[5]

[5]

By Josh Lehner

Oregon Office of Economic Analysis

Oregon’s construction outlook remains solid in the years ahead. Our office’s employment forecast calls for moderate gains due to the fact the industry is at historic highs today, and the underlying volume of work moving forward should be fairly steady in the big picture. There are a number of balls in the air at the moment that are trying to look at what it would take for Oregon to increasing housing production. Our office will share more when available. But for today let’s take a quick look at a few pieces of the overall industry.

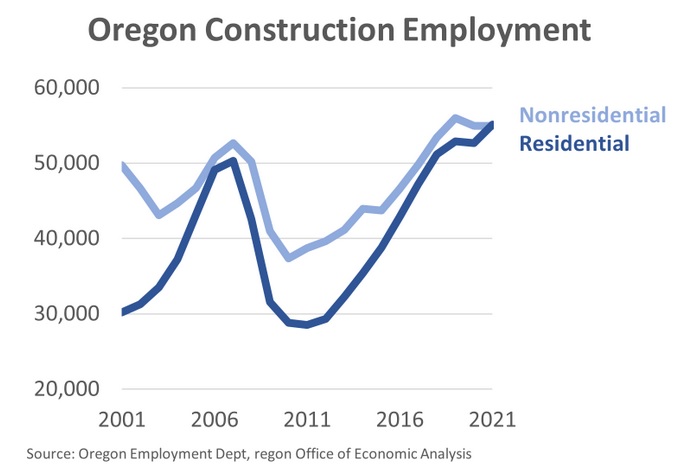

Oregon’s construction workforce is about half residential and half nonresidential. Of course many contractors work on both types of projects, but in terms of the primary nature of their individual businesses this is how the data shakes out. Residential has certainly been more boom/bust over recent cycles, whereas nonresidential is a little more stable in part due to public works.

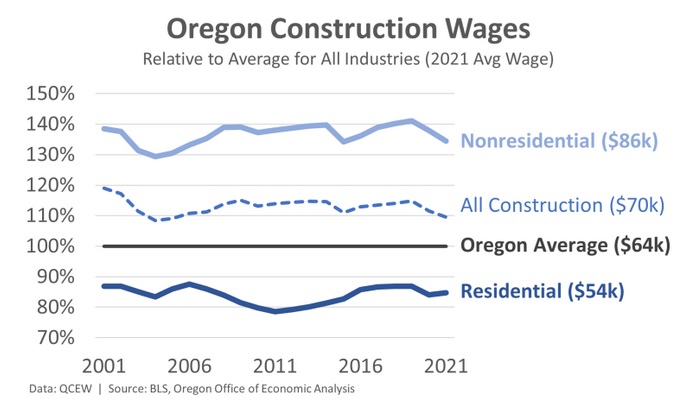

In total, the construction industry has about a 10% wage premium relative to the statewide average wage. However this masks considerably different wages across occupations and different segments of the industry. Nonresidential construction workers on average make $86,000 per year which is 34% above the statewide average. On the other end, residential construction workers on average make $54,000 per year which is 15% below the statewide average. These differences are important to keep in mind when talking about attracting and retaining workers, or growing the construction workforce to increase housing starts and the like.

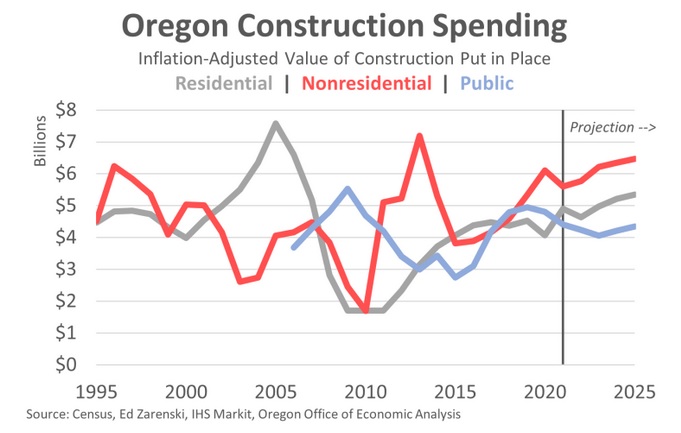

Finally, an updated look at our office’s expectations for construction spending by broad category in the years ahead. These spending numbers are adjusted for inflation to get a better gauge of underlying volume of work, but it’s imperfect in that regard.

In terms of the outlook, broadly speaking it’s fairly similar to the last time we dug into it. We should get official Census state nonresidential figures for 2021 any day now. But so far the declines nationally are less pronounced than first feared. It may still be some time before we start building new offices and hotels in our urban cores which weighs on the outlook, but both food and beverage, and amusement and recreation are picking up. Health care should too when hospital finances improve again with more elective surgeries. Warehousing has been astronomically strong but the industry is likely to slow moving forward. Manufacturing has seen strong gains lately as well. All told, nonresidential is doing well even if there are specific weaknesses.

Residential construction will be fine in the years ahead. Our office’s forecast for housing starts are for moderate gains overall, and home improvements should remain strong given the record setting home equity that owners have. However, we do have a year-over-year decline forecasted for 2022 given the mortgage rate shock. It will take some time for buyers to adjust to the new interest rate environment. Monthly payments on new mortgages is through the roof relative to just a handful of months ago. We have seen U.S. new home sales drop, and builder cancellations are starting to rise some. These are expected to be relatively short-term impacts (this year) as the market adjusts, but they should feed into fewer actual housing starts in the months ahead. However, over the coming years, we know housing demand is strong and both housing starts and construction activity will increase.

Lastly in terms of public works there are a few risks to the outlook. Public revenues are quite strong, providing policymakers funding for projects should they so choose. We also have the federal infrastructure bill that passed last year. Those impacts have more of a mid- to late-2020s timing as it takes awhile to get projects designed and up and running. On the other side we have difficult budget choices of where policymakers will choose to allocate their funds, and we have inflation. The cost of building materials is rising by double-digits. That means a dollar of public works builds less than it used. The $1 trillion federal infrastructure package is likely to fully fund fewer projects than originally expected.