Latest state economic forecast and impacts of Measures 66 & 67

By Economist Dr. Eric Fruits,

Econinternational

This is a “told you so” story about Measures 66 & 67 …

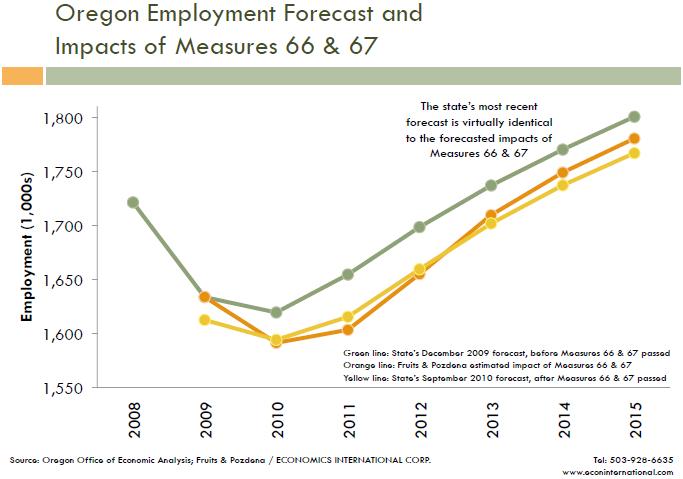

In December 2009, Randall Pozdena and I published research forecasting the impacts of Measures 66 and 67 on Oregon employment (a copy of the study is attached). Our study was based on thorough research of peer-reviewed literature and a quantitative analysis of the taxes and economic growth across the U.S. and over a long period of time. We concluded that the tax measures would have a significant negative impact on Oregon’s employment picture, as shown in Exhibit 1 of the report.

Needless to say, advocates of the tax measures lambasted our research.

Oregon State University agricultural economist William Jaeger claimed that our research was examined by a “nationally-recognized expert in state public finance” who said our findings were “without merit.”

According to the Oregon Center for Public Policy, Oregon economist Joe Cortright, chair of the Governor’s Council of Economic Advisers, reviewed our study. Cortright concluded that “neither the economic literature nor the data presented by [Pozdena, Fruits and Conerly] support the claim that Measures 66 and 67 will be bad for the Oregon economy.”

Fast forward to today.

The state economist released his latest forecast of the Oregon economy. The attached figure shows that the state’s employment forecast is virtually identical to the employment forecast that Dr. Pozdena and I projected in our study of the impacts of Measures 66 & 67. Despite the vituperative criticism of our research and ad hominem attacks on our character, it is becoming more and more clear that our forecast was almost spot-on.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.