Latest Wells Fargo survey: expectations for increased revenues improve small business owner optimism

Outlook also better for capital spending and credit availability

From Wells Fargo Bank,

Optimism among small business owners improved during October, driven by improved outlook for revenue, capital spending and hiring, according to the latest results of the quarterly Wells Fargo/Gallup Small Business Index.

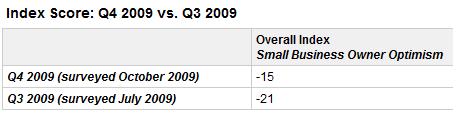

Concluded October 9, the latest Wells Fargo/Gallup Small Business Index optimism score came in at negative 15 (-15), a net six-point increase from the previous survey (conducted in July, 2009), and 129 points lower than the Index high of 114 (conducted December, 2006). A score of zero indicates that small business owners, as a group, are neutral — neither optimistic nor pessimistic — about their companies’ situations.

The Index is the sum of “present situation” and “future expectations” of small business owners for six key measures, including financial situation, cash flow, revenues, capital allocation spending, job hiring and credit availability. The “present situation” score stayed relatively stable, down one point to negative 24 (-24), the lowest present situation score in the history of the Index. “Future expectations” increased seven points, from two to nine.

Of the six key measures, the following measures contributed to the increase of this quarter’s Index:

Revenues – 20 percent (vs. 28 percent in Q3 2009) expect revenues to “decrease a little” or “decrease a lot” over the next 12 months

Capital Spending – 33 percent (vs. 38 percent in Q3 2009) expect capital spending to “decrease a little” or “decrease a lot” over the next 12 months

Hiring – 18 percent (vs. 14 percent in Q3 2009) expect the number of jobs or positions to “increase a little” or “increase a lot” over the next 12 months

About the Small Business Index

For the last 26 quarters, the Wells Fargo/Gallup Small Business Index has surveyed small business owners on current and future perceptions of their business financial situation. The Index consists of two dimensions: 1) Owners’ ratings of the current situation of their businesses and, 2) Owners’ ratings of how they expect their businesses to perform over the next 12 months. An Index score of zero indicates that small business owners, as a group, are neutral — neither optimistic nor pessimistic — about their companies’ situations. Results are based on telephone interviews with 602 small business owners in the continental United States conducted October 5 –9, 2009. The overall Small Business Index is computed from a formula that scores and sums the answers to 12 questions— six about the present situation and six about the future. The overall Index can range from -400 (the most negative score possible) to +400 (the most positive score possible), but in practice takes on a much more limited range. The margin of sampling error is +/- four percentage points.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.