Steep price hikes under Obamacare

Steep price hikes under Obamacare

By Taxpayer Foundation of Oregon

Health insurance prices on the Obamacare exchanges have been published on HealthCare.gov, and it’s not good news. Higher premiums, higher deductibles, and fewer choices.

Fewer plans: Last year, residents in Portland, Oregon had a choice of 87 plans. This year, we get only 37 plans from which to choose (1).

Higher premiums: For my family of 2 adults and 4 kids, the average premium has increased by $290 a month—that’s a 25 percent increase. The cheapest plan is $939 a month, but you pay $50 just to walk into the doctor’s office. That’s $50 per person, per visit. That adds up.

Higher deductibles: To make matters worse, deductibles have increased.

• Last year, several plans had zero deductible. This year, only one plan has zero deductible (Kaiser Permanente KP OR Gold 0/20)(2).

• Last year, three plans had the highest deductible of $13,700. This year, 10 plans have a deductible of $14,300. If you have to burn through $14,300 of your own money before any meaningful health coverage kicks in, what the heck are you paying for?

Cheap plans are a bad deal. Bronze plans are sold as the most “affordable” plans. But they come with some high costs. The lowest deductible is $10,000. And, as noted earlier, the cheapest of the cheapest plans have outrageous copayments for primary care visits.

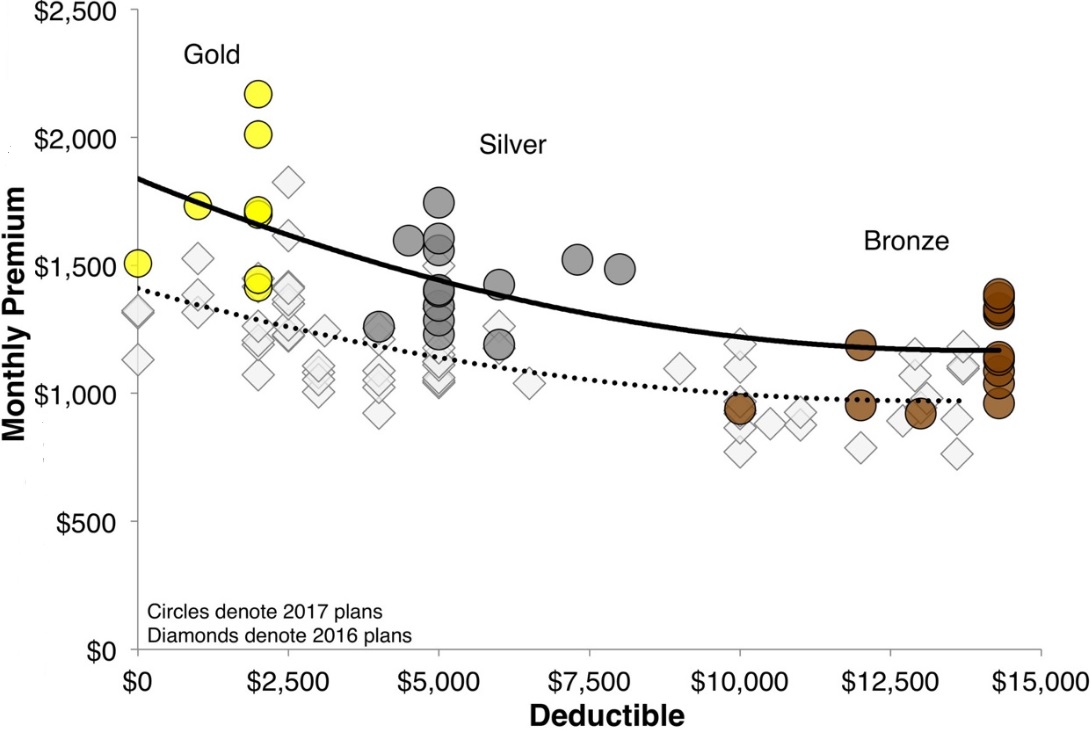

Let’s compare the plans. Look at the figure above.

Gold plans have premiums averaging $1,700-$1,800 a month (that’s more than $20,000 a year).

• The cheapest Gold plans are all Kaiser Permanente plans, which means you have to haul yourself all over town to see your doctor and you have to get a referral to see a specialist. What you’re saving in money, you’re spending in time and frustration.

• The next best alternative is a Moda plan with a $1,000 deductible for $1,732 a month (Moda Health Plan, Inc. Beacon Be Protected)(3)

Much of the ACA attention is focused on Silver plans. Last year, I was able to get a zero deductible Silver plan for $1,100 a month. That was pretty good, but the provider pulled out of the Obamacare exchange, so that plan’s gone.

• For 2017, the “best” Silver plan has a $4,000 deductible and a monthly premium of $1,261 and, again, it’s a Kaiser plan.

• For $1,285, Providence offers a plan with a $5,000 deductible (Providence Health Plan Connect 2500 Silver)(4).

Bronze plans are so poor that they are not even worth considering. For almost every Bronze plan, there is a Silver plan with a similar premium and a lower deductible.

That’s what happens when regulators load up scads of things as mandated “preventive services” (i.e., no out-of-pocket) and forbid insurance underwriting to manage risk. We end up with high premiums and high deductibles, when most people would prefer lower premium with “just in case” coverage.

Welcome to 2017: Fewer choices, worse choices, and higher prices. When November 1 rolls around, it might be worth checking out the plans available off the ACA exchange.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.