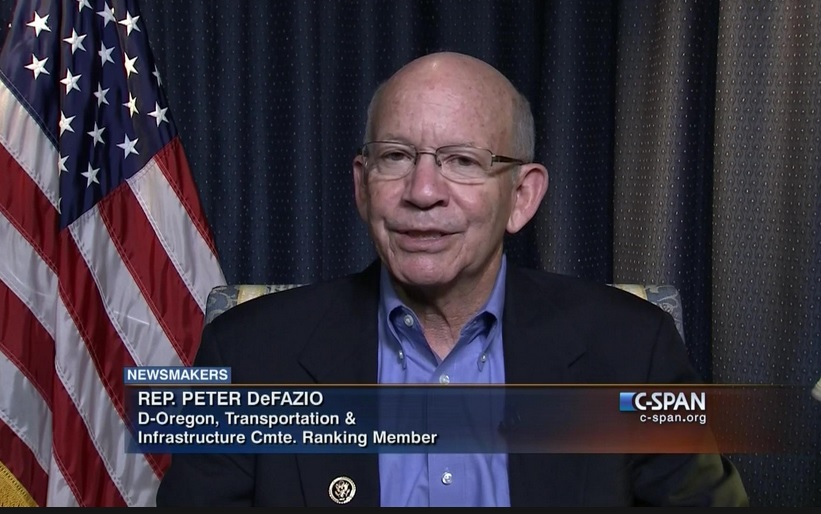

Congressman Peter DeFazio,

Press Release,

Rep. Peter DeFazio introduced legislation to discourage multinational corporations from moving abroad by taxing corporate profits on a per-country basis.

“Republicans promised that their tax plan would bring jobs home to the U.S., but instead it is encouraging multi-billion dollar corporations to move jobs and ship profits overseas,” said Rep. DeFazio, (D-OR). “My legislation would close the loopholes Republicans left open for wealthy businesses and eliminate incentives luring American jobs and American dollars to other countries.”

While Republicans and the Trump administration promised their recently-passed tax bill would bring jobs back to the U.S., it actually encourages multinational corporations to move overseas in order to avoid paying U.S. taxes. The new tax law allows multinational corporations to reduce their overall tax liability by requiring only a minimum tax on an average of profits earned in both low-tax and high-tax countries, instead of taxing profits earned in different countries separately. This system incentivizes companies to shift earnings abroad in order to bypass U.S. taxes.

To correct this, Rep. DeFazio’s Per-Country Minimum Act, H.R. 6015, would require that the tax rate be applied on a per-country basis. Under this legislation, taxes are paid based on the country in which the profits are earned and not averaged. This reform would raise a significant amount of revenue for the United States and remove the incentive for businesses to move profits to foreign nations.

Rep. DeFazio’s legislation is endorsed by the FACT Coalition, a group of progressive organizations including Public Citizen, Center for Economic and Policy Research, Citizens for Tax Justice, and the Main Street Alliance.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.