![]()

By Josh Lehner

Oregon Office of Economic Analysis Blog

Our office is releasing a new report on gaming in the U.S. and state revenues. Below is the executive summary.

Download: Report | Slides | Data

Atlantic City, New Jersey has been in the headlines for their troubled casinos, with 4 closures and a bankruptcy over the past year. The gaming industry’s troubles are not isolated to Atlantic City alone. Across the country, gaming firms are under pressure from increased competition and weak sales growth following the Great Recession.

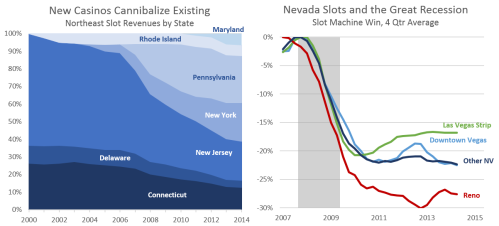

What sales growth firms have seen has largely come at the expense of other gaming venues. New casinos or games in previously untapped cities and states are driving overall growth, masking the underlying industry trends. This is particularly pronounced in the Northeast. Mature gaming destinations, of which Atlantic City is an extreme example, continue to suffer declines or exhibit no growth. Regional sales have shifted to newer venues in Maryland, Pennsylvania and New York. Even in locations with minimal competition, sales have increased more along the lines of population growth than economic measures like jobs or income.

These trends are not only issues for the casinos and businesses that operate gaming facilities, but also for the state and local governments that reply upon tax revenues from such operations. Unlike gaming revenues, most government tax instruments, including personal income and sales taxes, have rebounded along with the economy. Without sales growth, programs and agencies tied to gaming revenues have faced continued budgetary pressures.

The outlook for the gaming industry and associated tax collections in established markets is not exactly robust, barring a major change to consumer behavior or a significant improvement in economic conditions. As in the recent past, new gaming establishments are likely to fare well in the near term. However, as the novelty wears off and competition continues to increase, sales will slow.

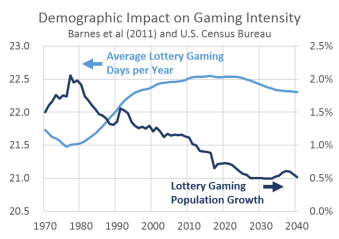

Three broad factors influence the outlook for spending on gaming: real income growth, population growth and consumer tastes. Even if tastes remain unchanged, and younger generations gamble to the same extent as did the Baby Boomers before them, demographics will weigh on sales going forward. Most Baby Boomers are currently in their peak gaming years, and will spend less going forward. This decline in sales will be offset to some degree, but not entirely, by additional spending on the part of the Millennial population cohort. To the extent that Millennials choose to pursue other entertainment or recreational activities as they enter their peak earning years, demand for gaming will erode further. Many of the challenges facing the industry will occur over the extended time horizon. Near-term trends are more positive. Demographics remain in the industry’s favor for at least the next few years. Also, a stronger economy bodes well for consumer spending more broadly, including discretionary items.

Many of the challenges facing the industry will occur over the extended time horizon. Near-term trends are more positive. Demographics remain in the industry’s favor for at least the next few years. Also, a stronger economy bodes well for consumer spending more broadly, including discretionary items.

The good news for the industry is that entertainment spending, and gaming expenditures, have stabilized as a share of household budgets, albeit at lower levels than in the past. While fundamental demand for gaming appears to be more in line with population gains than broader economic indicators, such an outlook brings with it sizable upside risks. A pickup in near-term sales growth is not out of the question, with the driver likely to be a stronger economy with more broad-based income gains or a shift in consumer preferences in gaming’s favor.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.