![]()

By Josh Lehner

Oregon Office of Economic Analysis Blog

Raise your hand if you’ve heard that Oregon lags the business cycle? Or worse yet, that Oregon falls first and recovers last? Something along these lines really does seem to be the conventional wisdom. In this case, the conventional wisdom is wrong. While the NBER has a business cycle dating committee for U.S. recessions, no such entity exists for local or regional recessions. In the past I have used University of Oregon professor Jeremy Piger’s dating algorithm to try and gauge this. Today I want to focus just on employment, one of the only really good indicators available at the local level.

First, a quick look at employment growth in recent decades. This graph is always included in our office’s presentations as it clearly shows how Oregon fares over the business cycle.

Clearly Oregon is more volatile than the U.S. overall. We fall further in recession but grow quicker in expansion. In the good times we call this our traditional advantage. Much of the volatility comes from the state’s industrial structure (natural resources and manufacturing are very pro-cyclical) and our population growth (migration ebbs and flows with the cycle). Given that the economy spends many more years in expansion than in recession, Oregon comes out ahead over the full cycle.

This next graph shows how Oregon fares over the entire cycle relative to the U.S. by measuring employment change from one business cycle peak to the next business cycle peak.

In most cycles since World War II, Oregon comes out ahead. This is true today as well. Right now Oregon employment is 4.9% above pre-Great Recession levels while the U.S. is 3.9% above.

There are a couple of exceptions however. In the 1980s, Oregon’s full business cycle was weaker than the U.S. due to the timber industry restructuring in the early 1980s. At the time, Oregon lost 12% of its jobs while the U.S. only lost 3% of its jobs. Another exception is during the Asian Financial Crisis in the late 1990s. While Oregon’s growth in the 1990s was stronger than the U.S., those last few years did see slower job gains (see the first graph where the dark blue line drops below the light blue line).

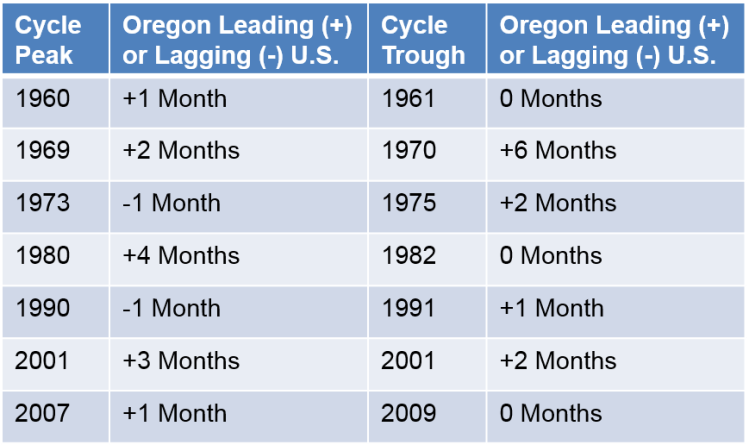

Ok, but how does our regional business cycle line up with the nation’s? The table below compares the month when Oregon employment peaks relative to when U.S. employment peaks for each recession since 1960.

The big takeaway here for me is that there are not many differences at all. In fact, if you average these figures, Oregon actually leads the national employment cycle both entering and exiting a recession. Oregon does not lag. Personally I would not make too much out of a couple months here or there based on the data. But the point is clear that Oregon’s business cycle is very much in sync with the U.S. cycle and Oregon does come out ahead over the full cycle.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.