Bill Conerly , Conerly Consulting LLC, “Businomics”

Everyone knows that we have this huge fiscal stimulus. I went looking for it. I didn’t look everywhere, though. We’ve had some tax cuts and increases in transfer payments. The raw data on these subjects reflect not only policy, but the circumstances of citizens. Taxable income goes down in a recession, and unemployment goes up, so tax revenue and transfer payments adjust automatically.

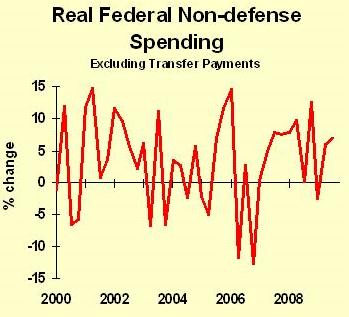

We can look at federal expenditures, which include garden variety government plus public works spending. Here’s the data, expressed as seasonally adjusted percent changes at annual rates:

Sorry, but I don’t see the stimulus as large. The last two quarterly figures were 6.1 percent and 6.9 percent, which are certainly larger than long-run GDP growth, so I’d call that stimulus. However, I had expected to see a large surge. Perhaps this reflects that the Obama stimulus is phased in, with more coming. Or perhaps the stimulus just isn’t as big as the headlines make it out to be.

(I also don’t understand why the path of government spending is so jerky. Does it really jump around that much, or is that a relic of archaic data collection procedures? If you know the answer, please say so in the comments.)

Bill Conerly is principal of Conerly Consulting LLC, chief economist of abcInvesting.com, and was previously Senior Vice President at First Interstate Bank. Bill Conerly writes up-to-date comments on the economy on his blog called “Businomics” and produces a monthly audio magazine available on CD. Conerly is author of “Businomics™: From the Headlines to Your Bottom Line: How to Profit in Any Economic Cycle”, which connects the dots between the economic news and business decisions.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.