States at Full Employment, A Prime-Age EPOP Story

Oregon Office OF Economic Analysis

By Josh Lehner

The key economic question economists are trying to answer today is whether or not the U.S. economy is at full employment. Given it is more a concept then a hard calculation, you look for signs in the data that suggest the economy is there. In terms of jobs and the unemployment rate, there is no question the data do suggest this. However, at least nationally, wage growth is still relatively slow, albeit picking up some, and inflation remains consistently below target.

Here in Oregon we’re checking more of the boxes than the U.S. overall. Not only have we seen stronger wage gains, but we got the labor force response in terms of rising participation rates. Furthermore, now that the labor market is tight, we are seeing slower job growth which is also expected. Again, I don’t think we’re quite there just yet, but in looking across the nation it’s clear that Oregon is closer than most states.

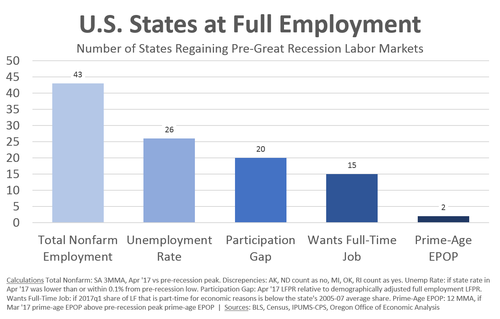

Speaking of the other states, our office and a host of economists across the region are currently in Bend this week for the annual Pacific Northwest Regional Economic Conference (PNREC). I know, it’s a hard job at times. Mark is giving the U.S. Outlook talk so we’ve been digging into the region and other states a bit more. Similar to the national data, the vast majority of states are currently at or near a record-high number of jobs and the typical state’s unemployment rate is back down to where it was prior to the Great Recession. However, fewer states are fully healed in terms of deeper measures of labor market health.

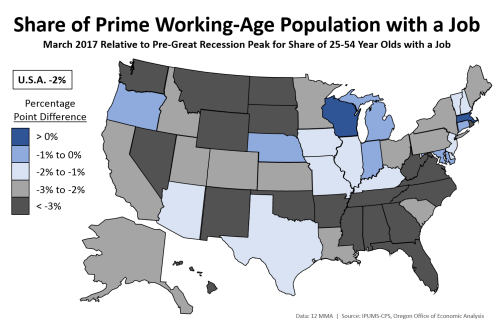

Specifically, when it comes the share of the prime working-age population that actually has a job, those between 25 and 54 years old, just two — two! — states are back to where they were last decade, let alone the late 1990s.

Focusing just on the prime working-age population is a really good way to strip out the impact of the aging demographics. This age group also has the highest labor force participation and employment rates. And by looking at rates, or shares, you control for any population growth at the same time. Right now, across the nation the employment rate (or employment-population ratio, or EPOP for short) for this group is 2 percentage points lower than prior to the Great Recession. Both Adam Ozimek of Moody’s Analytics and Nick Bunker of Equitable Growth have been highlighting these trends in recent years as a key barometer of the economy. In fact, Adam was just on Bloomberg TV earlier this week. He pointed out some of his recent research showing that there is still room to run based on the prime-age population and also the fact that there has been a stronger labor force response in states with faster wage growth. Sound familiar?

The map below shows how each states’ prime-age EPOP compares today relative to their pre-recession peak employment rate. Just two states have a higher EPOP today and only a handful of other states are relatively close, Oregon included. The vast majority of the states have considerable room for improvement.

Note: The state level data comes from the household survey which can be noisy due to its relatively small sample size. This can especially be true once we parse the data further and focus just on the prime-age population. Take the specifics with a grain of salt.

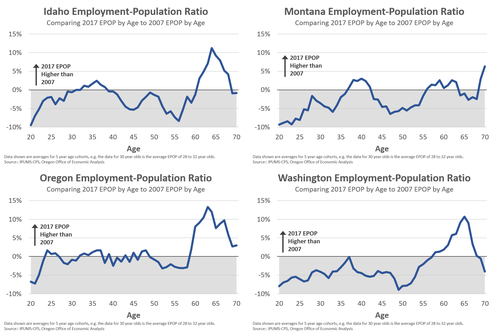

Since we’re at PNREC, I wanted to focus on the region for a minute which I think is illustrative of what the nation is facing as well. The charts below compare the employment rate, or employment-population ratio across the entire age spectrum for the core PNW states. We previously did this just for Oregon and found that the employment rates for all ages in Oregon were back to pre-Great Recession rates. Our neighbors’ patterns differ.

Idaho is largely back except for employment rates for Idahoans in their 40s and 50s. This is exactly where Oregon was in 2015. The concern here is that this gap may be structural based on skills or geographic mismatches or age discrimination in the hiring process. Given Oregon’s middle-age gap has now closed, structural issues may be less of a concern than initially feared. As the labor market gets tight firms must cast a wider net when hiring. They must dig a bit deeper into the resume stack and hire those with an incomplete skill set or a gap in their resume due to long-term unemployment and the like. That’s happening nationally and here in Oregon. I expect it to happen in Idaho too. Montana and Washington are seeing some of these same trends, albeit their prime-age EPOP isn’t back nearly as much. Montana was making progress until the oil crash in late 2014 set them back, along with the other energy states and Canadian provinces.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.