![]()

By Josh Lehner

Oregon Office of Economic Analysis Blog

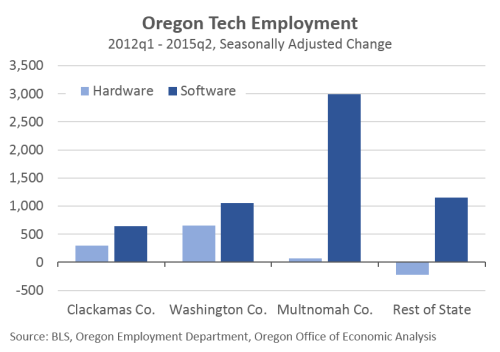

Mike Rogoway has really good update on the Oregon high-tech sector in The Oregonian, and then asks the question of whether or not this growth is impacting the housing market. The answer to that question is no, or at least only a tiny amount, despite some of the conversations I’ve been apart of. Tech growth is having a bigger impact in San Francisco and Silicon Valley as Tech Crunch’s Kim-Main Cutler has written, and to which she spoke at Metro’s housing panel the other week. However that’s due to high-tech being a much bigger industry in the Bay Area than it is here in Portland and Oregon more broadly. Even as Oregon high-tech job growth has been solid in recent years, in Portland it accounts for about 10% of all jobs and 8.5% of the growth from 2012 through 2015. Which brings us to the Graph of the Week, which compares hardware and software high-tech growth across different counties.

This is made possible by our friends over at Employment Department (thanks Beth and Ken) who provided us with the detailed industry data that depict these underlying trends, which largely continues with our previous work and look at Oregon high-tech. A similar graph was included in Mike’s Oregonian article, but due to deadlines and the just released data, this graph includes three more months of data; however the big story remains the same of course.

While Washington County has long been the home of the state’s high-tech sector, and remains the county with the largest tech employment count today, that balance has been shifting somewhat in recent years. Nearly half of all high-tech jobs added in recent years have occurred in Multnomah County (about 3,100 of the 6,600). This is due to the shift in growth within the high-tech sector from Oregon’s traditional advantage in hardware (particularly manufacturing) to software more broadly. Overall, our office’s take on the industry and outlook follows our previous work:

However it is important to think about what types of technology we actually have here in Oregon, compared with what other sub-sectors are concentrated more heavily in other locations. For example, we know that Oregon has a higher concentration of manufacturing high-technology with the presence of Tektronix (more historically) and Intel (more recently), and the like.

The strong growth in recent years, both nationally and here in Oregon, is dominated by the software side of the industry. Hardware is largely holding steady, but not likely to grow employment significantly in the future.

Our office is working with the other friends at the Department of Revenue to conduct some more high-tech research, which will hopefully be available in the near future. Also, ahead of my talk to the home builders, there will be a bit more on housing as well. However the intersection of these two topics is somewhat limited here in Oregon just due to the industry’s size. Furthermore, as detailed previously, laying the blame for higher housing costs at the feet of Californians, tech-related or not, is incomplete and a bit misguided.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.