by Jason Norris, CFA

by Jason Norris, CFA

Executive Vice President of Research

Ferguson Wellman,

A leading Oregon financial firm

A Nobel Prize for Bob Dylan couldn’t buoy the markets last week. Uncertainty in China and a rocky start to earnings season resulted in a down week for stocks. While equities rallied on Friday, the S&P 500 ended the week down close to 1 percent. Pre-announcements from Honeywell, Dover and Fastenal weren’t a positive way to start the week; however, bank earnings and a positive retail sales report on Friday alleviated some concern.

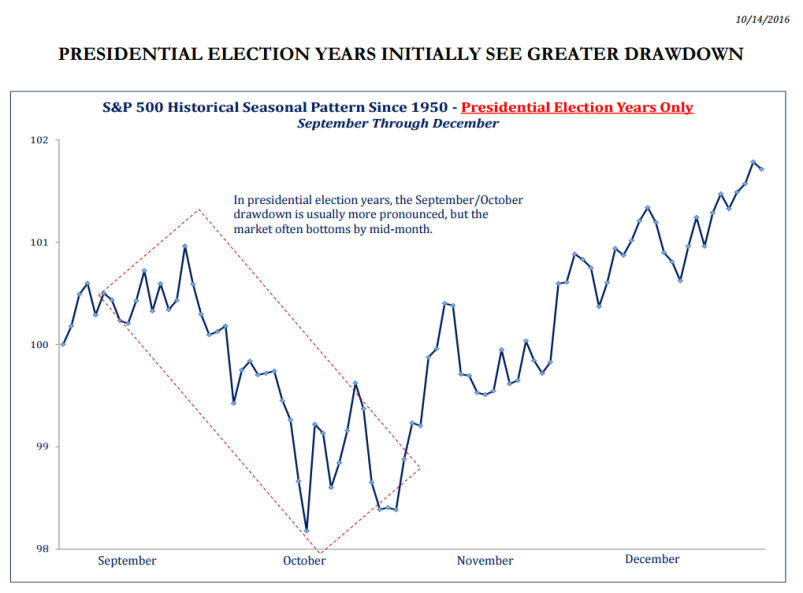

As we head into the last two months of the year – which also happens to coincide with what many pundits describe as an “unprecedented” election – we are often asked where would we put money? We recently reduced our equity exposure and added to bonds, not so much as turning bullish on bonds, but buying some as insurance to the volatility. However, looking back to 1950, stocks usually perform well in these periods. The chart below from Strategas Research Partners highlights the average return of the S&P 500 during the fourth quarter in a presidential election year.

Weakness in the first part of October seems to be the norm with a little bounce back in the last 10+ weeks of the year. While this is only an average, at least history is on the side of remaining long equities.

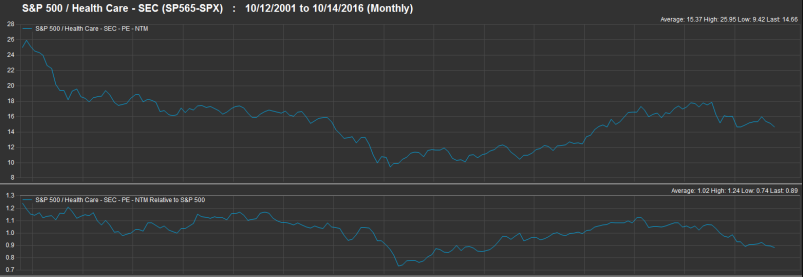

Another weakness in the market was healthcare. While we have not and will not make a call on the election, our base case (as is with most investors) is the Democrats retain the White House, Republicans will retain the House and the Senate is a wildcard. The events a week ago, and recent polling showed increasing odds that the Democrats may take the House. With all three branches in Democratic control, regulatory risk in the healthcare space would increase. This spooked investors, resulting in a 3 percent sell-off in the space. While we are wary of the headline risks, we still believe it is too early to sell the stocks and maintain exposure. Historically, healthcare stocks earn a premium valuation (price/earnings multiple) to the broad market. The chart below shows that with the sector trading under 15x earnings and a 10 percent discount to the market, healthcare is at the “cheaper” end of its historical range.

We believe, especially now, that this is still warranted to be overweight healthcare stocks based on the underlying growth prospects. Earnings growth for the S&P 500 is roughly 1 percent for 2016 and the healthcare space offers just under 10 percent growth. With the stocks at a discount to the market, we continue to view the healthcare space positively.

Our Takeaways for the Week

- Volatility will remain high into the end of the year; however, equities are still attractive

- Headlines are a short-term risk to healthcare stocks, but we believe growth should trump them

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.