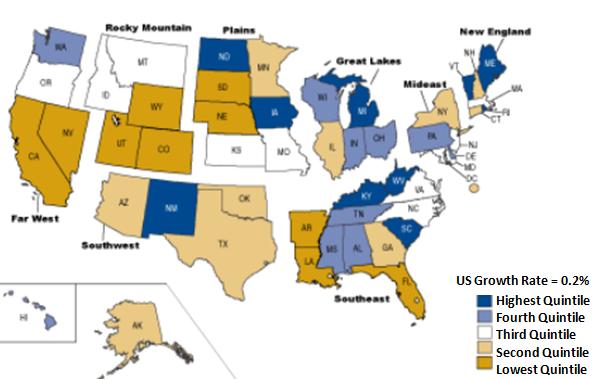

State Personal Income Percent Change: Second Quarter 2009

U.S. personal income grew 0.2 percent in the second quarter of 2009, the first growth in a year for the U.S. and for 15 states, according to estimates released today by the U.S. Bureau of Economic Analysis. In the first quarter, U.S. personal income fell 2.3 percent.

U.S. personal income growth was offset by inflation, as measured by the national price index for personal consumption expenditures, which rose 0.3 percent in the second quarter after falling 0.4 percent in the first quarter.

Personal income increased in the second quarter in 36 states after falling in all states except Maryland in the first quarter. The percent change in second quarter personal income ranged from 1.5 percent in North Dakota (where the farm sector accounted for a large portion of growth) to -1.0 percent in Wyoming (with large losses in mining).

The personal income increase in every state except North Dakota can be attributed to growth in transfer receipts. The other components of personal income-net earnings and property income-declined in every state except North Dakota where net earnings grew 0.9 percent and Iowa where net earnings was unchanged. Second quarter transfer receipts were boosted by the American Recovery and Re-Investment Act (ARRA) of 2009 and by rising unemployment benefits. ARRA payments for OASDI, SSI and food stamps were $60 billion in the second quarter, State UI benefits increased $44 billion, and all other transfers increased $49 billion.

ARRA payments contributed as much as 0.9 percentage point to second quarter personal income growth in Mississippi and West Virginia and 0.8 percentage point in Alabama, Arkansas, and Kentucky, but only 0.3 percentage point in the District of Columbia, Maryland, and Colorado.

Earnings growth in the second quarter was in the government, health care, and farming industries; earnings declined (or was unchanged) in the other 19 industries BEA tracks quarterly with particularly large losses ($48 billion) in construction and manufacturing. Declines in mining (including oil and gas extraction) earnings accounted for relatively large portions of total earnings declines in Wyoming, Alaska, Oklahoma, Louisiana, and West Virginia.

NOTE.–Quarter-to-quarter percent changes are calculated from unrounded data and are not annualized. Quarterly estimates are expressed at seasonally adjusted annual rates, unless otherwise specified. Quarter-to-quarter dollar changes are differences between published estimates.

Comprehensive revision of the state personal income estimates

The annual estimates (1969-2008) and quarterly estimates (1969:I-2009:I) of state personal income have been revised to incorporate the comprehensive revision of the National Income and Product Accounts (NIPA). Comprehensive revisions, which are undertaken every 4 to 5 years, are an important part of BEA’s regular process for improving and modernizing its accounts to keep pace with the ever-changing U.S. economy. Such revisions differ from annual revisions because of the scope of the changes and because of the number of years subject to revision. Comprehensive revisions consist of: (1) changes in definitions and classifications that update the accounts to portray more accurately the evolving U.S. economy, (2) statistical changes that introduce new and improved methodologies and incorporate newly available and revised source data, and (3) presentational changes that make the accounts more informative and easier to use and that reflect the definitional, classification, and statistical changes.

The major definitional change that affects state personal income is the new treatment of disasters to better reflect the distinctions between current and capital transactions and to bring the NIPA in line with recommendations of the System of National Accounts (SNA) 2008. This raises total personal income in some states and years affected by major disasters such as Hurricane Katrina in 2005 and the terrorist attacks of September 11, 2001.

Two major methodological improvements were made. The first is an improvement in the measurement of wage and salary disbursements. The Quarterly Census of Employment and Wages, which BEA uses to estimate wage and salary disbursements, does not include employee contributions to cafeteria plans in 28 states where state law excludes these contributions from wages for unemployment insurance purposes. These contributions were estimated using state data from the Medical Expenditure Panel Survey of the Agency for Healthcare Research and Quality.

The second is an improvement in the estimation of employer contributions for Old-Age, Survivors, and Disability Insurance (OASDI) by industry. Previously, a national estimate of private employer OASDI contributions was allocated to industries in proportion to wage and salary disbursements, overstating contributions in high-wage industries. The methodological improvement uses data on the distribution of employment by wage rates, states, and industries from the Occupational Employment Survey of the Bureau of Labor Statistics and maximum taxable earnings from the Social Security Administration.

Newly available and revised source data used in the revision of state personal income include: U.S. Department of Agriculture farm income, expenses, and employment statistics from the Census of Agriculture and Bureau of Labor Statistics tabulations of wages and salaries for the first quarter 2009.

The major presentational changes for the state personal income statistics include a new table, SA40, with a breakdown of property income into separate estimates of dividends, interest, and rent and the addition of charts and graphs to BEARFACTS (forthcoming).

The revised annual and quarterly estimates of state personal income are released today and are available without charge on BEA’s Web site www.bea.gov. Revised annual estimates of state personal income and the percent revision for 2006-08 are presented in Table 5 of this news release.

Articles previewing the NIPA comprehensive revision were featured in the March and May 2009 issues of the Survey of Current Business and an article in the July 2009 issue previewed changes affecting state personal income. The November Survey will contain an article that describes the results of the revisions to state personal income in detail.

Definitions

Personal income is the income received by all persons from all sources. Personal income is the sum of net earnings by place of residence, rental income of persons, personal dividend income, personal interest income, and personal current transfer receipts. Net earnings is earnings by place of work (the sum of wage and salary disbursements (payrolls), supplements to wages and salaries, and proprietors’ income) less contributions for government social insurance, plus an adjustment to convert earnings by place of work to a place-of-residence basis. Personal income is measured before the deduction of personal income taxes and other personal taxes and is reported in current dollars (no adjustment is made for price changes).

The estimate of personal income in the United States is derived as the sum of the state estimates; it differs from the estimate of personal income in the national income and product accounts (NIPAs) because of differences in coverage, in the methodologies used to prepare the estimates, and in the timing of the availability of source data.

BEA groups all 50 states and the District of Columbia into eight distinct regions for purposes of data collecting and analyses: New England (Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont); Mideast (Delaware, District of Columbia, Maryland, New Jersey, New York, and Pennsylvania); Great Lakes (Illinois, Indiana, Michigan, Ohio, and Wisconsin); Plains (Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, and South Dakota); Southeast (Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Virginia, and West Virginia); Southwest (Arizona, New Mexico, Oklahoma, and Texas); Rocky Mountain (Colorado, Idaho, Montana, Utah, and Wyoming); and Far West (Alaska, California, Hawaii, Nevada, Oregon, and Washington).

BEA’s national, international, regional, and industry estimates; the Survey of Current Business; and BEA news releases are available without charge on BEA’s Web site at www.bea.gov. By visiting the site, you can also subscribe to receive free e-mail summaries of BEA releases and announcements.

****

Next state personal income release – December 17, 2009, at 8:30 A.M. ET for state personal income, third quarter 2009.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.