by Jason Norris, CFA,

Executive Vice President of Research

Ferguson Wellman,Portland

Back in Business Again

It has been a volatile year for equities and as we head into the holiday season, that doesn’t look to dissipate. After the 12 percent sell-off investors went through over the past few months (Fed rate hike concerns, China market crash, Greek debt issues and the constant geo-political flare-ups), the S&P 500 has rallied back, culminating with its best week of the year. While 2014 proved to be a narrow market, 2015 is even more so. When you look at the 10 largest U.S. companies (see table below), you notice the majority of them, have enjoyed significantly greater returns than the 3 percent for the S&P 500.

Source: FactSet data through Nov 20, 2015

What is even more dramatic is that three stocks were responsible for all of this return: Amazon, Alphabet/Google and Facebook.

There have been prior periods of large cap driven markets, coupled with a handful of names driving that performance. But what we have experienced this year is less than a handful of mega cap names delivering all the index returns.

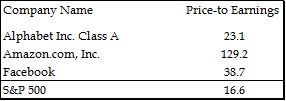

One thing to note on this narrow focus is the emphasis on “growth.” The sell-off we experienced this summer was a classic “growth” scare. Investors believed that due to the strong dollar and the slowdown in China would cause global economic growth to slow. While we’ve seen some stabilization in the equity market, there is still concern over global economic growth. As such, investors have been willing to “pay up” for growth companies and avoid cheaper names that are tied to the face of economic growth. For instance, the three stocks mentioned earlier trade at substantial premiums to the overall market.

Source: FactSet data through Nov 20, 2015

Investors are paying a lot more for a dollar of earnings for a select few names due to the concern over growth. This has resulted in growth stocks returning roughly 7 percent this year, while value stocks are down 2 percent.

Takeaways for the Week:

- Different “styles” can come in and out of favor, the key is to remain focused on the long term and not chase short-term performance

- As the global economy improves, value stocks should regain some leadership in 2016

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.