Bill Conerly, Conerly Consulting, Businomics,

Oregon economist

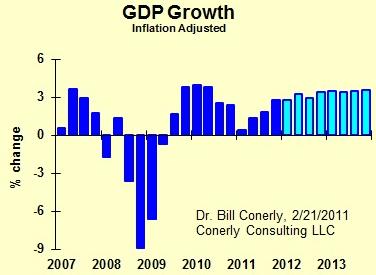

I’ve updated my economic forecast, and it’s not as favorable as last quarter’s projection. I continue to see upward pressure on the economy this quarter and next from the lagged impacts of the Federal Reserve’s second round of quantitative easing. However, I’ve offset most of that with a hit to exports and attitudes from the European financial crisis. The result is a very boring forecast.

This continues our pace far below our potential. Using the CBO’s estimate of Potential GDP, we’re more than four percent below where we should be at the end of 2013. Unemployment will fall to around 6.5% by end of next year; an improvement for sure, but not nearly good enough for people to feel happy.

Policy response? I see not much change for fiscal or monetary policy. (That’s my forecast, not my recommendation.)

Further reading click here to go to the full Forbes article

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.