University of Oregon Regional Economic Indexes

University of Oregon Regional Economic Indexes

By Tim Duy

Oregon Economic Forum

University of Oregon

Oregon economic indicators were consistent with ongoing near-average growth in November.

Highlights of the report include:

- The Oregon Measure of Economic Activity fell to -0.59 from an upwardly revised -0.37 in October (October was initially reported at -0.58). The three-month moving average stands at -0.59, where “zero” for this measure indicates the average growth rate over the 1990-present period.

- The manufacturing sector contributed positively to the measure, with both hours worked and employment showing strength. Construction remains a drag. Even as residential housing continued to improve (see below), the level of activity in the sector remains below normal.

- The University of Oregon Index of Economic Indicators™ rose 0.6 percent in November, a second consecutive increase. Initial unemployment claims and employment services payrolls were largely unchanged while residential building permits (smoothed with a five month-moving average) continued to increase, rising to 1,058 – a third consecutive month greater than 1,000.

- Nondefense, nonaircraft capital orders rose again to its highest level since June 2012, rebounding after several months of disappointing weakness. Also, the Oregon weight distance tax (a measure of trucking activity) Oregon weekly hours worked in manufacturing, and US consumer sentiment all improved in November.

- The two indexes suggest the economic expansion in Oregon continues to remain intact. The same holds for the US economy in the final months of 2013. Notably, the housing market continues to improve; it would be highly unusual for the economy to slip into recession during an upturn in residential construction.

- Economic growth, however, is expected to remain muted, in part a consequence of tighter fiscal policy. Fiscal policy remains a downside risk. Although the so-called fiscal cliff was averted, further tax increases and spending cuts remain likely outcomes of the upcoming debt-ceiling debate.

More detail…

Oregon economic indicators were consistent with ongoing near-average growth in November. The Oregon Measure of Economic Activity fell to -0.58 from an upwardly revised -0.37 in October. The three-month moving average stands at -0.59, where “zero” for this measure indicates the average growth rate over the 1990–present period. The manufacturing sector contributed positively to the measure, with both hours worked and employment showing strength. Construction remains a drag. Even as residential housing continued to improve (see below), the level of activity in the sector remains below normal. Overall, the Oregon economy is growing near its average rate since 1990.

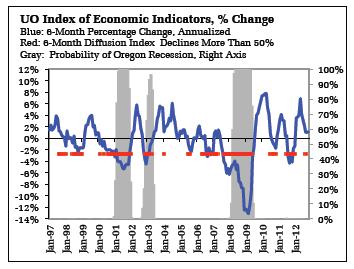

The University of Oregon Index of Economic Indicators™ rose 0.6 percent in November, a second consecutive increase. Initial unemployment claims and employment services payrolls were largely unchanged. Residential building permits (smoothed with a five-month moving average) continued to increase, rising to 1,058—a third consecutive month greater than 1,000. Nondefense, nonaircraft capital orders rose again to their highest level since June 2012, rebounding after several months of disappointing weakness. Also, improving in November were the Oregon weight distance tax, a measure of trucking activity; Oregon weekly hours worked in manufacturing; and U.S. consumer sentiment.

The two indexes suggest the economic expansion in Oregon continues to remain intact. The same holds for the U.S. economy in the final months of 2012.

Notably, the housing market continues to improve; it would be highly unusual for the economy to slip into recession during an upturn in residential construction. Economic growth, however, is expected to remain muted, in part a consequence of tighter fiscal policy. Fiscal policy remains a downside risk. Although the so-called fiscal cliff was averted, further tax increases and spending cuts remain likely outcomes of the upcoming debt-ceiling debate.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.