By Josh Lehner

Oregon Office of Economic Analysis Blog

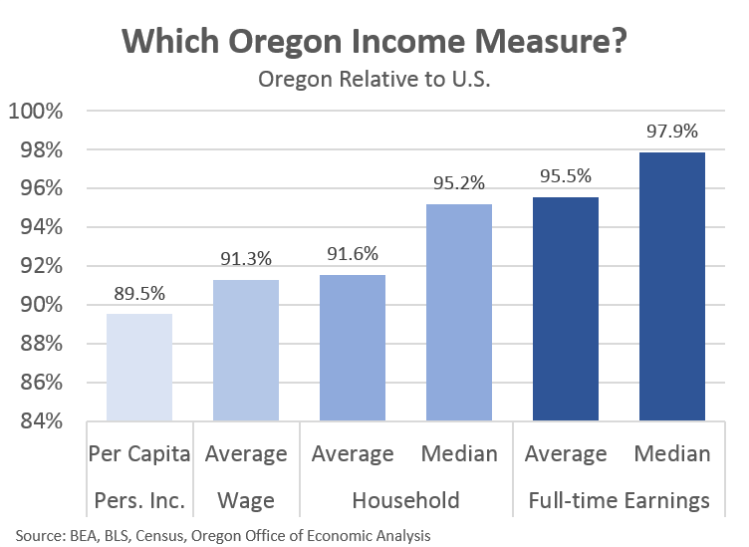

A lot has been made of and discussed about the fact that Oregonians have lower incomes than the nation overall. However, I find myself reaching for various measures of income when the need arises, or to answer specific questions. Are we talking about wages, or about household income, or about the potential tax base for revenues? There is no one measure to rule them all. Each has both pros and cons about its usefulness, depending upon the question being asked. Below I have pulled together a handful of income measures to show how Oregon stacks up. Interestingly enough, the differences shown below are pretty important. Note that the graph shows Oregon’s income by category as a share of the national figure. Values below 100% indicate that Oregon has lower incomes than the nation.

Clearly there is a wide range of outcomes when looking at the data. Median earnings for full-time workers in Oregon are just a notch below the national figure, however the state’s per capita income is 10% below the national figure. There are some important reasons for why these patterns happen, based on the underlying demographics, economy, share of full-time vs part-time workers and the like. However I want to focus on two measures in particular: per capita personal income and median household income.

Per capita personal income is a measure that simply adds up all the personal income in the state and divides by the population. Oregon’s per capita personal income has eroded over time, relative to the nation, as research from both the business community and the Employment Department has documented. (Quick aside: our average wages have not eroded in a similar manner, which is an important distinction) I would argue that per capita personal income is a very important measure when discussing tax revenues, or the potential tax base. It shows the average ability to pay, more or less, of a given region’s residents. However it is also an average and susceptible to both demographic shifts and to the distribution of the incomes across the population. As such, even though per capita personal income is widely cited, it is probably not the best measure to use when talking about how Oregonian incomes compare to the nation overall. I am not saying, however, that per capita personal income is not an important measure, rather that it has a time and place to be used.

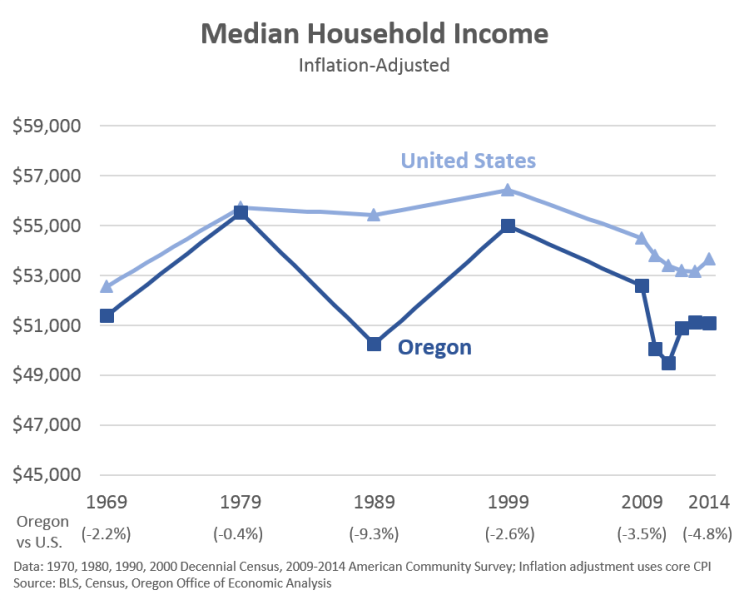

Median household income is my go-to measure when someone asks to compare incomes across regions. The simple reason is that, by definition, the median household income represents the typical household, so it is much less susceptible to outliers, distribution issues and household/family/population composition. In my view, it is a more accurate reflection of what the typical Oregonian earns.

Oregon’s median household income has largely tracked the national figure in recent decades, which is to say it is unchanged or declining after adjusting for inflation. Outside of the timber industry’s peak and restructuring in the 1970s and 1980s, Oregon’s median household income has pretty consistently been 2-3 percentage points lower than the national figure.

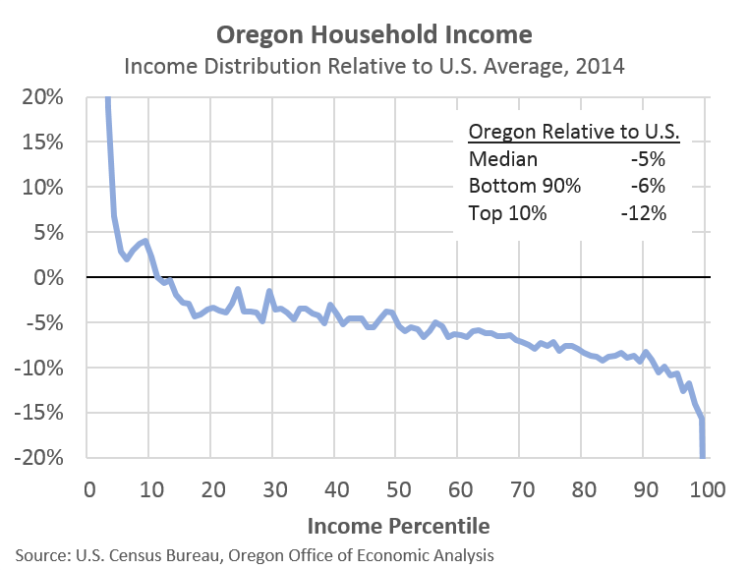

What is really interesting is to look at the distribution of household incomes in Oregon relative to the nation. The final graph does just this for incomes across the entire distribution, based on percentiles. For example, Oregon households at the 20th percentile earn about $21,000 while a U.S. household at the 20th percentile earns $21,700. As noted in the graphs above, the median Oregon household income is about 5 percent below the national median ($51,100 vs $53,700).

What really stands out is the widening gap at the highest income levels. To be in the Top 5% of household income in Oregon it takes roughly $185,000 per year, whereas to make it nationally it takes roughly $207,000 per year, or a gap of 11 percent. In fact, the Oregon-US gap among the highest 10% of incomes is twice that of the bottom 90% of incomes. Why exactly this is the case is not entirely clear. However we do know that Oregon is not a financial center, so we miss out on some of those really high-paying occupations. It is also true that our high personal income tax rates likely play a role as well in deterring some, but not all, high-income households and businesses from locating or operating in our state. But what is very clear is the fact that the widening gap in incomes at the top end of the spectrum mathematically weighs on average incomes, but not medians. Go back to the first chart and see how much further away from the national figures the averages are relative to the medians. The differences there are being driven by the widening gap at the top.

Is this a problem? Well, that depends upon the question you are asking.

A big thank you to Kanhaiya, our state demographer, for pulling the historical Census data and the distribution figures for the latest ACS!

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.