By Bill Conerly, Businomics, Conerly Consulting

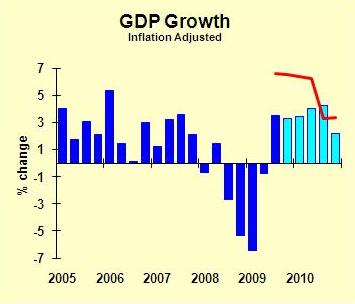

I’ve updated my economic forecast for 2010. Here’s a chart showing quarterly growth rates:

Key features: consumer spending on durables dips this quarter (after cash-for-clunkers), then grows at a pace that mixes conservative attitudes with pent-up demand and limited credit availability. I spent more time this round modeling inventories. It’s still a big wild card, that can swing quarterly numbers hugely. For instance, an optimistic–but not implausible–figure for the change in inventories this quarter adds another 1.5 percentage point to GDP growth.

This growth rate is well above productivity growth, so we’ll make progress lowering the unemployment rate. Note huge, sudden progress, but gradual improvement.

I’m assuming that the Fed will slow it’s stimulus, preventing an upside breakout. With this in place, the inflation rate should be tame.

This is strong enough growth that businesses should conduct a Recovery Readiness Audit, that surveys all issues tied to business expansion: sales, operations, finance. I can help your company with that; give me a call.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.