By Bill Conerly, Businomics, Conerly Consulting,

Bank loans to businesses for commercial and industrial (C&I) purposes continue to decline. That by itself does not prove that we are in a credit crunch.

Credit crunch definition: “When credit is rationed by non-price means in a way not typical for that type of credit at that time of the business cycle.” My definition excludes tightening of credit simply by raising interest rates, and it also excludes the tightening of credit that is normal during recessions. The concept we’re trying to get at is abnormal tightness.

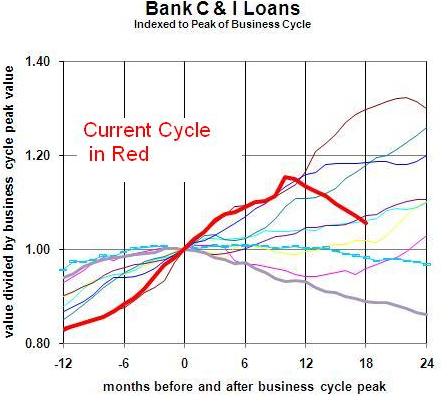

Do we have that now? Here’s a picture of C&I loans outstanding by banks. For each of the past 10 business cycles, I measure the dollar value of loans outstanding divided by the value of loans outstanding at the time when the business cycle was at its peak. So a value of 1.2 on the chart says that loan volume is 20 percent higher than it was when the business cycle hit its peak.

Three observations:

1) In the latest cycle, loan volume grew surprisingly fast in the early months. Maybe NBER’s Business Cycle Dating Committee has the cyclical peak wrong.

2) There seems to have been a little blip up in October of last year, probably caused by borrowers who were closed out of the commercial paper market exercising their standby lines of credit.

3) Loan demand is usually soft in a recession and immediately following. That makes sense given what we know about inventories and capital spending, the two main triggers of C&I loans.

So are we in a credit crunch? I think not. It’s simply garden variety credit tightening combined with weak demand for loans.

(Note that this discussion does NOT include consumer loans or real estate loans.)

How does credit availability affect the economic forecast? I think that business demand for credit will be soft for its own reasons, but limited even more by normal bank behavior of tightening credit standards in the wake of a recession.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.