opponents have crossed the line. Many of them condemn Measure 97 as unfair because unprofitable businesses, which appear to have no ability to pay, are nonetheless obliged to pay the tax. They express similar concerns with respect to low-margin, high-turnover businesses, for example, grocery stores. However, as Fox, Luna, and Murray observe, economists generally do not share these concerns, “because the base is not intended to be profits and the tax is likely shifted forward to consumers.” Arguably, these anti-claims merely take the pro-side’s argument about who pays seriously, but it’s probably not how this would play out.

Of course, gross receipts taxes, like most taxes, create tax wedges. In this instance the wedges affect both interstate and intrastate commerce. They arise because some of the goods and services providers that are subject to the tax must compete with those that are not. This may induce them to shift activities out of state or to purchase out-of-state inputs to avoid the tax. Compared with a retail-sales tax say, Measure 97’s distortions are potentially more severe, both because of pyramiding and because of the discrepancy between the tax rate faced by C-corps (2.5 percent) and the implicit rate (zero) faced by pass-through entities. But this looks to be a matter of degree, not of kind.

Measure 97’s supporters make a big deal of the fact that only about a 1,000 businesses will be directly affected by it: “It will raise taxes on only the largest corporations, affecting one-quarter of 1 percent of the companies doing business in Oregon.” (Of course, many more, probably most, will be indirectly affected by it through their supply chains – for example, most businesses in the state will face higher utility costs). However, $3 billion doesn’t grow on trees – to give some idea of the magnitude of what we are talking about here, that’s about what a 6.5 percent retail sales tax would produce. If the businesses affected by Measure 97 weren’t major players in the state’s economy, a 2.5 percent tax wouldn’t yield $3 billion. They are, The 1,000 corporations directly affected by Measure 97 employ 40 percent of the state’s business labor force, account for over half of the state’s value added and over half of its private-sector wages. In other words, they comprehend the state’s most productive enterprises and those that pay the best salaries.

Following up on the last point, in performing its analysis of the effects of Measure 97, both the Legislative Reference Office and the analysts at PSU presumed that the financial services industry would be largely unaffected by it. That is the case for two reasons. First, this industry is heavily weighted to pass-through entities, which are exempt from the gross receipts tax under Measure 97 (see Figure 4 from Owen Zidar).

Second, both explicitly assumed that Oregon would exclude the sale of real property, investment receipts, including interest, dividends, and capital gains, and sales of financial instruments, including bonds, mortgages, debentures, etc., in calculating gross receipts. Consequently, most financial service companies would only be on the hook for their management fees. And, given that the gross receipts tax under Measure 97 is an alternative minimum tax and that, where financial transactions are excluded, financial service companies tend to be high-margin, low-turnover businesses, this means that, for the most part, they will be unaffected by Measure 97 – C-corps in the financial services industry tend to pay fairly high corporate income taxes now, they would continue to do so under Measure 97.

Excluding sales of financial instruments is standard practice where financial services are concerned, since financial transactions vastly exceed state product. This issue hadn’t come up in Oregon previously because it’s irrelevant to defining the corporate-income tax base or to determining the existing alternative minimum tax, which is capped at $100 thousand. But it is inconceivable that the legislature wouldn’t address this issue if Measure 97 were to pass. Otherwise the results could be pretty scary. Interestingly, there is one financial service industry where this exclusion typically doesn’t apply, insurance. Presumably, Measure 97’s gross receipts tax would apply to insurance premiums purchased by Oregonians – indeed, the LRO estimates that 20 biggest insurers doing business in Oregon would see their state tax remittances increase from average of $200,000 to $3.5 million per annum.

This quasi-anomaly is partly due to the distinction between apportionment on the basis of “market” or “activity.” Oregon’s CIT apportionment is currently governed by the taxpayer’s principal business activity (PBA) code on their federal tax returns – and these codes are largely based on the NAICS code, which classifies business activities as goods or services – goods are currently apportioned on a market basis (defined in terms of their customers location) and services on an activity basis (where the bulk of the work is performed). Consequently, PBA codes control which apportionment method applies to a taxpayer when computing Oregon’s business tax. Most finance services, for example, take a service code. However, this isn’t necessarily the case. Grant Thornton offers the following illustration: “A company that processes financial transactions using advanced technology has all of its employees located in Oregon. It determines for Oregon tax purposes that a ‘technology’ NAICS code is most appropriate. Businesses that use the ‘technology’ code apportion receipts to Oregon based on the location of the business’s customers, which often results in apportionment of less than 100 percent.” In contrast, if the company chooses a ‘financial’ code, the apportionment percentage would be based on the company’s payroll in Oregon, which for this business would be 100 percent. However, because the federal PBA code disclosure doesn’t affect the computation of federal tax, the feds don’t require businesses to choose a code with any precision or consistency (one important caveat aside, where the selection of NAICS codes affects tariffs paid on goods/services crossing international borders, customs authorities strictly constrain gaming by multinational corporations of NAICS codes) – this is important because state administration of income taxes piggybacks on federal reporting, and playing with these codes is one of the ways that C-corps currently shift their tax liabilities away from higher-tax jurisdictions, like Oregon, to those with lower CIT rates, like Washington.

Gov. Brown has proposed to fix this anomaly, should Measure 97 pass, by basing all business taxes on the location of the customer buying the service, rather than the location of the company selling the service. Unfortunately, the state doesn’t have a mechanism for tracking in-state sales or following them back up the value chain. Right now, we pretty much rely on businesses to tell us what their Oregon sales are. Unfortunately, it is easy for businesses with out-of-state sales to fiddle this figure. Indeed, our inability to track in-state sales is one reason for Measure 67’s adoption of dollar limits for its alternative minimum tax. Consequently, the claim made by the pro-97 camp, that, because the measure targets sales rather than profits, businesses will find it harder to avoid Measure 97 taxes, may, in fact deserve a couple of Pinocchios.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.