![]()

By Josh Lehner

Oregon Office of Economic Analysis Blog

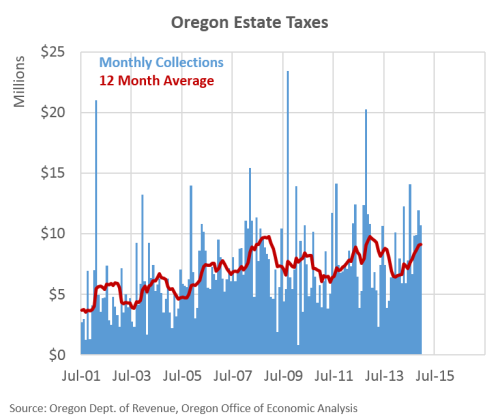

Death and taxes, right? Literally, in this case. In all seriousness, Oregon’s estate and inheritance tax is one that our office has trouble with in recent years. We did not initially build in a large enough drop in revenues due to the housing market collapse (many households that are impacted by the estate tax still have a sizable portion of their wealth tied up in the home itself.) In recent months our office has been having errors in the other direction as revenues are coming in above forecast (although still below the previous Close of Session outlook.)

There are two big, competing issues for the outlook in this case, which is something we routinely discuss with our revenue advisory committee. On one hand is the fundamental growth in underlying asset prices (home, equities, etc.) couple with an aging population. This strongly suggest estate tax revenues will grow briskly over the coming decade or two. However on the other hand, our advisors point that accountants and estate planners are much better today at planning and managing around these life events, inheritances and the like. From this view, expectations are that revenues will be relatively constant moving forward, or show little growth. This is not because estates are less valuable and not because people are not paying taxes, but because households are better able to manage the tax implications of larger estates. For the record, our office has a moderate growth outlook for estate tax collections moving forward, which reflects both of these competing trends.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.