Revenue Forecast Illustrates Oregon’s Fiscal Insanity

Via The Oregon Prosperity Project

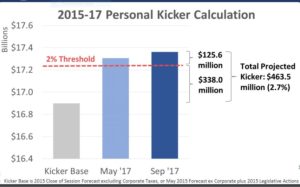

Last week’s revenue forecast from the Oregon Office of Economic Analysis officially closed the books on the 2015-17 biennium. And the final chapter underscored the insanity of Oregon’s current fiscal system. Revenue increased more than 15% during the biennium. Legislators increased school funding by $800 million during the 2017 Session, the biggest increase ever. Yet, many school districts still are cutting teaching positions. And, by the way, because revenue for the 2015-17 biennium exceeded projections by 2.7%, the state will return $463.5 million to taxpayers in the form of a credit on their next tax return.

How could that happen? The tax credits are a product of Oregon’s unique kicker law, which refunds money to taxpayers when revenue exceeds projections by more than 2%. The need to lay off teachers despite record revenue is largely a product of sharp increases in Public Employees Retirement System (PERS) obligations and well-above-average health care benefits for public employees.

Unfortunately, Oregon’s elected leaders made little progress during the 2017 Legislative Session controlling these spiraling costs. Nothing was done to slow the growth of PERS costs, which are rapidly approaching 30% of payroll for many school districts, state agencies and local government employers. The cost of health care benefits for Oregon state employees is 50% higher than the national average but Legislators rejected most reasonable reforms that were put on the table to address these costs.

The problem will become even more difficult to fix as more time passes. Not only are costs increasing, but revenue growth is slowing. State economists project a revenue increase of less than 5% for the 2017-19 biennium, compared with more than 15% for 2015-17. And, even a 15% increase was not enough to keep up with state spending.

Employment growth also is slowing, which was inevitable with the most populated parts of the state approaching full employment. Normally, low unemployment would help generate wage increases, but state economists said they revised income gains “down significantly” in part because of revisions by the Bureau of Economic Analysis.

In summary: Oregon is still in a period of above-average economic growth, but growth is slowing and the economy is more vulnerable than it has been in recent years. Yet, the Legislature just completed a Session in which it struggled to balance the budget and made no changes to PERS. And 2018 revenue will be reduced by kicker credits applied to Oregonians’ next tax bill.

That creates a lot more reason for worry than seems logical for a state that has one of the nation’s strongest economies. But, then again, there is little logical about Oregon’s current fiscal structure.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.