![]()

By Josh Lehner

Oregon Office of Economic Analysis Blog

So far in early 2015, the U.S. economic data flow has been relatively lackluster, including the disappointing March jobs report. As such, now is a good time to take a step back and mark one’s economic beliefs to market, to borrow a phrase from Brad DeLong. As detailed below, there are clear reasons for both near-term economic optimism over the next year or two and longer-term pessimism over the extended horizon.

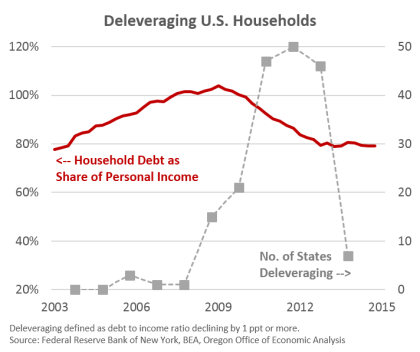

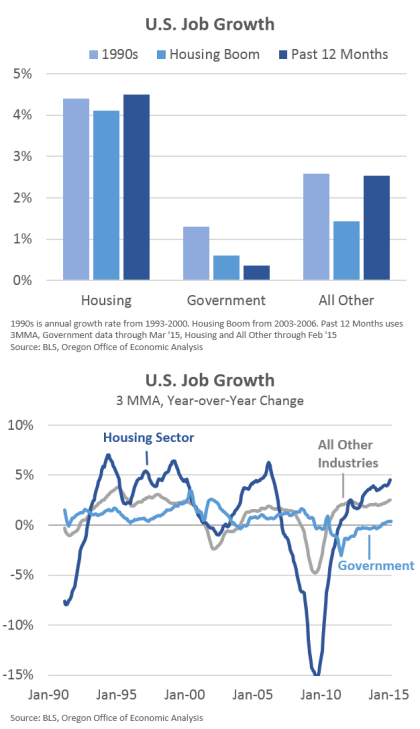

First the good news. The biggest weights on the recovery were household debt and the nature of the cycle with housing and government being the largest drags. While these issues were holding back the recovery in recent years, these weights have clearly lifted. Household debt, relative to personal income, has declined considerably since 2007 and is effectively flat the past 2+ years. These trends are widespread across states, with few still deleveraging in 2013 according to the latest NY Fed data. One can argue whether or not this is the appropriate amount of household debt, but progress has clearly been made and the deleveraging cycle appears to be over, at least in aggregate. This bodes well for near-term growth. Secondly, housing and government have turned from drags to moderate drivers. While public sector employment (and expenditures) remains on lower trajectories than in past cycles, housing related employment (using Jed Kolko’s definition) is now growing at its typical expansionary rate. The good news here is that while housing has not and may not provide an extra boost to growth rates, the housing recovery still has long legs to run. With housing starts still hovering around 1 million per year, there is considerable room for improvement. It will take some time to reach typical levels of housing starts, regardless of whether one argues that average should be 1.3 or 1.7 million units. The U.S. is still far below those levels.

Secondly, housing and government have turned from drags to moderate drivers. While public sector employment (and expenditures) remains on lower trajectories than in past cycles, housing related employment (using Jed Kolko’s definition) is now growing at its typical expansionary rate. The good news here is that while housing has not and may not provide an extra boost to growth rates, the housing recovery still has long legs to run. With housing starts still hovering around 1 million per year, there is considerable room for improvement. It will take some time to reach typical levels of housing starts, regardless of whether one argues that average should be 1.3 or 1.7 million units. The U.S. is still far below those levels. While the above points toward a return to normal economic and labor market dynamics, there is still reason for longer-term pessimism. This takes the form of demographics with an aging and slow growing population overall. Even as the number of working-age adults continues to grow outright, this represents a declining share overall. As Bill McBride says over at Calculated Risk, “2 % is the new 4%.” I think that is largely right.

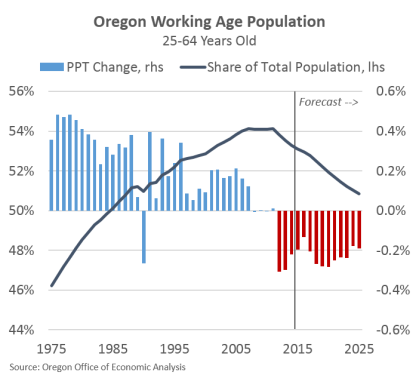

While the above points toward a return to normal economic and labor market dynamics, there is still reason for longer-term pessimism. This takes the form of demographics with an aging and slow growing population overall. Even as the number of working-age adults continues to grow outright, this represents a declining share overall. As Bill McBride says over at Calculated Risk, “2 % is the new 4%.” I think that is largely right.

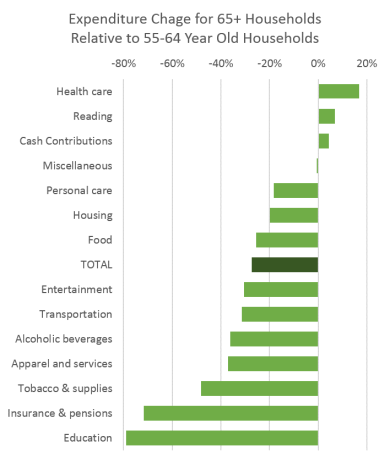

The back and forth between Ben Bernanke and Larry Summers on secular stagnation is interesting and insightful. While global financial markets, real vs nominal interest rates, productivity and the like may help the U.S. avoid true secular stagnation, they still don’t fix our demographics. Below I show the Oregon working age population as a share of the total population. The U.S. follows very similar trends. These trends are hard to impact over a short time horizon. Our office is more pessimistic about longer-term growth rates due to these demographic trends. From our perspective it has big implications for tax revenues and public services. Grandma not only has lower income than during her working years, she spends less and what she does purchase is largely not taxed (food, housing and healthcare.) Of course this is not just a public sector story, but affects potential economic growth rates more broadly.

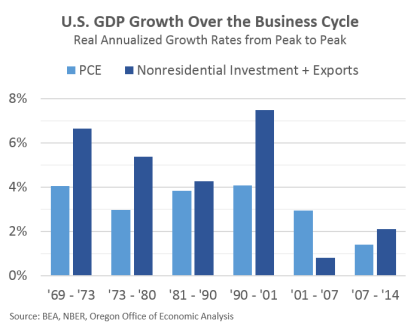

Our office is more pessimistic about longer-term growth rates due to these demographic trends. From our perspective it has big implications for tax revenues and public services. Grandma not only has lower income than during her working years, she spends less and what she does purchase is largely not taxed (food, housing and healthcare.) Of course this is not just a public sector story, but affects potential economic growth rates more broadly. This combined with the nature of economic growth and the need for the U.S. consumer to save more over time, is likely to weigh on growth rates moving forward. The savings rate today is higher than in the mid-2000s. Partly a response to household budgets and most recently it appears that a large amount of energy cost savings is, well, being saved. As the consumer may be more cautious than in the past decade or two, business investment and exports will play a larger role in economic growth. This pattern is more a return to previous cycles, than anything abnormal from a historical perspective. In a lot of ways, the 2000s are looking more and more like the historical outlier. Be it consumer-led and debt-fueled growth, single-family homes or manufacturing jobs.

This combined with the nature of economic growth and the need for the U.S. consumer to save more over time, is likely to weigh on growth rates moving forward. The savings rate today is higher than in the mid-2000s. Partly a response to household budgets and most recently it appears that a large amount of energy cost savings is, well, being saved. As the consumer may be more cautious than in the past decade or two, business investment and exports will play a larger role in economic growth. This pattern is more a return to previous cycles, than anything abnormal from a historical perspective. In a lot of ways, the 2000s are looking more and more like the historical outlier. Be it consumer-led and debt-fueled growth, single-family homes or manufacturing jobs. All told, even with these longer-term concerns, which have not gone away, it does not rule out a year or three of good growth today. Already U.S. employment has picked up considerably and wages should/hopefully/probably follow in the near future for the typical worker. Such gains will translate into a broader and deeper labor market recovery and continued improvement in household finances. We have already seen early signs of these trends here in Oregon and our office expects us to be more of a reverse canary in the coal mine along these lines.

All told, even with these longer-term concerns, which have not gone away, it does not rule out a year or three of good growth today. Already U.S. employment has picked up considerably and wages should/hopefully/probably follow in the near future for the typical worker. Such gains will translate into a broader and deeper labor market recovery and continued improvement in household finances. We have already seen early signs of these trends here in Oregon and our office expects us to be more of a reverse canary in the coal mine along these lines.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.