Oregon legislators are looking to boost education funding by $2 billion through tax increases on the business community. Oregon Business & Industry supports targeted investments in education but we believe cost control must accompany any new revenue to ensure new dollars actually make it to the classroom.

“We’re supportive of finding the opportunity to invest in better education outcomes,” said Mike Stober, OBI director of government affairs for tax and fiscal policy. “Our students are the talent and future labor pool for Oregon businesses. A better educated workforce means more successful companies.”

OBI has indicated to legislators that we are prepared to participate in discussions of tax reform – a comprehensive review of the state’s tax system – where any new forms of taxation are paired with cost-containment measures and adjustments to existing tax rates, particularly the corporate and personal income tax rates. In preparation for the discussion about a new tax this legislative session, OBI and our partners in the Oregon Business Plan developed an option that we believe is stable and adequate, and aids economic growth: the Business Activity Tax, or BAT.

In February, Stober and OBI President and CEO Sandra McDonough testified on the BAT before the Joint Committee on Student Success Subcommittee on Revenue, which is tasked with finding a way to raise the $2 billion for education.

We expect the committee will be building its tax proposal in the coming weeks. Along the way Stober and OBI have been answering the committee’s questions, providing more information to committee members and meeting with legislators.

“We are as engaged as anyone could be,” Stober said.

Explaining the Business Activity Tax

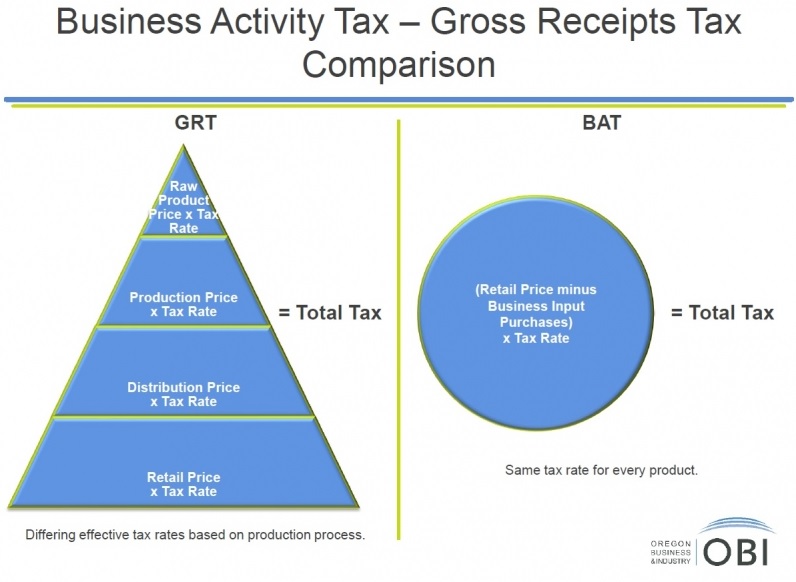

So what is a Business Activity Tax? Put simply, it takes the total amount of sales, subtracts the purchases from other businesses, and taxes what is left.

The BAT is better for business than a Gross Receipts Tax (GRT) – another major tax proposal the committee is considering – because a GRT is applied to each step in the supply chain, a concept known as “pyramiding.”

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.