10th biennial fiscal report card of the governors

By Cato Institute,

State governments have had to make tough budget choices in recent years. Tax revenues have stagnated as a result of the poor economy, and that has prompted governors to take a variety of fiscal actions to close large budget gaps. Some governors have cut spending to balance their budgets, while others have pursued large tax increases.

That is the backdrop to this 10th biennial fiscal report card of the governors, which examines state budget actions since 2008.

It uses statistical data to grade the governors on their taxing and spending records — governors who have cut taxes and spending the most receive the highest grades, while those who have increased taxes and spending the most receive the lowest grades.

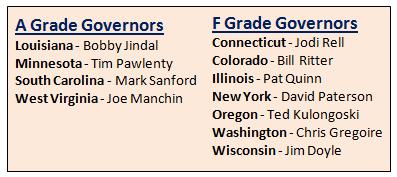

Four governors were awarded an “A” in this report card — Mark Sanford of South Carolina, Bobby Jindal of Louisiana, Tim Pawlenty of Minnesota, and Joe Manchin of West Virginia. Seven governors were awarded an “F” — Ted Kulongoski of Oregon, David Paterson of New York, Jodi Rell of Connecticut, Pat Quinn of Illinois, Jim Doyle of Wisconsin, Bill Ritter of Colorado, and Chris Gregoire of Washington.

Chris Edwards is director of tax policy studies at the Cato Institute and editor of Cato’s Downsizing Government. Amy Mandler assisted in preparing this report.

Many states have raised taxes the past two years, which has hurt families and businesses at a time when they are already struggling because of the slow economy. Across the 50 states, recent tax increases have been by far the largest in many years. Many states raised taxes even though the federal government showered them with billions of dollars of added funding in last year’s “stimulus” bill.

To their credit, many governors have trimmed their budgets to match lower revenue levels. But overall state debt levels have doubled during the past decade, and many states face giant funding gaps in their pension and health care plans.

Further budget cuts are needed to deal with these problems. At the same time, rising competition in the global economy calls for the states to reduce their business taxes to attract investment.

America needs a lot more “A” governors to face these fiscal challenges and make the needed tax and spending reforms.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.