[5]

[5]

By US Chamber of Commerce

Press Release,

The U.S. Chamber of Commerce today launched an extensive campaign to expose and defeat Consumer Finance Protection Bureau (CFPB) Director Rohit Chopra’s ideologically driven agenda to radically change the nature of America’s financial services industry. If allowed to proceed, his agenda would harm consumer choice and innovation.

In various speeches, Director Chopra has outlined extreme and inaccurate views around the state of our financial system regulations. He has:

- Described “repeat offenses” as “par for the course for many dominant firms.”

- Stated that financial regulators were “…clueless and often corrupt lawyers and economists…often seen as auditioning for a future job…”

- Coined the term “junk fees” as “exploitive income streams” in a heavy-handed attempt to vilify legal products that have well-disclosed terms.

The Chamber’s campaign is specifically objecting to several unlawful actions including Chopra’s intentions to change rules without accountability, injecting great uncertainty into the market therefore causing financial companies to limit the types of mortgages, car loans, and personal credit they can offer consumers. Chopra has also proposed outright bans on certain products and has stated his intention to restructure the industry, ultimately hurting consumers by limiting choice and diminishing competition.

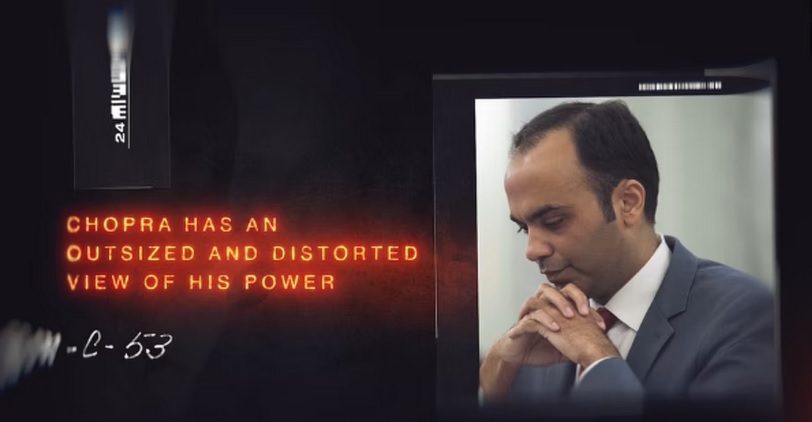

“Director Chopra is attempting to use the CFPB to radically reshape the American financial services sector,” said Neil Bradley, Executive Vice President and Chief Policy Officer at the U.S. Chamber of Commerce. “Rohit Chopra has an outsized view of the CFPB’s role and the Director’s power. By willfully mischaracterizing the state of competition in the market Chopra is laying the groundwork to force the financial services sector to comport with his personal vision of the appropriate size of companies and what products and services should be offered and under what conditions. No previous CFPB Director has thought they had such power. Rohit Chopra’s radical agenda and reckless actions will only hurt consumers, businesses, and our economy and he needs to be held accountable.”

As part of this campaign, the U.S. Chamber of Commerce is:

- Launching a new six figure digital ad campaign [6]. The ads highlight Director Chopra’s outsized view of his role and radical agenda, subject to no accountability.

- Filing six Freedom of Information Act (FOIA) requests [7]. The FOIAs demand that the agency make available its current procedural manual, records relating to the agency’s communications with the White House on President Biden’s July 9, 2021 Executive Order on Competition, among other requests for additional transparency.

- Issuing two letters from the Chamber’s Litigation Center [8] detailing the CFPB’s unlawful and imprudent actions. The first letter details Director Chopra’s unlawful actions to rewrite the “unfairness” standard via a change to the agency’s examination manual. The second letter describes four other legally dubious actions, including its “Policy Fellowship Program,” changes to administrative adjudication procedures, changes to supervision of non-depository financial institutions, and issuance of an “interpretive rule” announcing new authority for state attorneys general.

The U.S. Chamber of Commerce is committed to pushing back against Director Chopra’s rogue CFPB and protecting American business and consumers from government-dictated consumer financial services offerings.