By Tim Duy

Oregon Economic Forum

University of Oregon

The Oregon Measure of Economic Activity rose in March to 1.01 compared to a downwardly revised February reading of 0.61. Highlights of this month’s report include:

– The construction sector made a modest negative contribution to the measure, weighed down by weaker employment components; new housing units permits made a nearly neutral contribution. A softer stock market compared to last year has reduced the contribution from that sector to nearly neutral. Consumer sentiment, however, continues to add positively to the measure.

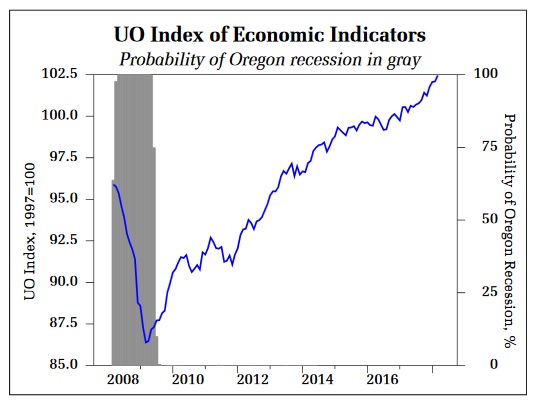

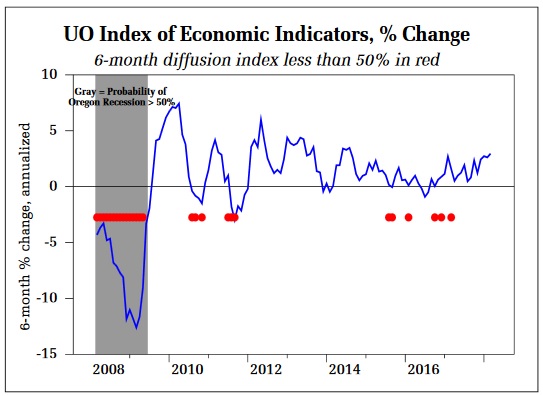

– The University of Oregon Index of Economic Indicators gained for a fourth consecutive month, rising 0.4 percent. Initial unemployment claims continue to bounce along sideways at very low levels consistent with economic expansion and ongoing job growth.

– Trucking activity as measure by the Oregon weight distance tax continues to rise, reaching a new cycle high and indicating gains for Oregon’s traded-sector economy.

– The moving average measure, which smooths out the volatility, slid to 1.09, well above average. (“zero” indicates average growth over the 1990-present period) but cooling somewhat compared to the run-up at the end of 2017.

Together, these indicators suggest ongoing growth in Oregon at an above average pace of activity.

This monthly economic report made possible through KeyBank

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.